Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Trump odds of winning the Presidential election are BELOW where they were after the debate…

Source: Predictit

The steepening trade continues with US 2s/30s yield spread jumping to 12bps, the highest since 2022.

Source: Bloomberg, HolgerZ

India’s dependence on Chinese imports keeps growing:

• In 2023-24 financial year China edged past the US to reclaim its position as India’s top trading partner • India’s imports from China rose by 56% since 2020, fuelling a 75% rise in country's trade deficit with China Source: Agathe Demarais, The Economist

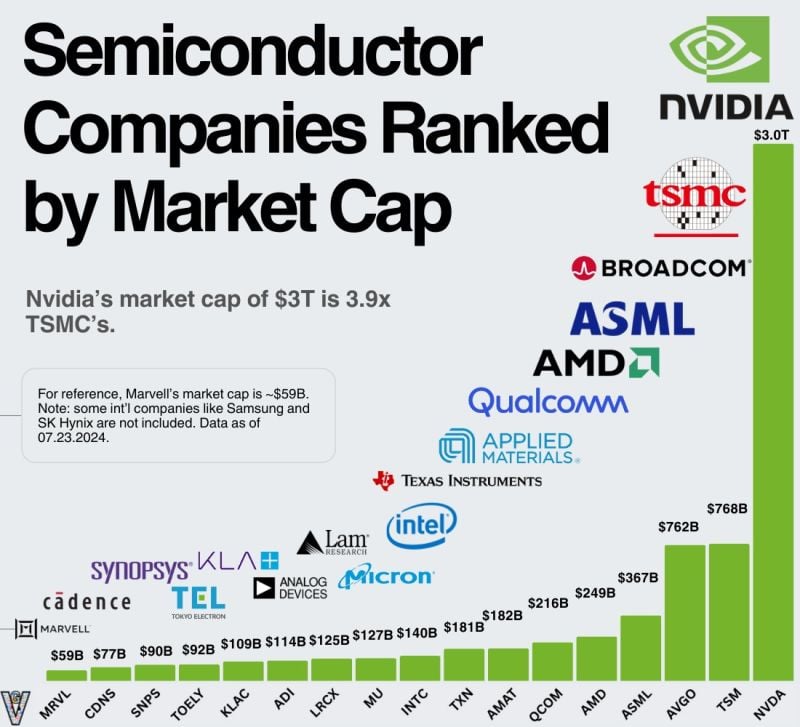

Semi conductors Companies Ranked by Market Cap - @EricFlaningam on X:

1)The scale of the industry is incredible. Many public companies larger than $10B aren’t listed here. 2) $NVDA's performance over the last two years has to be one of the best tech stories ever. Incredible how they built their accelerated computing ecosystem for over a decade before the current infrastructure boom.

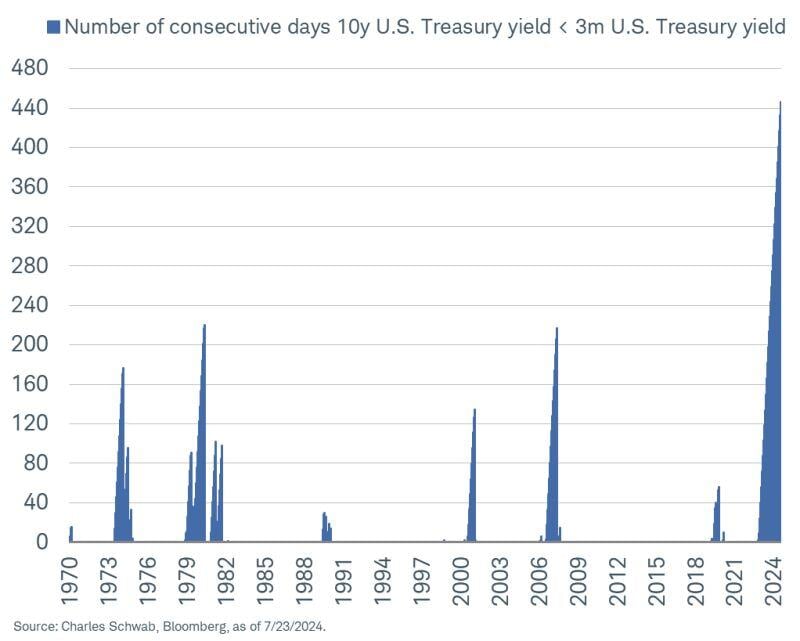

US 10y-3m yield spread has been negative for more than 440 days.

But no recession so far... Source: Kevin Gordon

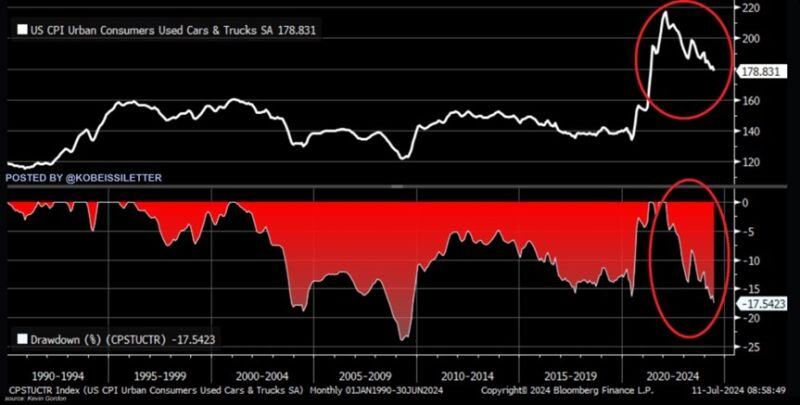

Used car prices are crashing: Used car and truck prices are now down 17.5% since the 2021 peak, the largest decline in 15 years.

Over the last 35 years, there were only two times when prices of used vehicles saw a bigger drawdown: in 2004 and 2009. Overall, US wholesale prices of used vehicles have declined for 22 consecutive months. In June, average wholesale prices decreased by 8.9% year-over-year to $17,934. EV makers have been hit the hardest, with some EV prices falling over 40% since last year. The car market bubble has popped. Source: The Kobeissi Letter, Bloomberg

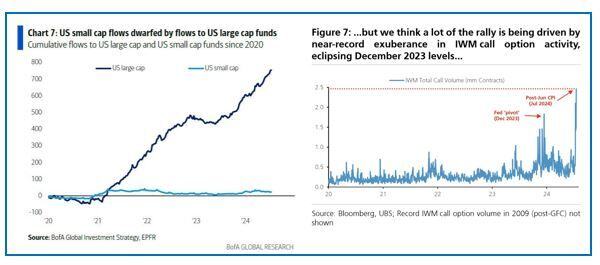

The current US small caps rally seems to be mainly driven near-record exuberance in Russell 2000 ETF $IWM call options activity

(chart on the right) rather than inflows into small caps funds (chart on the left). Source: BofA, UBS

BREAKING >>>> Kamala Harris starts the race down 9 Points, even worse than Biden

A national survey released yesterday (22/7) by HarrisX and Forbes Breaking News shows former President Donald J. Trump more than doubling his lead over both President Joe Biden and Vice President Kamala Harris in the aftermath of the Republican National Convention (RNC). The poll, taken before Biden officially dropped out of the race, indicates Trump leading Biden among registered voters 48%-40%, up from 45%-42% prior to RNC, and leading Harris 50% to 41%. Among likely November voters, Trump’s lead increases to double digits: 49%-39% against Biden, with 12% undecided and 51%-40% against Harris, with 9% as undecided voters. The poll, which was conducted July 19-21, 2024 with 2,753 registered voters, also shows that voters expect Trump to win in November. Nearly two in three (65%) expected him to win against Biden and nearly as many (63%) say he would win against Harris. “Kamala Harris starts her 2024 battle behind Trump, who is enjoying a strong post-convention bump and leads her by almost digits in our polling,” commented Dritan Nesho, CEO and chief pollster at HarrisX, on the findings. “If the polls don’t start to close and show better traction for her, Biden’s decision to step aside for Harris may be a case of ‘too similar, too late.’ That said, Vice President Harris alleviates concerns among the democratic base and is better able to sway undecided independents and suburban women, showing some promise.” Source: HarrisX/Forbes

Investing with intelligence

Our latest research, commentary and market outlooks