Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

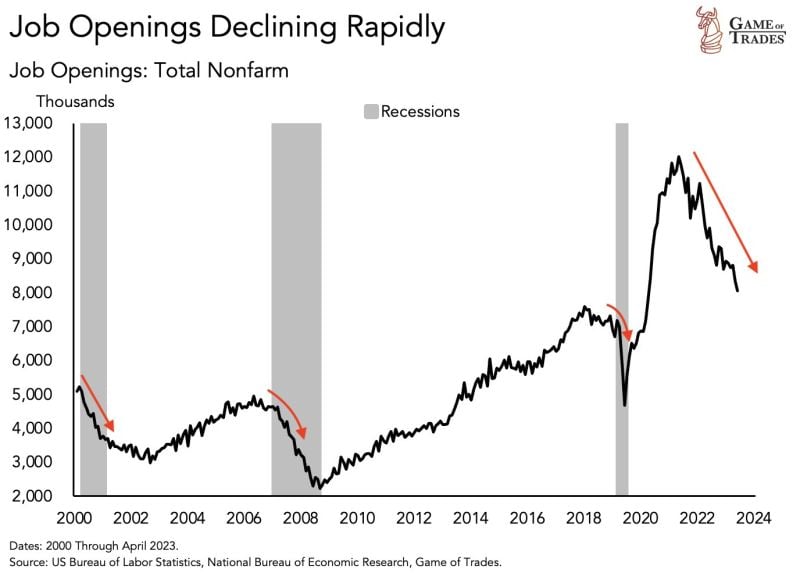

US job openings have just seen a sharp move down today.

JOLTS 8.06 million openings vs 8.4 million expectations. This is rather a large miss. This kind of a steep declining has only been seen 3 times since 2000. The jobs market continues to soften. Source: Game of Trades

Is US Consumer Discretionary vs Staples giving us a warning sign about the US consumer?

Source: Bloomberg

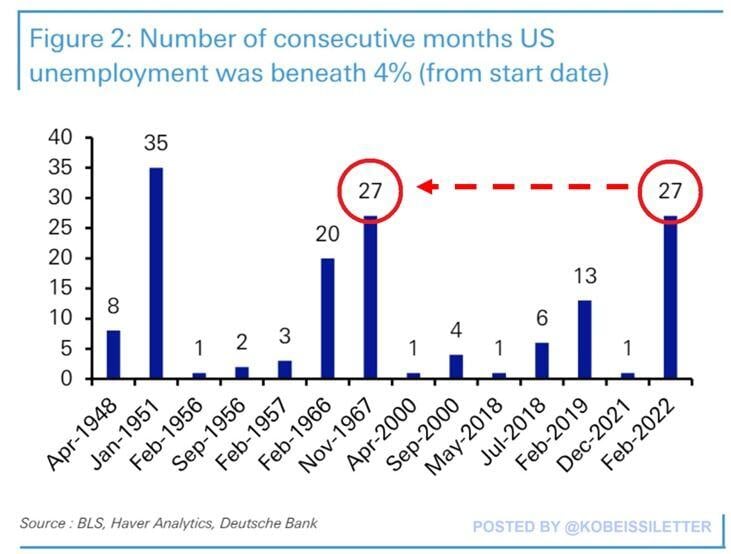

How "strong" is the labor market?

The US economy has seen an unemployment rate below 4% for 27 straight months, longest streak since the 1967. The longest streak of below 4% unemployment occurred in 1951 and lasted for 35 months. On Friday, the BLS will release labor market data for May, and estimates believe unemployment will be 3.9%. If unemployment comes in line or below expectations, it would mark the 2nd longest streak in history. Meanwhile, most Americans argue that the economy is getting worse. All eyes are on labor market data on Friday. Source: The Kobeissi Letter, DB

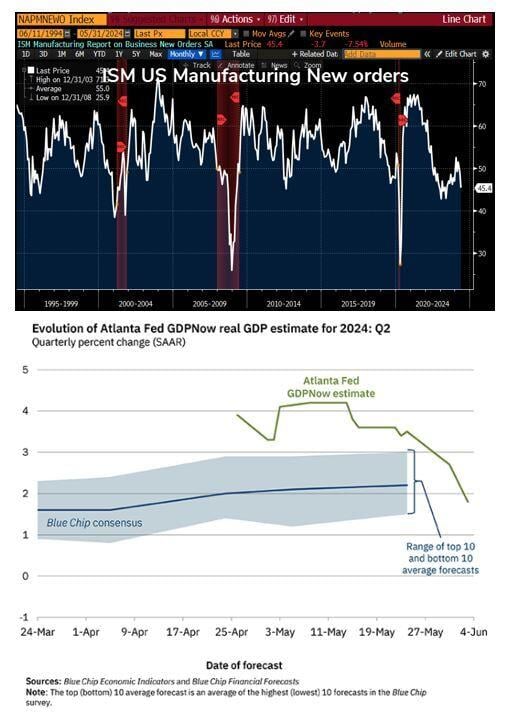

Atlanta Fed US Q2 GDP estimate plunges to 1.8% from 2.7% on May 31, and from 4.1% two weeks ago

Source: zerohedge

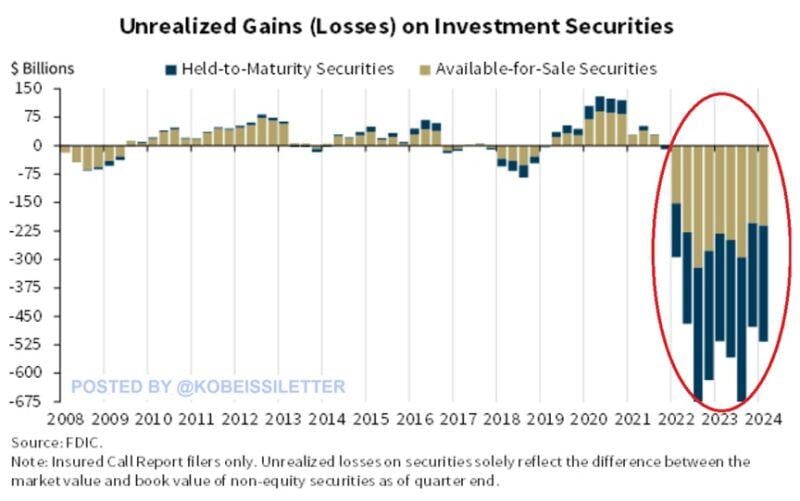

BREAKING: U.S. Banking System >>> FDIC warns that 63 Lenders are on the brink of insolvency due to banks sitting on $517 billion in unrealized losses

This is $39 billion higher than the $478 billion recorded in Q4 2023. The surge was driven by higher residential mortgage-backed securities losses held by banks due to rising mortgage rates. Q1 2024 also marked the 10th consecutive quarter of unrealized losses, an even longer streak than during the 2008 Financial Crisis. As “higher for longer” returns, unrealized losses are likely to continue rising. Source: BofA, The Kobeissi Letter

Two clear indications yesterday that the US economy is (finally) slowing down:

1) ISM Manufacturing New Orders rolling back over to 45.4 vs survey of 49.4; 2) Atlanta Q2 GDPNow dropped to 1.8% from 2.7% last week. And down from 4.2% in mid May... Source: Bloomberg, AtlantaFed

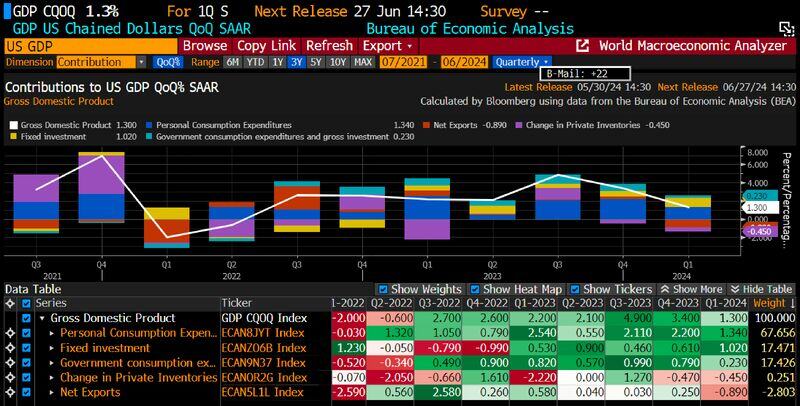

US Q1 GDP growth was slower on soft consumer spending.

The US economy expanded at 1.3% pace versus initial estimate of 1.6%. Consumer spending was lower on outlays for goods like autos. Source: Bloomberg, HolgerZ

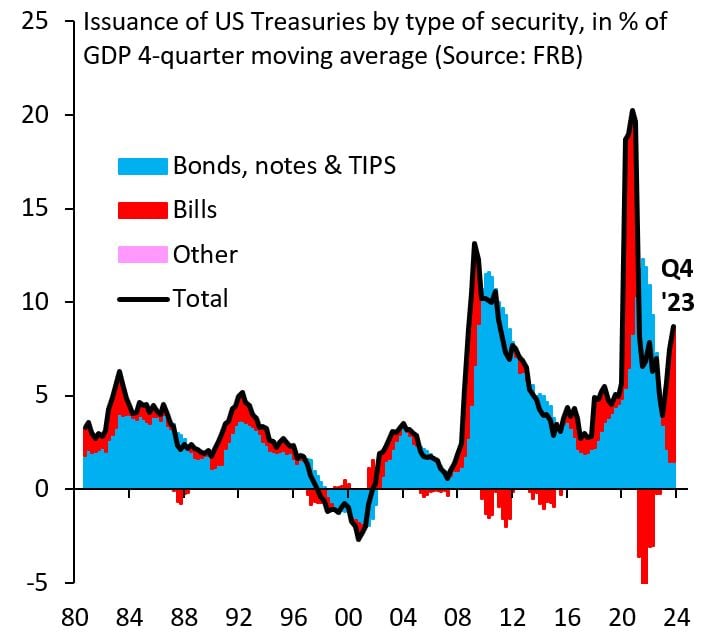

It's hard to understate just how unprecedented the scale of US fiscal stimulus is at the moment.

Not only is the deficit massive for a non-crisis period, but its financing is almost entirely via very short-term issuance, which has never been the case before in a non-crisis time. Source: Robin Brooks

Investing with intelligence

Our latest research, commentary and market outlooks