Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

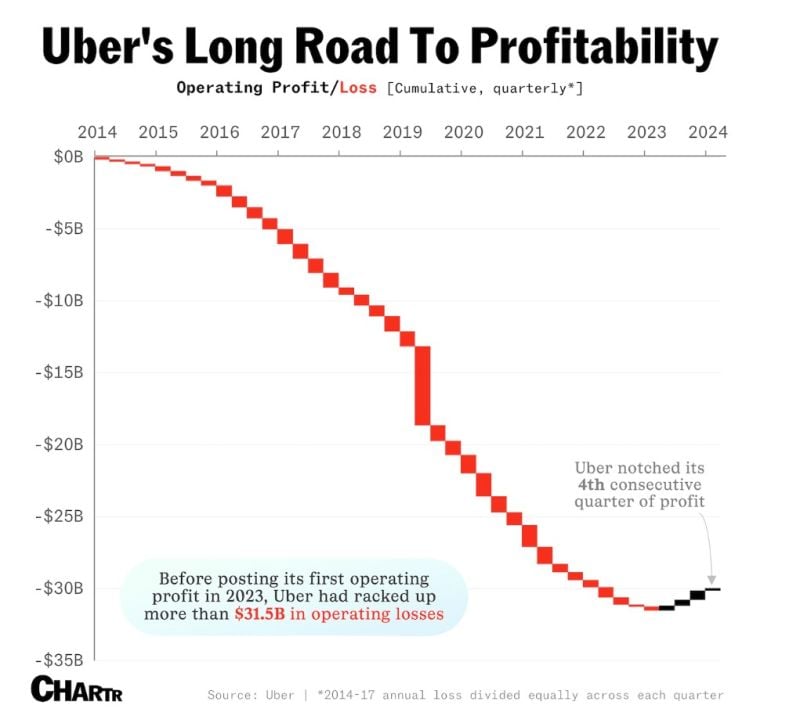

Uber long road to profitability...

In 2019, The Economist wondered aloud whether Uber would ever be profitable. The classic refrain from the company and its investors was that at a certain scale, it would be. It first had to get big enough and outlast enough of its competition. As it turns out, they were pretty much right. Last year, Uber had its first annual profit, and recent quarters have also been solidly in the black, with investors expecting another profitable quarter to be announced on August 6th. The company’s main rival still hasn't quite reached that scale. Lyft has narrowed its losses significantly, but is still in the red. Source; Chartr

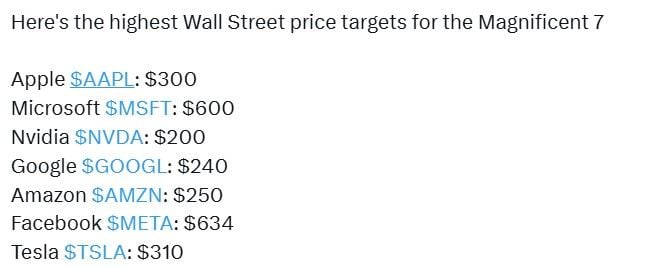

Highest Wall Street price targets for the Mag 7

source: Evan on X

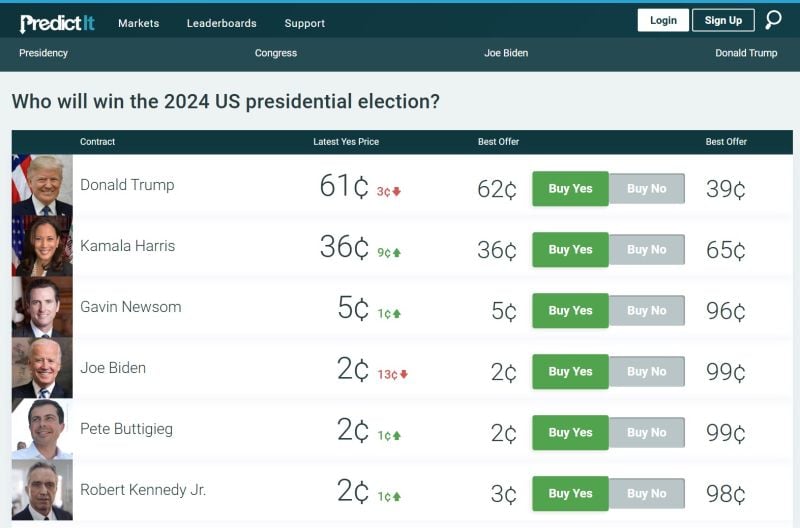

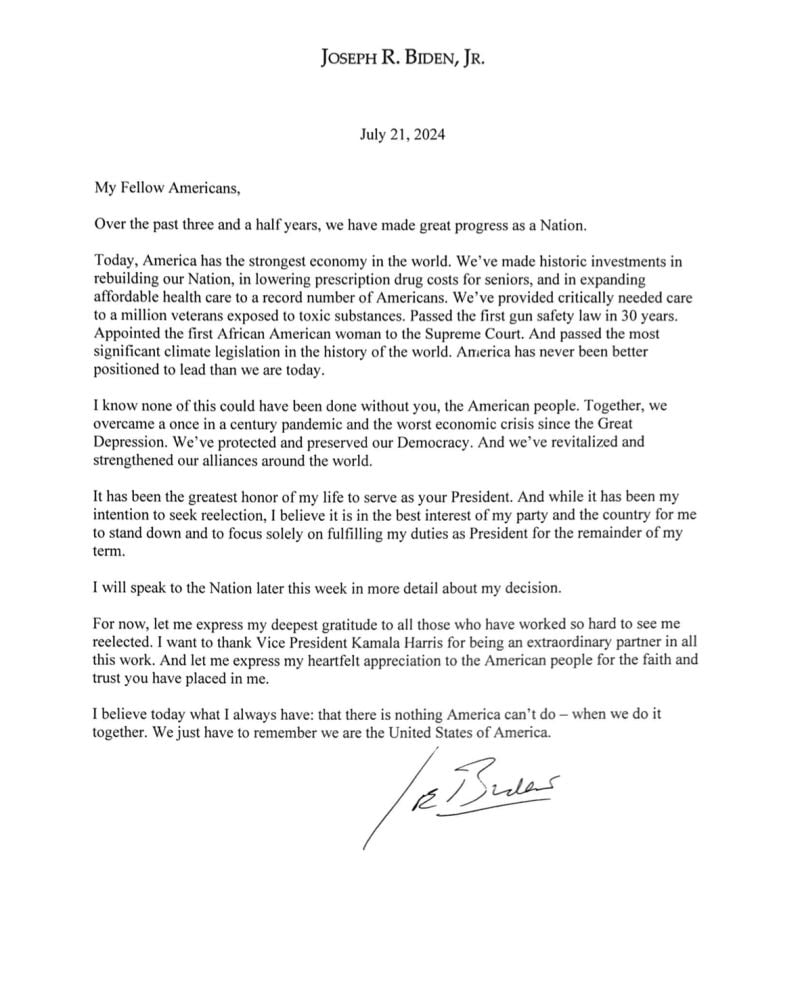

President Biden announces he is dropping his re-election bid and endorses Vice President Kamala Harris as the Democratic candidate.

Here is where we stand on Predictit.

BREAKING >>> BIDEN IS DROPPING OUT OF PRESIDENTIAL RACE

US President Joe Biden has abandoned his re-election bid following overwhelming pressure from fellow Democrats, saying that “it was in the best interest of my party and the country for me to stand down”. The president announced his decision in a letter published to social media on Sunday, throwing this year’s White House race into turmoil with less than four months to go until voters in the world’s biggest economy elect their new leader on November 5. Biden’s announcement follows more than three weeks of wrenching debate among Democrats about his candidacy after a disastrous debate performance against Trump reignited concerns about his mental acuity and damaged his standing among American voters. An Associated Press poll out last week found nearly two-thirds of Democratic voters said Biden should drop out of the race. Source: FT

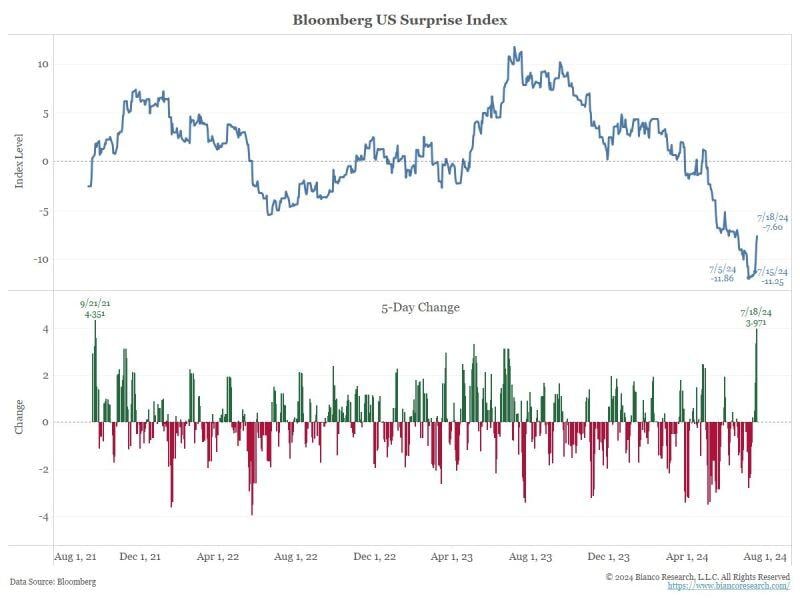

The most interesting question going into next week is whether the US economy is picking up.

Did it start with the release of the June data? Is this going to frustrate a September rate cut? The Bloomberg Surprise Index (see chart below) bottomed on July 5, the nonfarm payroll release date. Since then, it has been trending higher. The move higher over the last five days (one business week) has been the biggest since September 2021 (bottom panel). Source: Jim Bianco, Bianco Research

Speculators have ramped up their bets against long-dated US bonds due to the rising prospects of Trump 2.0.

Source: Bloomberg, HolgerZ

The Japanese Yen is up against the US dollar to its strongest level since mid-June.

The USD-JPY currency pair is down over 3% since Thursday after hitting a 38-year high following another round of intervention by Japan’s Ministry of Finance. Japanese authorities reportedly spent $22 billion on Thursday and Friday to prop up the yen, according to Bloomberg. This comes after Japan spent a record $62 billion to support the currency between April 26th and May 29th. Over the last 12 months, the Yen has declined by ~12% and has been the worst-performing currency of G10. Source: The Kobeissi Letter

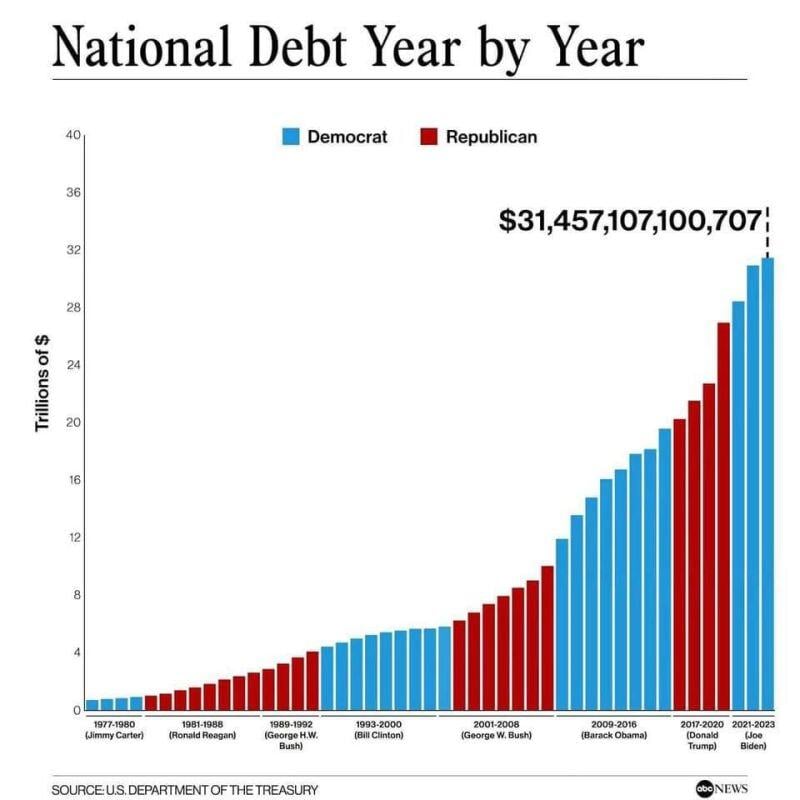

US National debt. A bit of maths...

The current level is almost $35 trillion. And the government has baked in minimum $2 trillion deficits going forward. There are $5 trillion in government revenues per year. 100% of government revenue is consumed by Social Security, Medicare, Medicaid and interest on the debt. Interest on the debt is WAY over $1 trillion per year, more than 20% of government revenue. It takes another $2 trillion minimum per year to fund defense and all of the other departments of the government that they are unwilling to cut. There are also extra items like Ukraine and whatever the wars going on that get additional off budget funding. It should thus keep rising. Source: Wall Street Silver, ABC News

Investing with intelligence

Our latest research, commentary and market outlooks