Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Thursday's US stock market heat map. $NVDA is literally holding up the entire market.

Source: The Kobeissi Letter

Jamie Dimon does not rule out a hard landing for the US economy

Source: CNBC

Bears are capitulating...

Mike Wilson chief equity strategist of Morgan Stanley has revised his price target of the S&P 500 from 4,500 to 5,400 Notoriously a market bear, he had previously predicted a 15% drop by December for the index. Source: Radar, The Macro Guy, Bloomberg

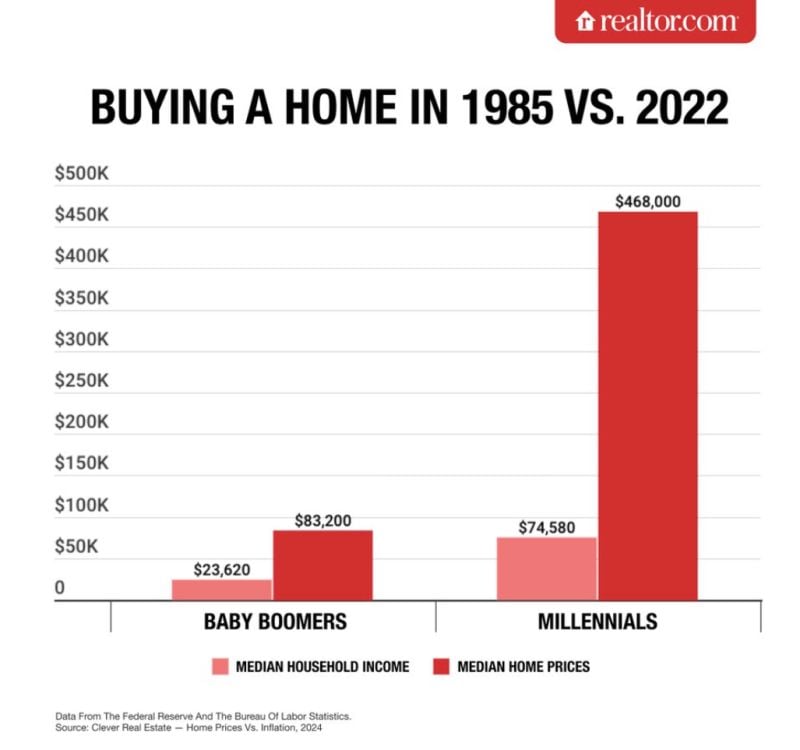

Want to buy a home?

1980: save for a couple years 2024: forget about it Source: Michael Burry Stock Tracker

The cost of servicing US government debt is on course to surpass defense spending

Source: Bloomberg, Michael McDonough

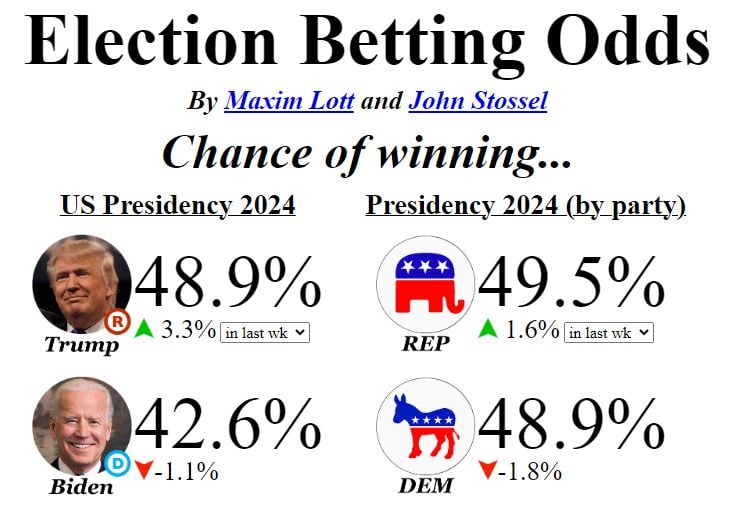

We've seen a pretty big move in Presidential betting odds over the last week

Trump now holds a 6.3 point lead on Biden and Republicans are now on top in the generic head to head. From @maximlott at https://lnkd.in/dT6EHQvp thru bespoke

SUMMARY OF FED CHAIR POWELL'S COMMENTS (5/14/24):

1. "Overall a good picture looking at US economic data" 2. Inflation was notable in Q1 for the lack of further progress 3. Housing inflation has been a bit of a puzzle for the Fed 4. Restrictive policy may take longer than expected to lower inflation 5. Unlikely the Fed's next move will be an interest rate hike 6. "Credibility is everything for central banks" Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks