Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

With the US 10-year yield close to 5%, long duration bonds start to look attractive

There is one issue though: sentiment on long-dated bonds look too optimistic E.g 1/ not a single sell-side analyst does have a 10-year target yield above 5% for the next 6 months; 2/ Long-dated bonds funds are enjoying record inflows; 3/ Magazine cover pages look upbeat on bonds (source: J-C Parets). The consensus is not always wrong but so much optimism is usually not a good sign from a contrarian perspective.

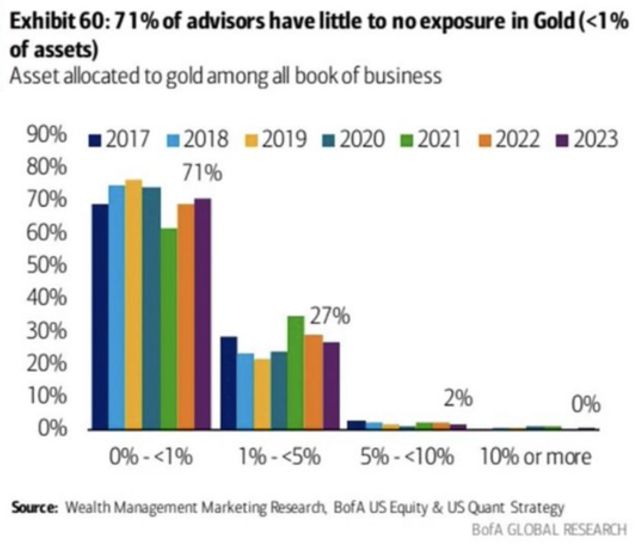

As highlighted by Tavi Costa, despite the recent push toward new highs, gold remains severely under-allocated

In fact, 71% of US advisors have little to no exposure to the metal. Similar to how Central banks continue to aggressively accumulate the metal, conventional investment portfolios have yet to take steps to find true diversifiers. Sources: Tavi Costa, BobEUnlimited

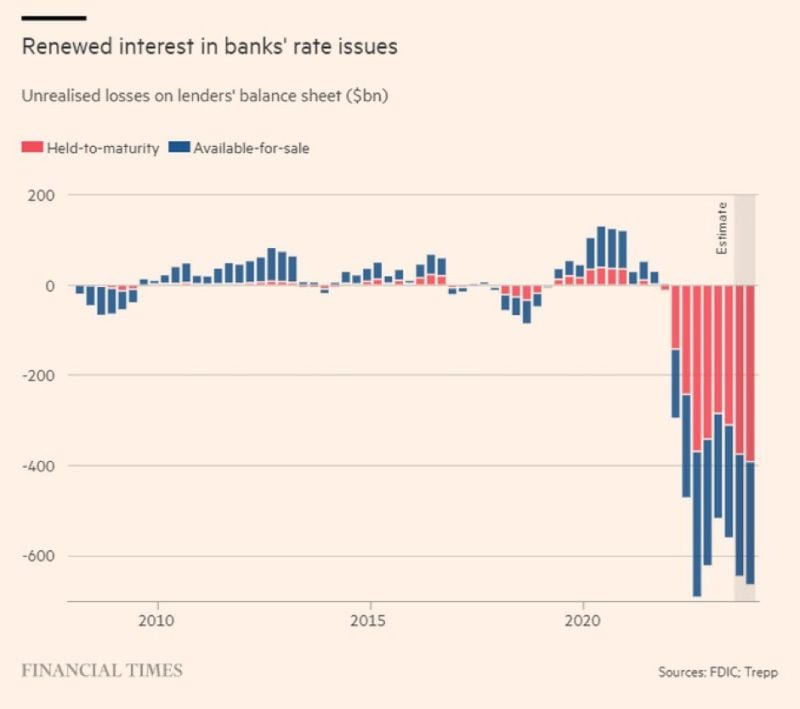

U.S. Bank losses on held-to-maturity assets have soared to an ALL-TIME HIGH of $400 Billion

Source: Barchart

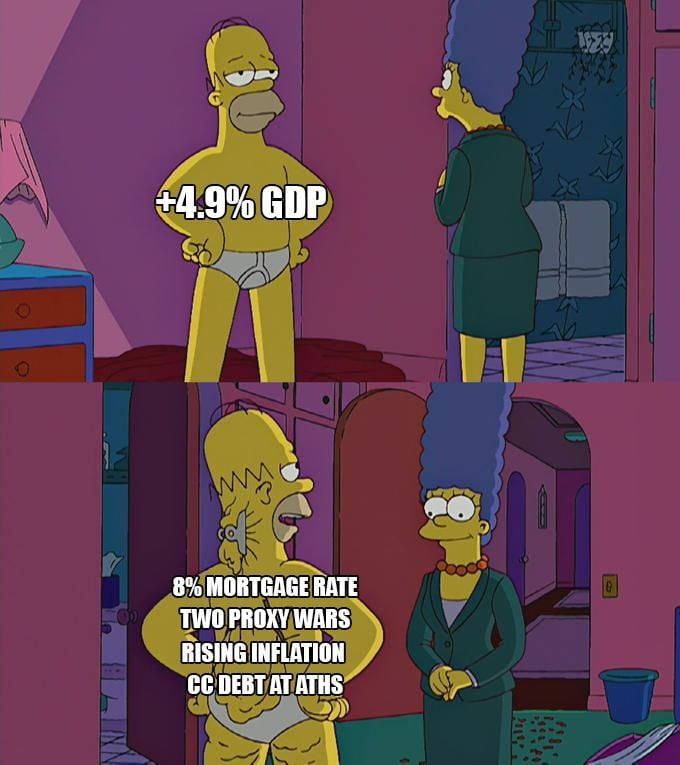

US Q3 GDP numbers summarized in one cartoon

Source: Elizabeth Oliveira Fonseca

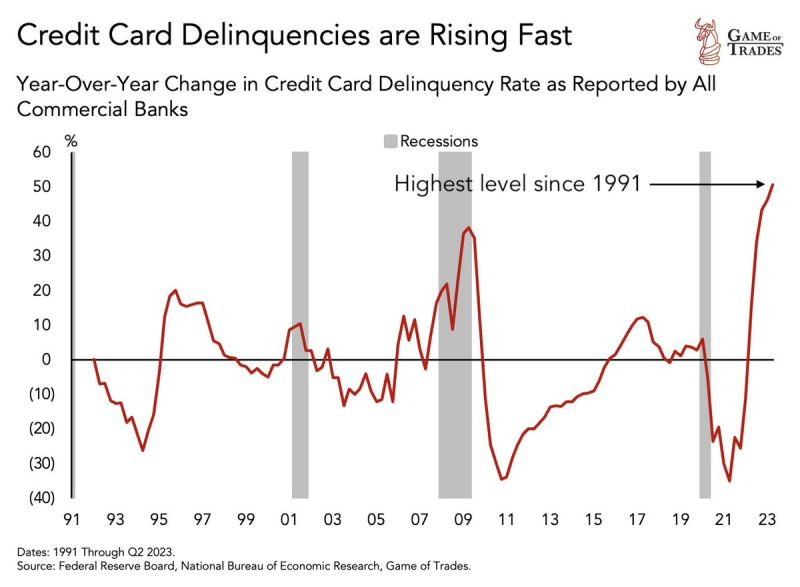

This is WORSE than the 2008 Financial Crisis. Credit card defaults are rising at levels NEVER seen in 3 decades

Source: Game of Trades

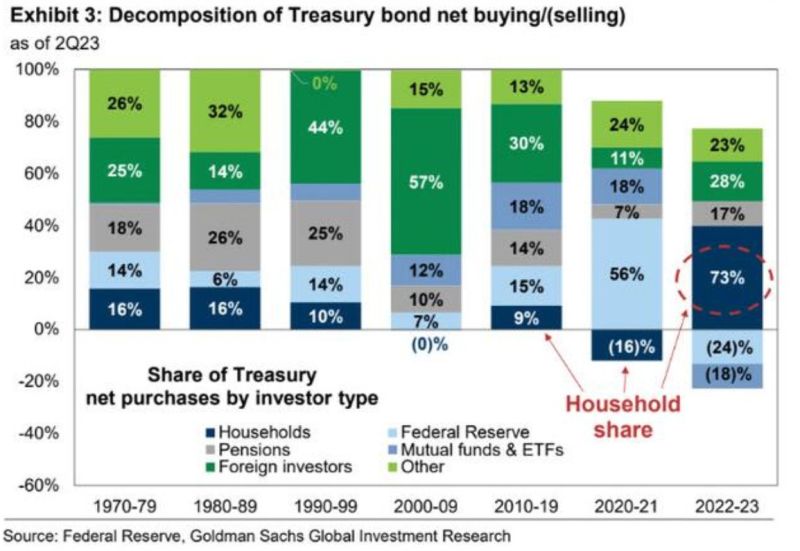

Adding to that Great Rotation theme is this chart

US households account for 73% of Treasury bond buying in 2022-2023 (so far) A lot of pain being experienced for those not willing to hold to maturity amid this bond blood bath... Source: Markets & Mayhem, Goldman Sachs

P/E Forward for the largest US companies - Magnificent 7

$TSLA Tesla 62 $AMZN Amazon 58 $NVDA NVIDIA 40 $MSFT Microsoft 30. $AAPL Apple 28 $GOOGL Alphabet 24 $META Meta 23 Source: Vlad Bastion

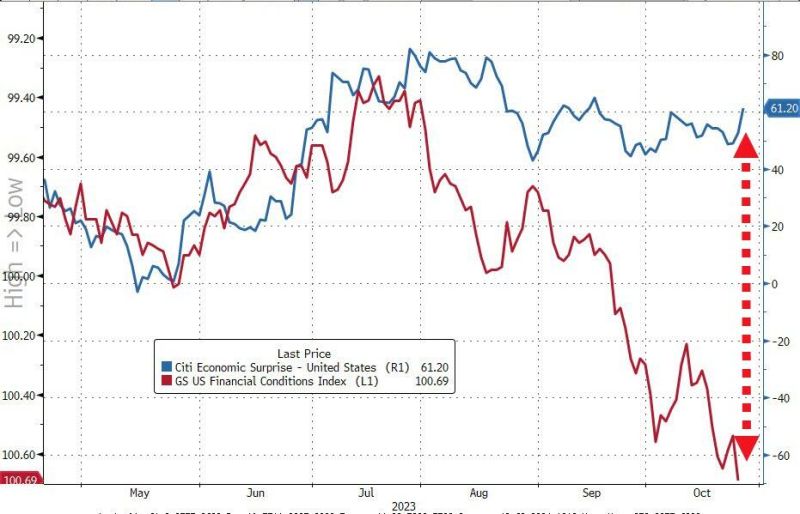

For now, the monetary policy transmission route of tightening US financial conditions are NOT reaching the economy...

Indeed, an avalanche of US macro data on Thursday presented a positive blend of updates across growth (better), inflation (lower), and labor markets (looser/worse). - Economic Growth: Real GDP rose 4.9% in 3Q (consensus 4.5%) driven by strong demand across consumer and federal/state government, and inventories. However, a major contribution from inventories could in turn weigh significantly on growth in 4Q - Manufacturing: Orders for Durable and core capital goods also grew by more than expected... thanks to a massive surge in non-defense aircraft orders (so don't expect it to last). - Housing: Pending home sales rose 1.1% month over month in September, above expectations for a decline... but brace for October to be a bloodbath as mortgage rates re-accelerated. - Inflation: Core PCE prices component of the GDP report rose less than expected. - Labor: Initial and continuing jobless claims both increased by more than expected -- a positive for markets which are focused on labor market re-balancing (i.e., could benefit from less wage inflation).

Investing with intelligence

Our latest research, commentary and market outlooks