Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

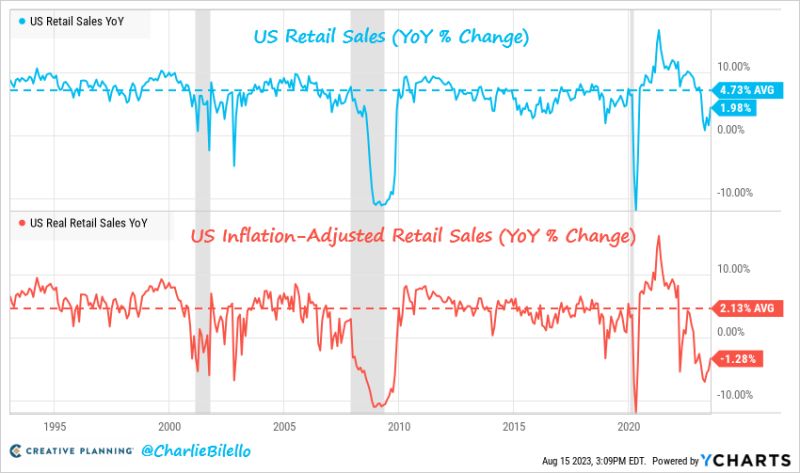

After adjusting for inflation, US retail sales fell 1.3% over the last year, the 9th consecutive YoY decline

That's the longest down streak since 2009. Nominal retail sales increased 2% YoY vs. a historical average of 4.7%. Source: Charlie Bilello

US stock market current mood in one picture

Source: Heisenberg - Mr_Derivatives

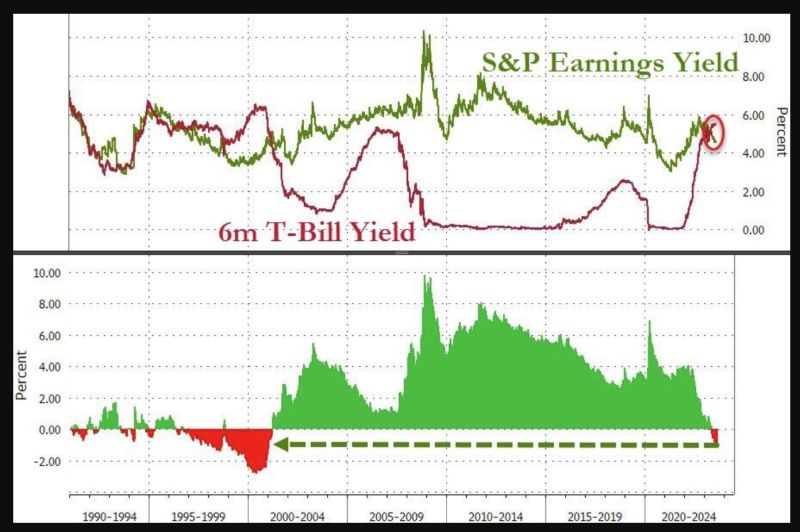

From T.I.N.A (There Is No Alternatives to Risk assets) to T.A.R.A (There Are Reasonable Alternatives)... 6-months US T-bills yield 94bps more than the S&P's earnings yield...

Source: Bloomberg

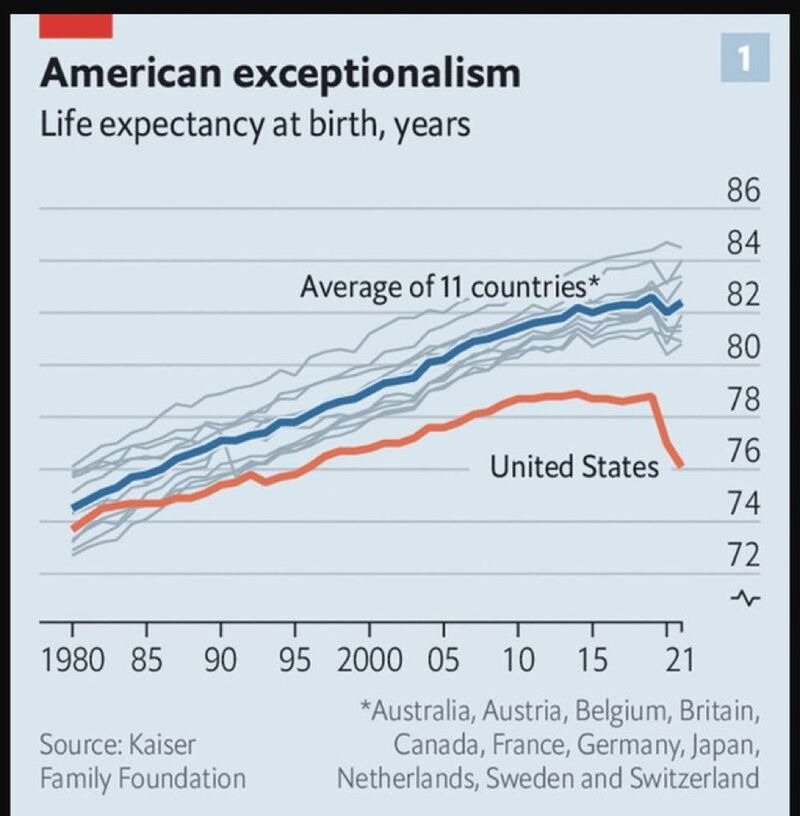

Comparable countries bounced post-COVID, but US did not

~1 million Americans have died of OD’s just since 2010; that’s more than the # of Americans that died in all wars America has ever fought in. Source: The Economist Via Dan R Dimicco thru Luke Gromen

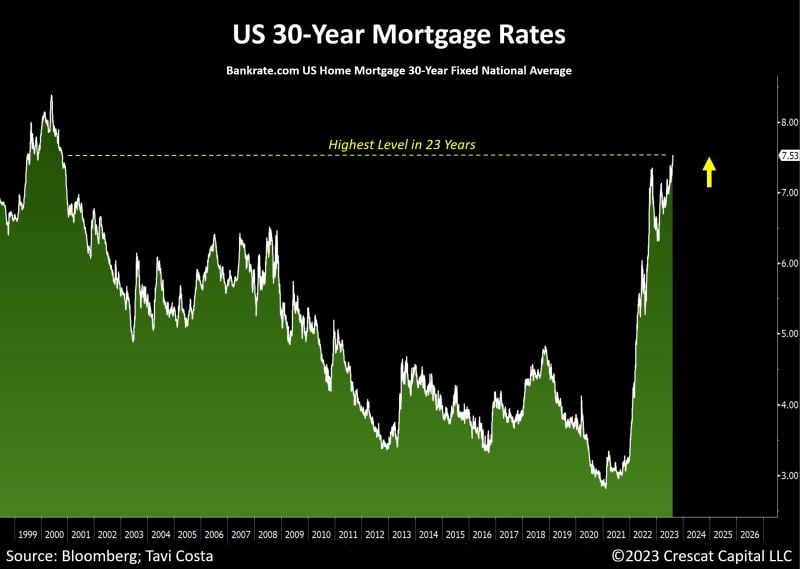

US average mortgage rates just surged above 7.5% for the first time in 23 years

There are some reasons why US house prices haven’t crashed: 1. Buyers can’t afford the rates; 2. Sellers would be insane to sell a home with a significantly lower rate to buy another at 7.5%. Market is frozen. The economy is currently experiencing a significant tightening of financial conditions, largely driven by the persisting fragility in the Treasury market. The bill will come due at some point. Source: Crescat Capital, The Wolf of All Streets

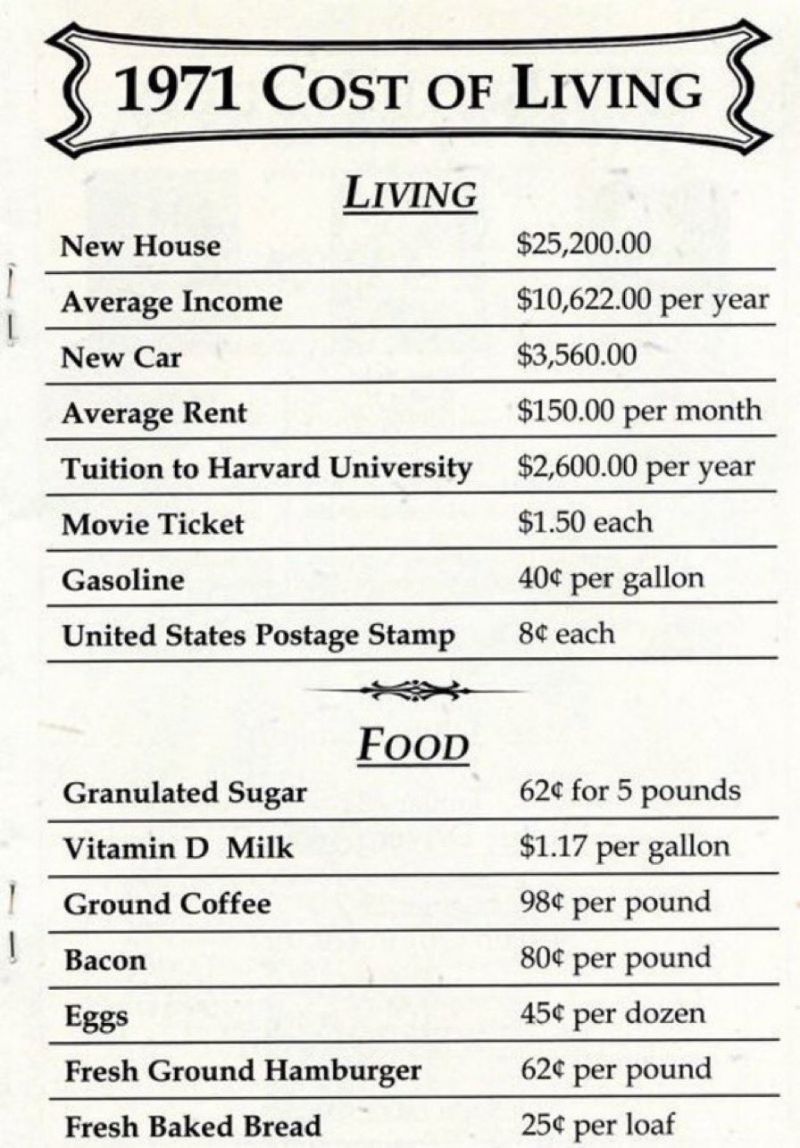

1971 vs NOW

The average U.S. annual income in 1971 paid off a house in ~2.5 years, could buy 3 new cars in a year, send 4 kids to Harvard in a year and easily afford food, shelter, necessities and entertainment. Does the older generation understand the difficulties the young face today? Source: Gabor Gurbacs

Only 16% of Californians can afford to buy a home, a situation that is unfortunately not unique to the state, but where they are leading the way

Source: Markets & Mayhem, Bloomberg

The comeback of bond vigilantes: US 10y real rates have jumped to 1.77%, almost the highest level since 2009

Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks