Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US GDP grew 4.9% in Q3 QoQ annualized, way faster than +4.3% expected

However, bond yields dropped in the afternoon session. This Bloomberg US GDP chart shows why. Indeed, US GDP growth in Q3 was mainly driven by private consumption & inventories. This may not last. Source: Bloomberg, HolgerZ

US stocks now account for 61% of the $60 Trillion MSCI All-Country World Index, the highest level in history

Source: FT, Barchart, Bloomberg

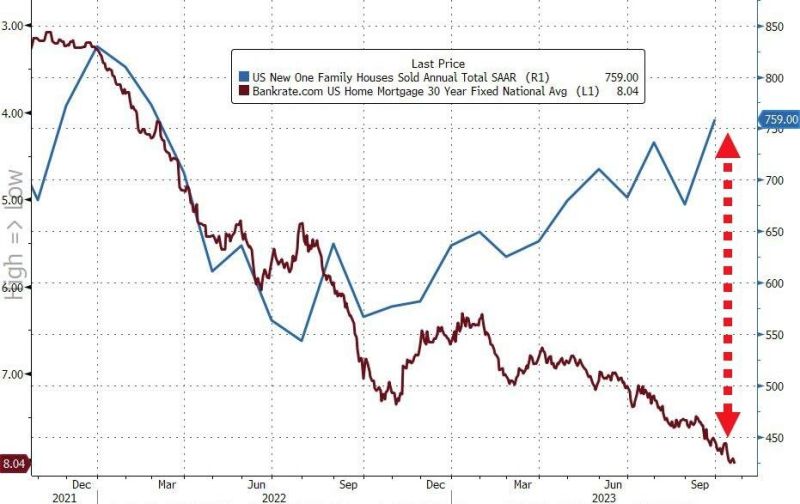

The US housing market conundrum ->

New home sales just surged 12.3% month-over-month in September, the largest jump since August 2022. Even as mortgage rates push above 8% for the first time in 23 years, new home sales are surging. The gap between new home sales and mortgage rates has never been wider. Why is this happening? Explanation by The Kobeissi Letter: -> Homebuilders are taking on some of the cost of higher mortgages AND existing home sales are at their lowest since 2010. New homes are the only option for buyers and homebuilders are helping pay for it. Source: The Kobeissi Letter, www.zerohedge.com

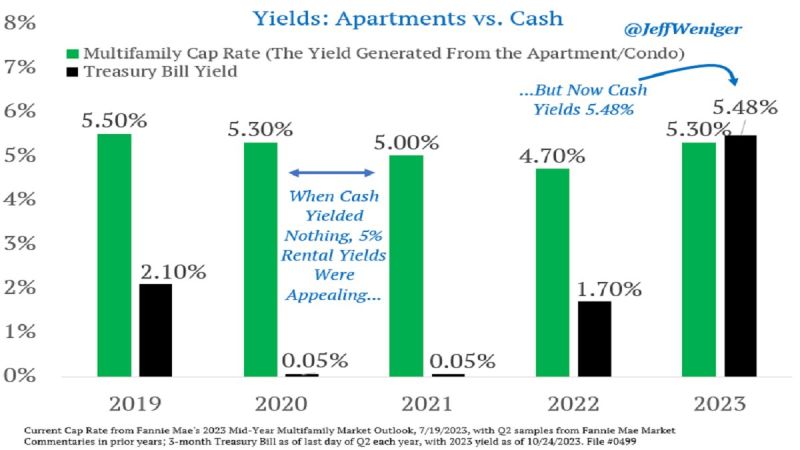

The money market yield spike upends a ton of business models. In this case, landlording in the US

Inded, multifamily cap rate is now BELOW cash rate... Source: Jeff Weniger

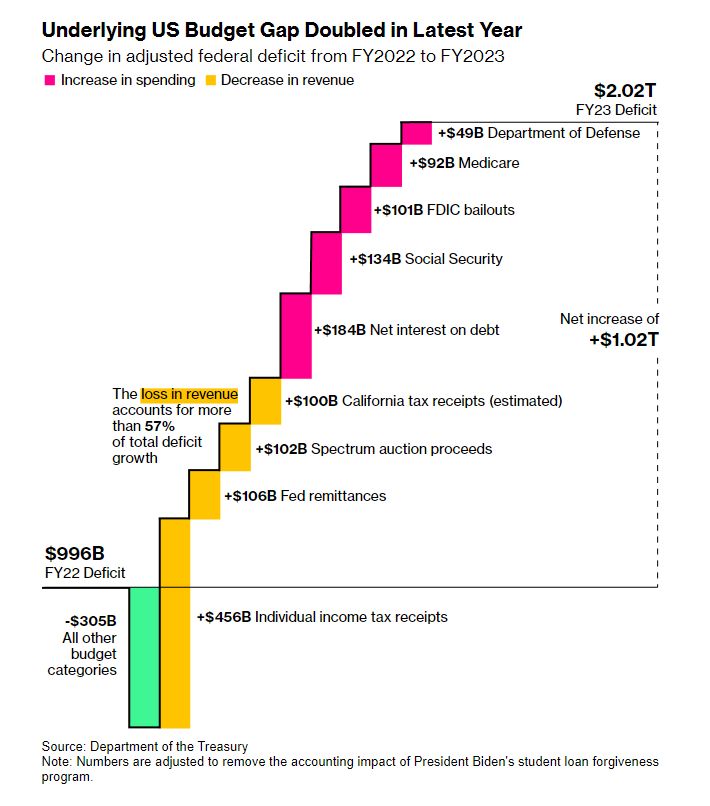

US deficit is doubling as US Economy grows shows why yields are at 5%

Source: Bitcoin magazine

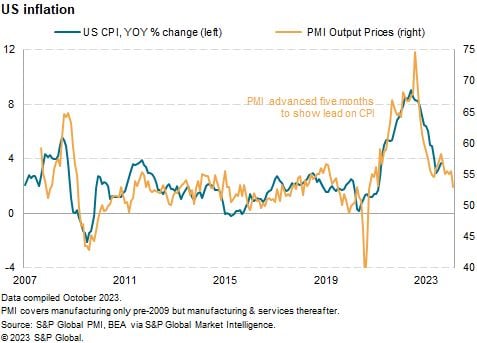

A Big drop in US flash PMI selling price gauge in October brings the FOMC 2% target into focus for the first time in three years

Source: Chris Williamson

CTAs are running equity shorts, global as well as US

Source: TME, GS

This chart illustrates another factor contributing to the increase in US bond yields:

Concerns about the govt's ability to manage its debt responsibly. The price of insuring against the possibility of the US government defaulting on its obligations (CDS Price) has recently jumped Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks