Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Momentum Trading is having the most success in history, even surpassing the Dot Com Bubble

Source: Barchart, Bloomberg

Interesting article by The Wall Street Journal ->

US dollar stable coin BOOST DEMAND for US government bonds and help the US keep up with China... Source: Radar, WSJ

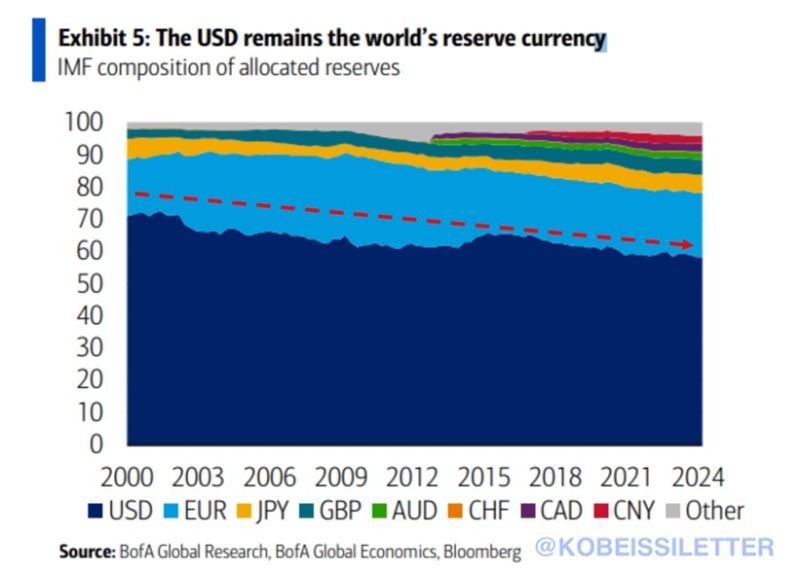

The US Dollar's reserve currency status remains in a downtrend:

The US Dollar share of the world's central banks reserves fell slightly to 58.4% in Q4 2023 from 59.2% in Q3 2023, according to the IMF. By comparison, the US Dollar accounted to 71% of reserves globally in 2000. However, it is worth noting that the US Dollar remains the most dominant currency and it's not even close. For example. the Chinese Yuan's share in Q4 2024 was just 2.3% and the Euro's share is ~20%. Is the US Dollar's reserve currency status safe? Source: The Kobeissi Letter, BofA

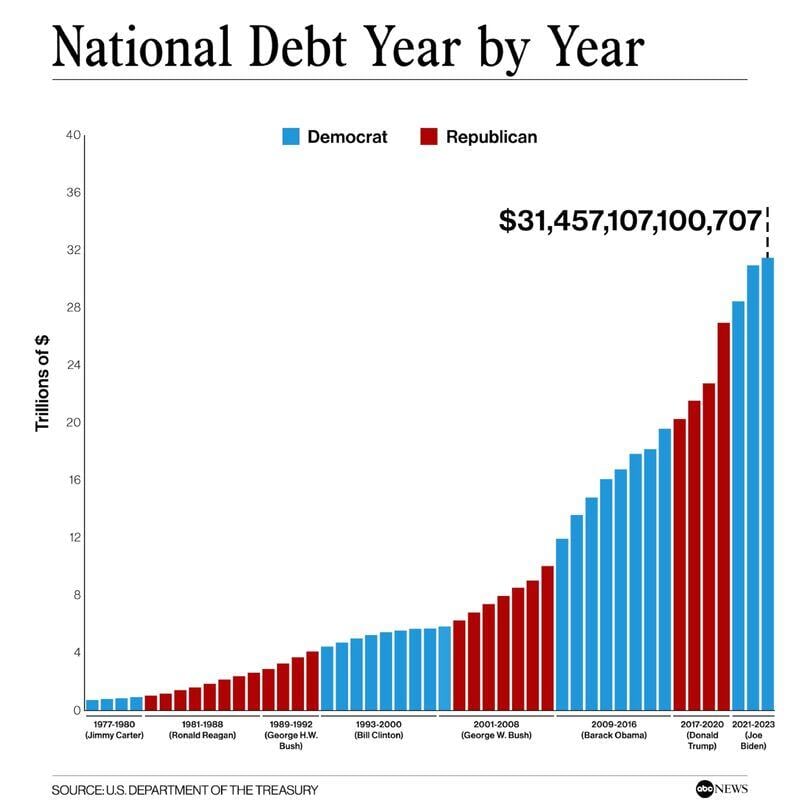

There are 3 sure things in life: death, taxes… and the rise of National debt (whoever is in the White House)

Source: EricOfRivia⚡️🍕

BREAKING >>> The Fed held rates unchanged as expected...

*FED HOLDS BENCHMARK RATE IN 5.25-5.5% TARGET RANGE And changed wording on inflation (from a "lack" of progress): *FED: INFLATION MADE MODEST FURTHER PROGRESS IN RECENT MONTHS BUT... The dot-plot was hawkish, adjust to just one 25bps cut in 2024 (and four 25bps cuts in 2025) *FOMC MEDIAN FORECAST SHOWS 25 BPS RATE CUTS IN '24 VS 75 BPS *FOMC MEDIAN FORECAST SHOWS 100 BPS RATE CUTS IN '25 VS 75 BPS There is another notable development: The longer-run estimate of the federal funds rate has gone up to 2.8% now, in the median forecast. That’s the second straight increase. Last time it had ticked up to 2.6% from 2.5%. So, in six months, policymakers have added more than a quarter percentage point to where they see the benchmark rate over the longer haul -- the so-called neutral rate. Additionally, The Fed increased its end-2024 expectations for inflation...but kept its unemployment expectations unchanged... There were 10 Fed members who saw rates at 4.625% or below by end 2024 in March... now there are none... There were NO dissents today, extending the streak of zero votes against the FOMC policy decision to 16 meetings, the longest period of no dissents since Alan Greenspan’s 17-meeting streak from August 2003 to September 2005. Today’s reassuring CPI report was relayed to FOMC members during the meeting, but many may be waiting for additional inputs (eg, PPI, PCE) before changing their forecasts. Bottom-line: The Fed re-arranged 2024-2025 dots from (2+3) to (1+4), and marked-to market their Core PCE forecast for year-end - signalling they are just being extra careful, and want some more evidence before committing to a cut. On our side, we still expect monetary policy to normalize in the months to come. We expect the Fed to continue their "meeting by meeting" approach with our base case being a cut in September. Indeed, it will take at least several more months of data to gain confidence that inflation is behaving in a manner the Fed finds acceptable. One key takeaway from today is that there’s a significant number of FOMC members that may prefer to wait even longer than September if upcoming data do not give them additional cover. Source: Bloomberg, www.zerohedge.com

The US is adding almost $100B of deficit PER WEEK

Source: Geiger Capital

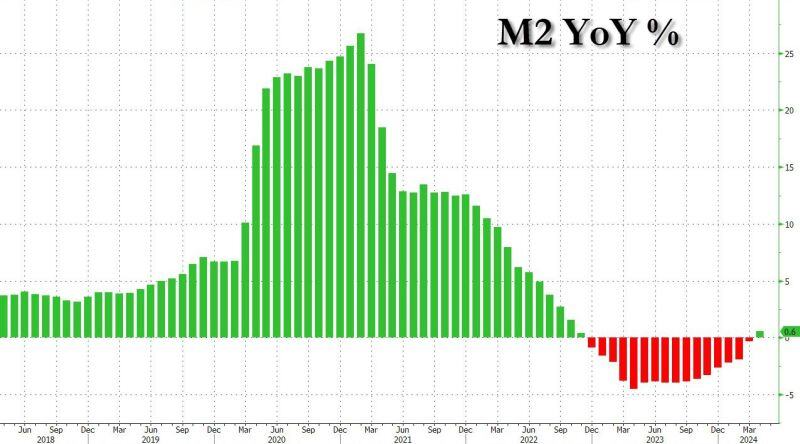

M2 is now positive in the US (with rates at 5.5%). Are rate cuts, QE and YCC just a matter of time?

Source: www.zerohedge.com, Bloomberg

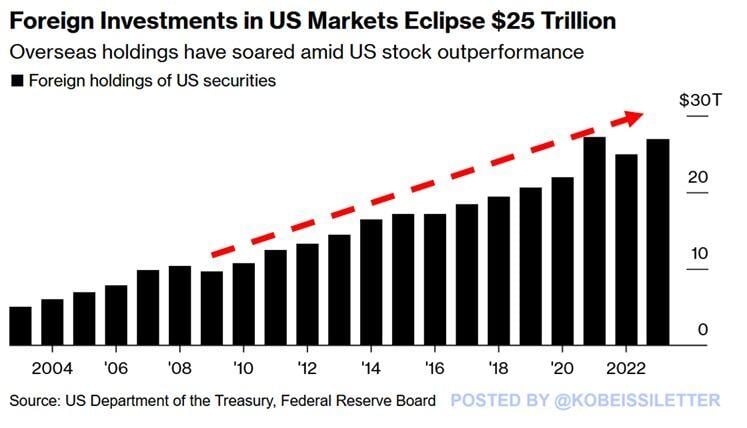

Foreign investors are piling into US markets:

Foreign holdings of US securities have hit ~$27 trillion in 2023, near the all-time highs seen in 2021. Since 2009, foreign investments in US markets have skyrocketed by 180%. This comes after the S&P 500 has gained 573% during this time materially outperforming other markets such as the EU, Canada, and Japan. Meanwhile, foreign investors’ share of the $78 trillion US equity market has risen to ~17%, an all time record. Source: Bloomberg, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks