Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

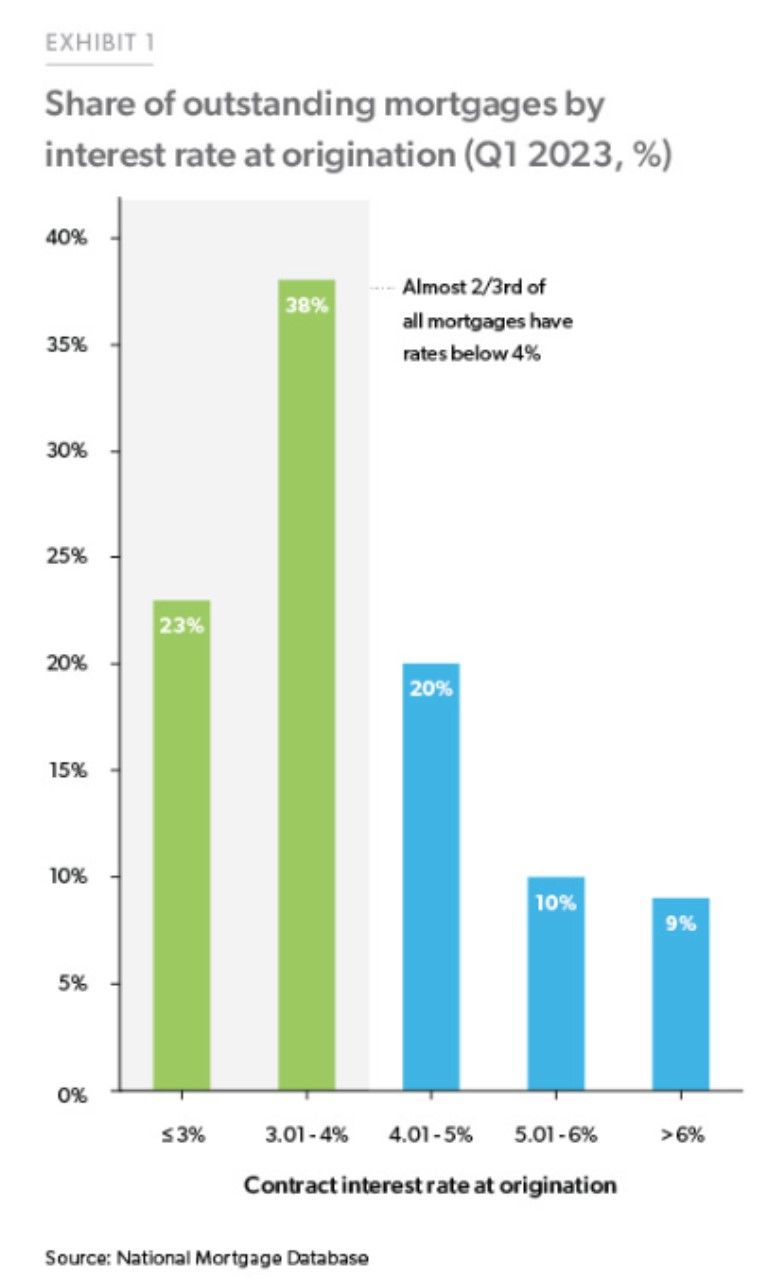

Over 60% of outstanding US mortgages have an interest rate below 4%. Current average 30y mortgage rate is north of 7.5%...

This is the 1 factor driving the limited housing supply as many of these homeowners can't afford to move... Source: Charlie Bilello, National Mortgage Database

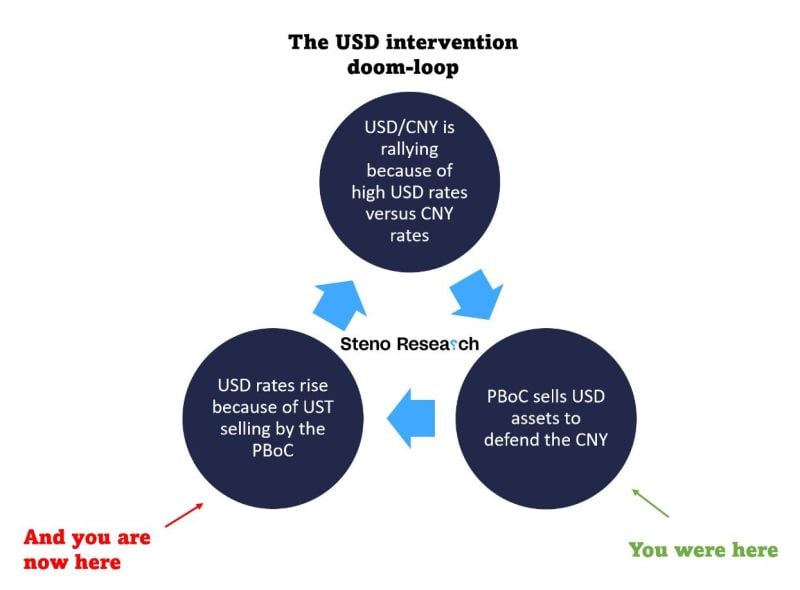

Nice one by Steno research

While there are some fundamental reasons for US Treasury yields to keep rising (check out the Atlanta Fed Nowcast model poiting towards nearly 6% annualized real GDP growth in 3Q), what is currently going in China probably has some impact as well Source: Stenio research

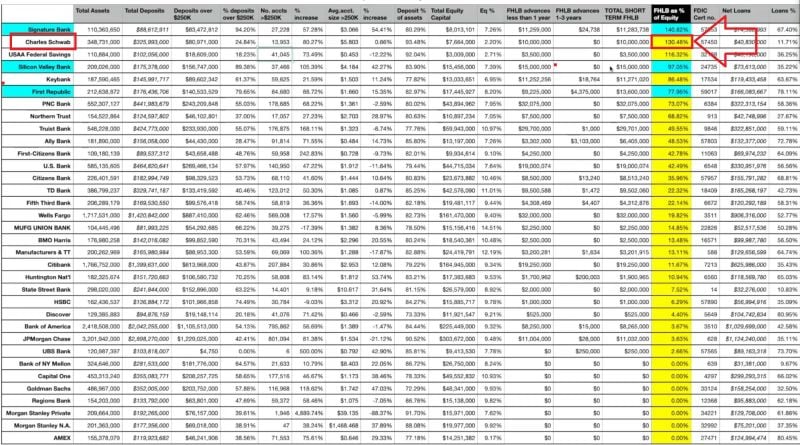

In case you missed it... Charles Schwab owes 130% of their total equity capital to short duration FHLB* loans that have to be paid back soon

Total assets $350 billion... Source: FinanceLancelot * What Is the Federal Home Loan Bank System (FHLB)? The Federal Home Loan Bank System (FHLB) is a consortium of 11 regional banks across the U.S. that provide a reliable stream of cash to other banks and lenders to finance housing, infrastructure, economic development, and other individual and community needs. (source: Investopedia)

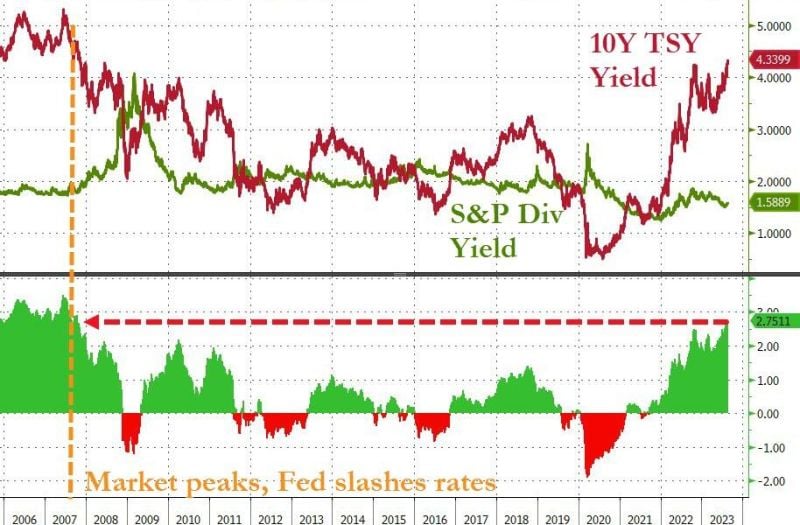

The last time US 10Y yields were this far above sp500 dividend yields was sept/oct 2007 (BNP Paribas funds liquidate, Fed slashes rates, market peaks...)

Source: Bloomberg, www.zerohedge.com

S&P 500 to 10-year note ratio is going parabolic

Source: barchart, The Daily Shot

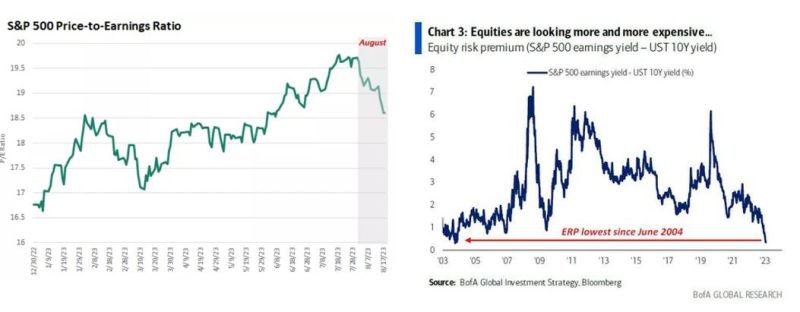

US equities: absolute & relative valuations offer a different perspective

•On the positive side, market (absolute) valuations have improved as stock prices have dipped and earnings have held up •On the negative side, the rise in bond yields imply a lower Equity Risk Premium (ERP), now at 39bps (19-year low), i.e equities are more expensive vs. bonds than at the start of the Summer... Source: Edward Jones, BofA

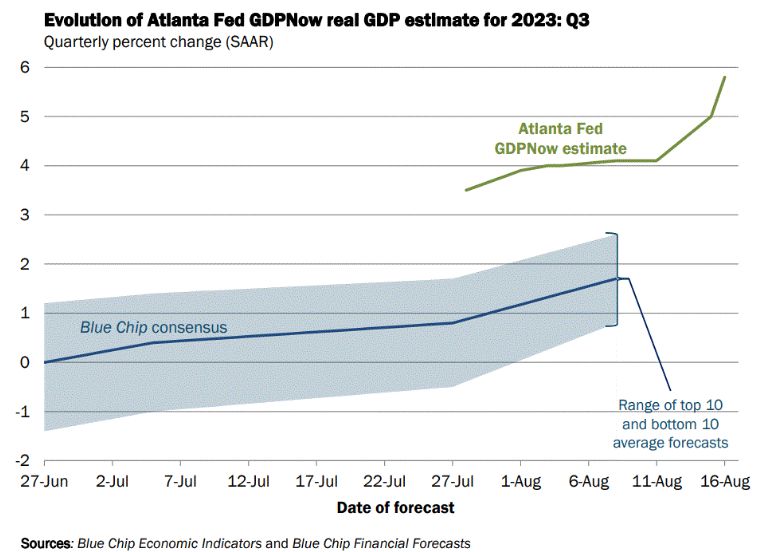

Ahead of Jackson Hole this week, Atlanta Fed GDP Now for US real GDP in 3Q is at 5.8%...

Way ahead of Street consensus and with a clear acceleration since early August...

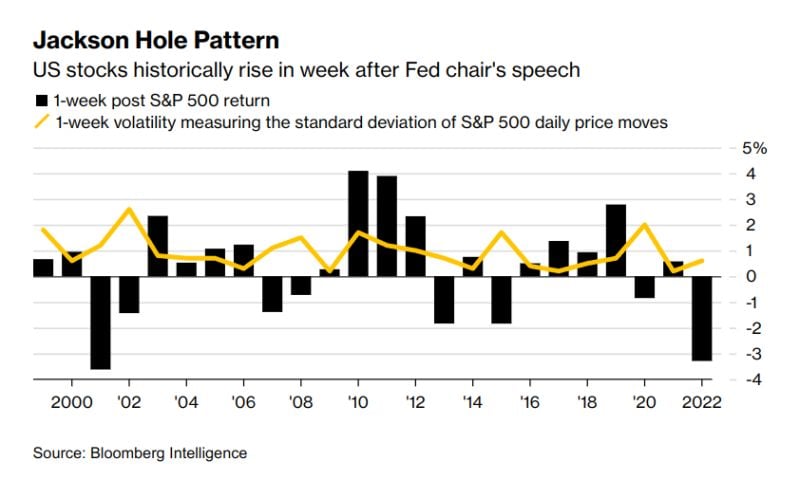

More often than not, stocks rise the week after Jackson Hole Will this year follow the pattern, or will it be one of the outlier years with a sell-off?

Source: Markets & Mayhem, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks