Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

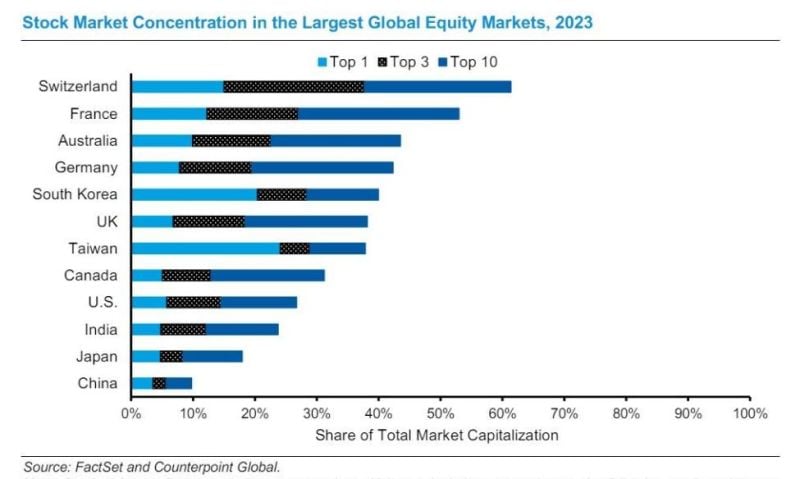

What US stock market concentration? Exhibit below

courtesy of Morgan Stanley and Factset - shows the market concentration at the end of 2023 for a dozen of the largest markets around the world. The U.S. is the fourth MOST DIVERSIFIED market notwithstanding the recent increase in concentration...

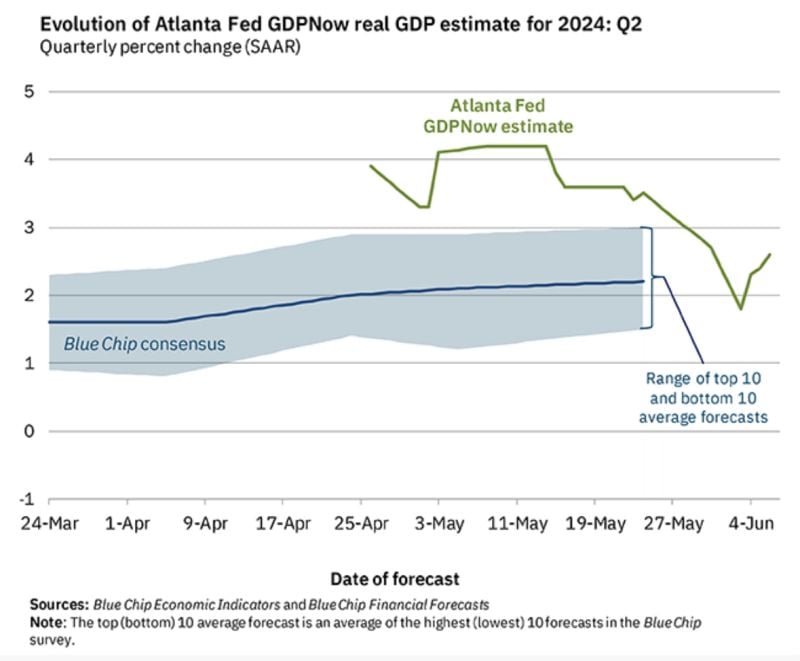

On June 6, the GDPNow model nowcast of real GDP growth in Q2 2024 is 2.6%

Source: Blue Chip Economic Indicators

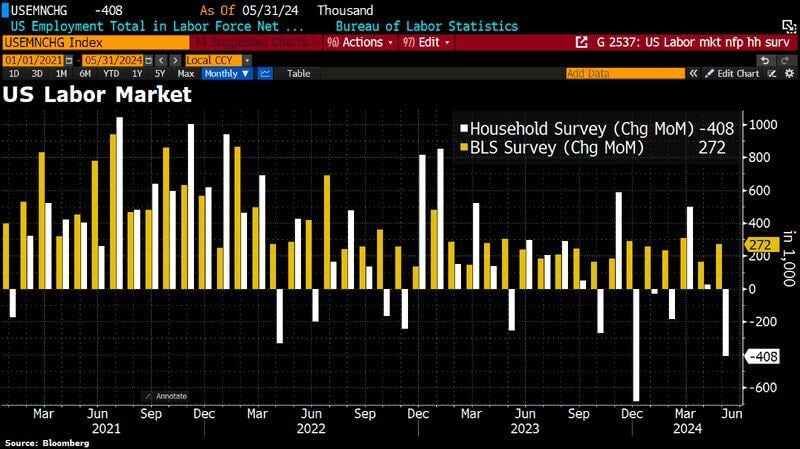

US employment data are out - here we go again with jobs numbers that don't add up...

here we go again with jobs numbers that don't add up... The Establishment survey by BLS reports 272k new jobs for May, smashing estimates (+185K consensus) and much strong than April (+165K). The labor market continues to show signs of resiliency in the face of higher Fed interest rates. This seems to decrease the odds that the hashtag#Fed could cut rates in September... BUT: - Labor force shrank: This is why the US unemployment rate has risen from 3.9% to 4% (first month with 4.0%+ unemployment since February 2022) despite a lower labor participation rate (Indeed, the labor supply as week, and as Unemployment Rate = Number of unemployed / labor force, a weak labor force implies higher unemployment rate despite rise in job creation). - Wage growth surprised to the upside: this could be linked to a reduction in the supply of labor which might be causing some bottlenecks given the still-robust job creation. Wage growth continues to remain a sticky source of inflation, rising at a 4.1% pace, which is still way too hot for the Fed. - The Household survey shows a large drop in the number of employed, down 408k jobs (see white bar below). - Full time jobs actually SHRUNK by 625k (This is the biggest drop in full-time employment since December 2023) while part time jobs rose by 286k. - Between the household and establishment surveys, the numbers are retarded and unusable. This makes economic data analysis very difficult. Bottom-line: Key Takeaway: All things considered, the May jobs report does not point to imminent Fed rate cuts. The pickup in jobs growth supports the case that the resilient labor market remains strong, and the economy continues to hold up better than expected. Source: Bloomberg

US sets stage for antitrust probes into Microsoft, OpenAI and Nvidia

Source: Reuters

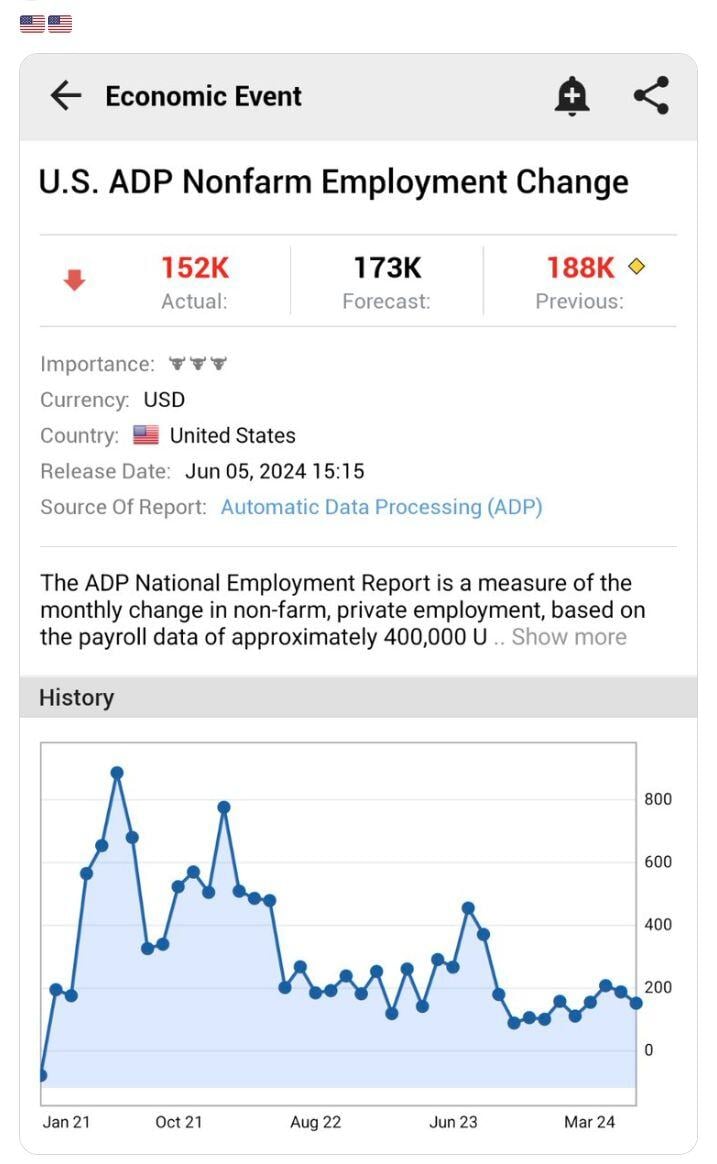

*U.S. MAY ADP NONFARM PAYROLLS REPORT*

1. The U.S. economy added a lower-than-expected 152,000 jobs in May, as per ADP, missing forecasts for a gain of 173,000 (previous was 188,000). 2. This is the lowest number since February 3. The number of job gains for April was revised down from +192,000 to show a gain of +188,000. Key Takeaway: The weak ADP report adds to evidence of a slowing labour market. September rate cut bets will grow stronger as cracks begin to emerge in the economy. Source: www.investing.com

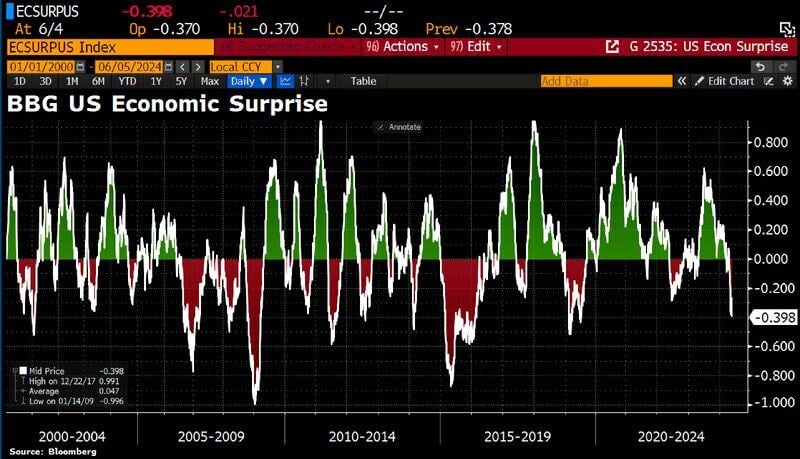

As economic data continues to underwhelm (ISM Manufacturing, JOLTs), the BBG US economic surprise index has plunged to its lowest level in 5 years.

Source: Bloomberg, HolgerZ

The US could be on the brink of the civil war according to Ray Dalio

In an interview given to the FT on 16 May, billionaire investor and founder of Bridgewater Associates warns about the risk of a civil war breaking in the US. Source: FT

The Bloomberg US Economic Surprise index is about the most negative since 2019.

DB's Jim Reid: Yesterday's ISM manufacturing report "was definitely one that dampened optimism about the state of the US economy right now. And it follows a run of weaker US data over recent days." Source: Bloomberg, Liza Abramowitz

Investing with intelligence

Our latest research, commentary and market outlooks