Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

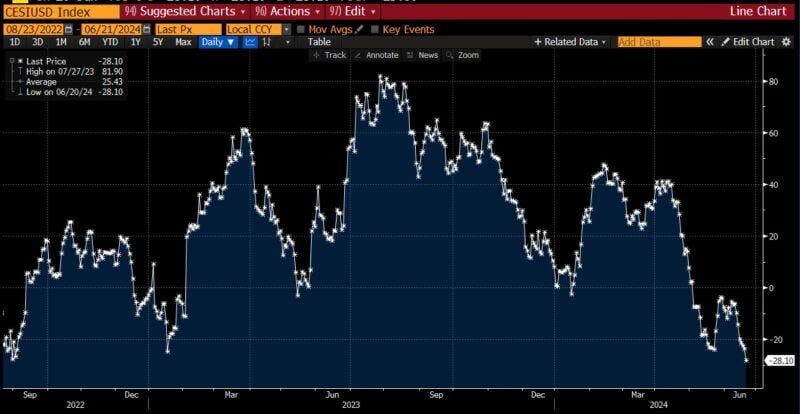

The Citi US economic surprise index has fallen to about the most negative since 2022

h/t @daniburgz, Liz Abramowitz, Bloomberg

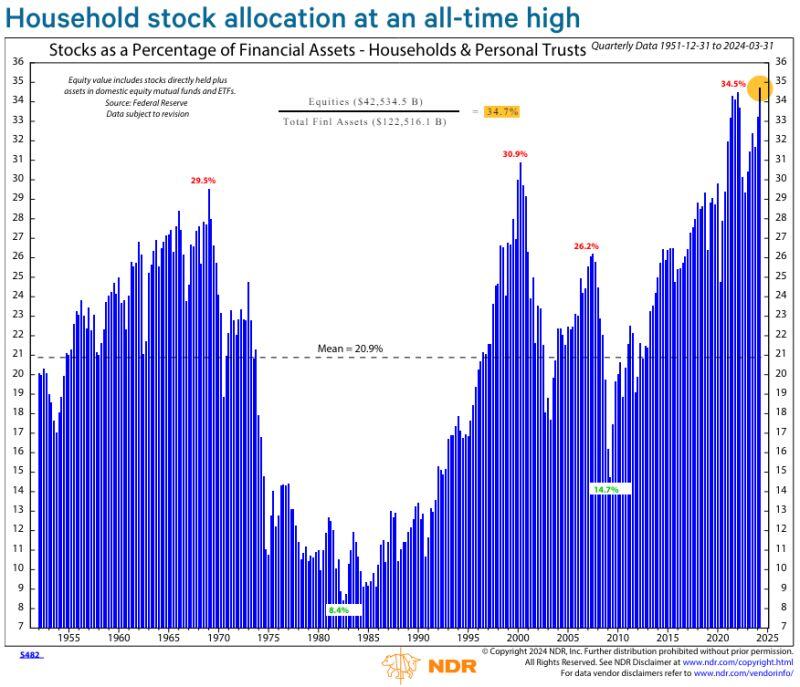

U.S. household stock allocation has reached an all-time high

Source: NDR_Research

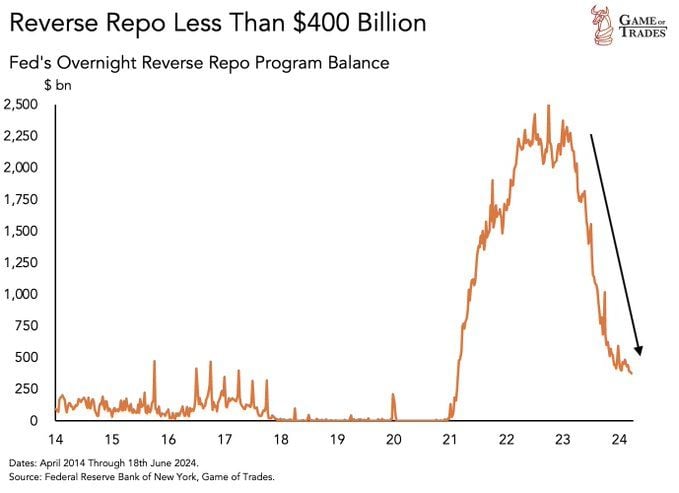

Reverse Repo has been falling off a cliff... Going from +$2300 billion to under $400 billion in just 1.5 years

Source: Game of Trades

There was no support for the markets from the liquidity side this week

US liquidity shrank by $50bn as bank reserves saw the largest drop since April tax deadline. Source: Bloomberg, HolgerZ

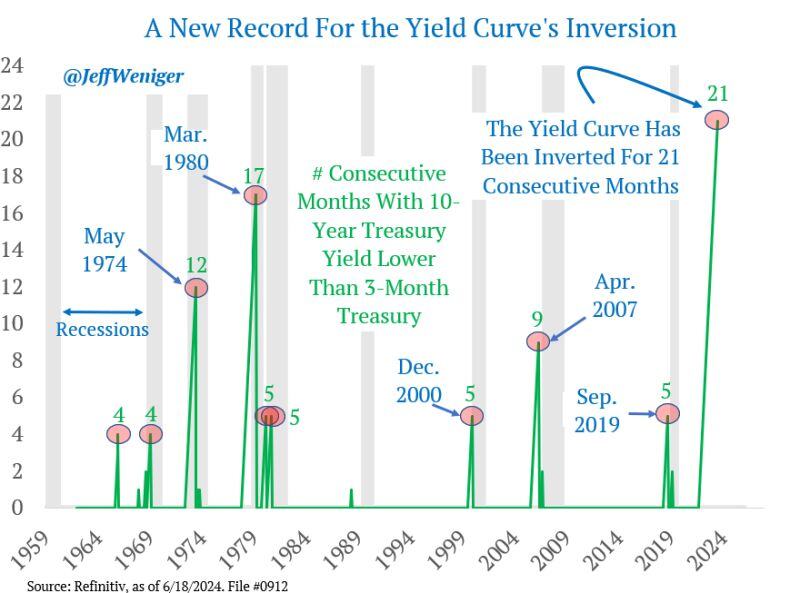

The count on this US yield curve inversion is up to 21 consecutive months, an all-time record. How long this goes, nobody knows

Source: Jeff Weniger

The US has captured one third of all global capital flows since 2020, compared to just 18% before the pandemic

Source: Barchart

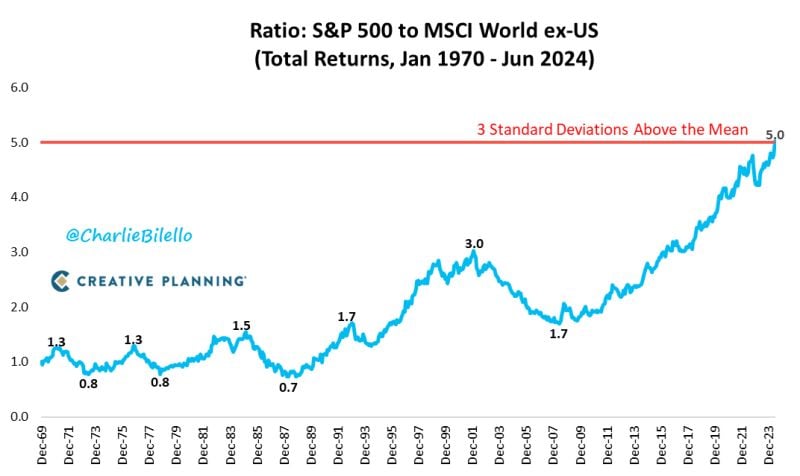

US vs. International stocks... 3 standard deviations above the mean...

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks