Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

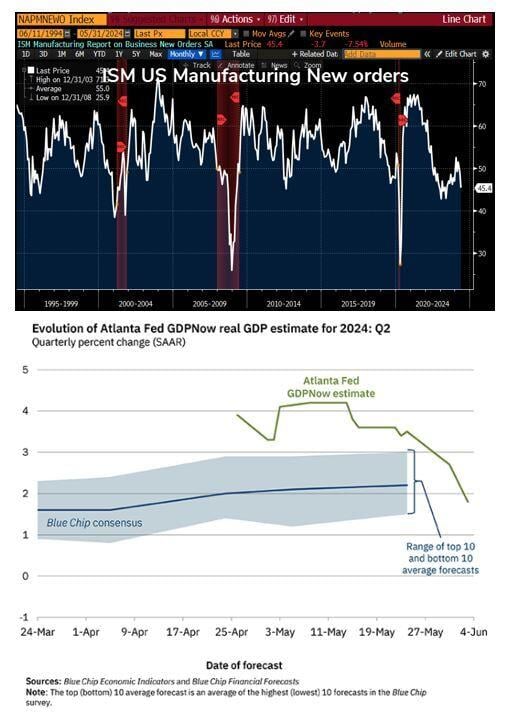

Atlanta Fed US Q2 GDP estimate plunges to 1.8% from 2.7% on May 31, and from 4.1% two weeks ago

Source: zerohedge

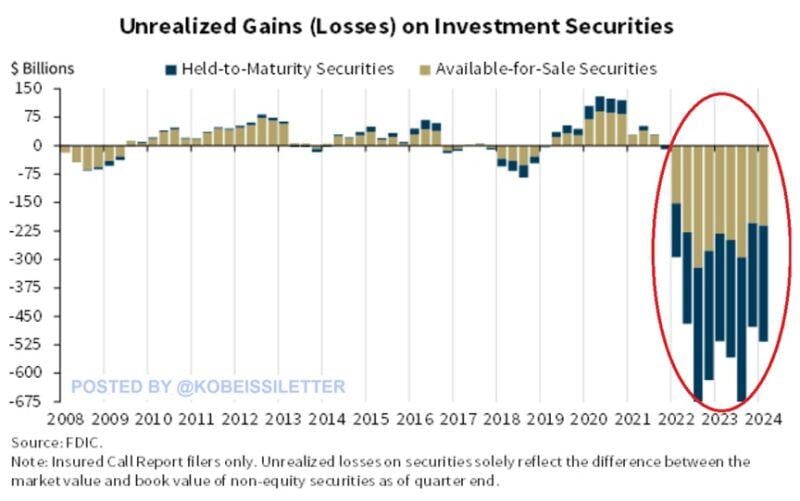

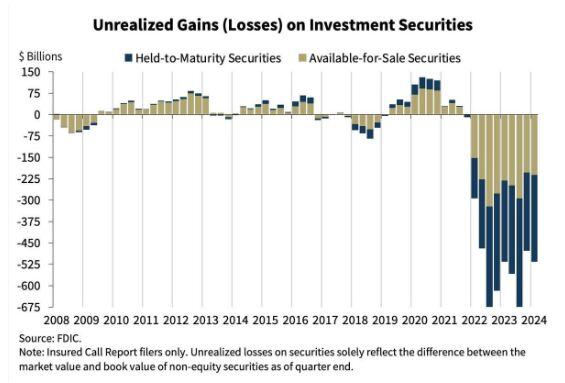

BREAKING: U.S. Banking System >>> FDIC warns that 63 Lenders are on the brink of insolvency due to banks sitting on $517 billion in unrealized losses

This is $39 billion higher than the $478 billion recorded in Q4 2023. The surge was driven by higher residential mortgage-backed securities losses held by banks due to rising mortgage rates. Q1 2024 also marked the 10th consecutive quarter of unrealized losses, an even longer streak than during the 2008 Financial Crisis. As “higher for longer” returns, unrealized losses are likely to continue rising. Source: BofA, The Kobeissi Letter

Two clear indications yesterday that the US economy is (finally) slowing down:

1) ISM Manufacturing New Orders rolling back over to 45.4 vs survey of 49.4; 2) Atlanta Q2 GDPNow dropped to 1.8% from 2.7% last week. And down from 4.2% in mid May... Source: Bloomberg, AtlantaFed

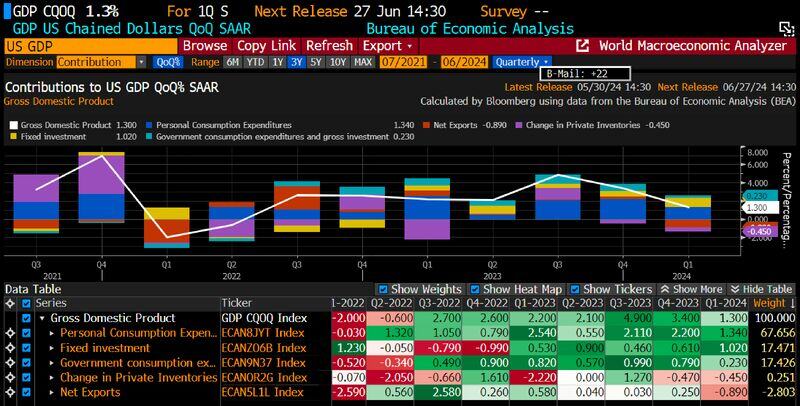

US Q1 GDP growth was slower on soft consumer spending.

The US economy expanded at 1.3% pace versus initial estimate of 1.6%. Consumer spending was lower on outlays for goods like autos. Source: Bloomberg, HolgerZ

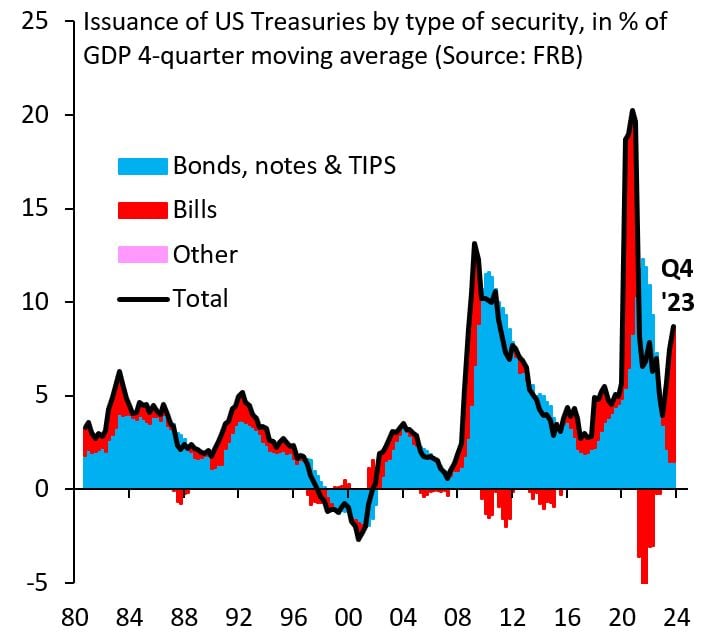

It's hard to understate just how unprecedented the scale of US fiscal stimulus is at the moment.

Not only is the deficit massive for a non-crisis period, but its financing is almost entirely via very short-term issuance, which has never been the case before in a non-crisis time. Source: Robin Brooks

Bullish sentiment on US equities is through the roof:

In May, 48.2% of Americans anticipated stock prices to increase over the next 12 months, according to the Conference Board Consumer Confidence Survey. This is the 3rd highest reading in history, only below the January 2018 and March 2024 surveys. Over just 2 years, this share has nearly doubled as stocks recovered from the 2022 bear market. Meanwhile, the S&P 500 has rallied a massive 48% since the October 2022 low. Stock market sentiment is incredibly strong. Source: Bloomberg, The Kobeissi Letter

BREAKING 🚨: U.S. Banks

Unrealized losses in the U.S. Banking System increased to $517 billion in Q1 Source: Barchart, BofA

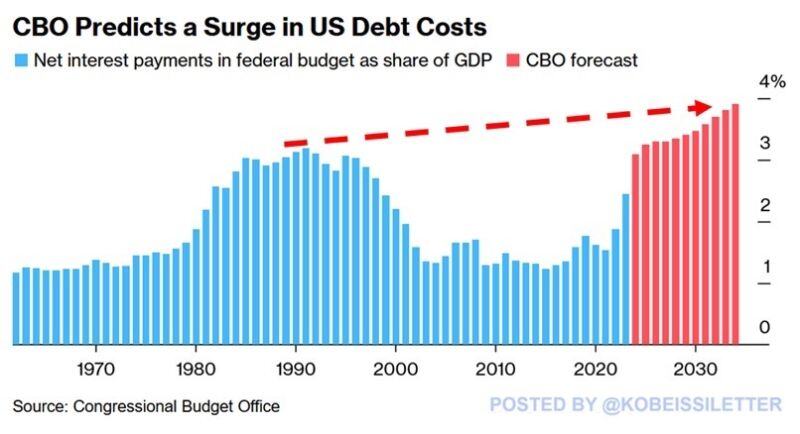

Shocking stat of the day: US net interest payments as a share of GDP are set to reach 3.9% by 2034, the highest in history.

This exceeds the all-time record percentage seen in the 1990s as well as World War II levels. Net interest is expected to account for 75% of the budget deficit increase over the next decade, according to the CBO. All as interest expense has already DOUBLED in just 3 years and now costs the US ~$2 billion per day. The worst part? This project assumes no recession hits within the next 10 years. What happens if we enter a recession? Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks