Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Treasury yields extend retreat from year’s highs after GDP data

Short-maturity yields led the move, with two-year yields declining about five basis points to around 4.85%, and most yields reached the lowest levels in more than two weeks. The

benchmark 10-year note’s yield touched 4.085%, the lowest level since Aug. 11.

Following downward revisions to the economy’s Q2 growth rate and related inflation measures, swap contracts tied to Fed meeting dates priced in slightly less than a 50% chance of another rate increase this year. Source: Bloomberg

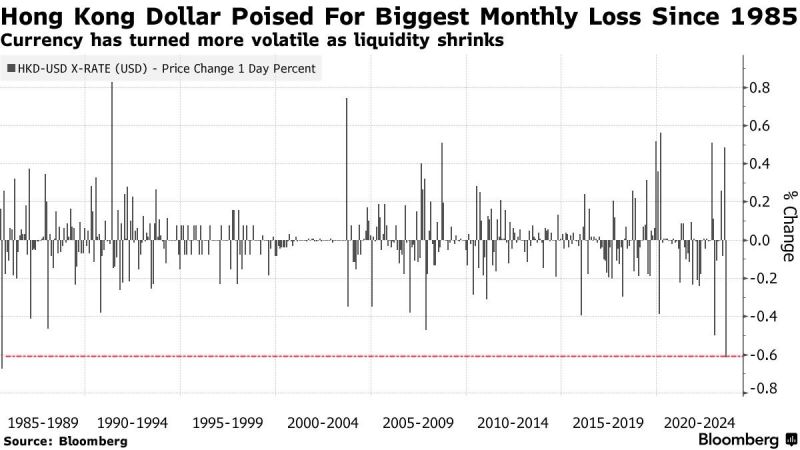

Hong Kong Dollar is on track for its biggest monthly loss against the US Dollar in 38 years

source: Bloomberg, Barchart

The importance of Nvidia and Tesla for the US equities market

Source: Mac10

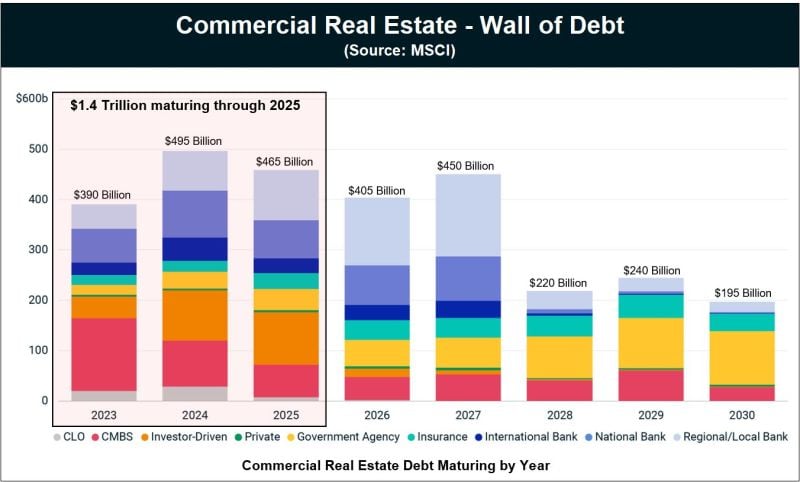

US commercial real estate prices prices are down sharply this year with offices building prices down ~30%

On top of declining prices, there are nearly $1.4 TRILLION of commercial real estate loans coming due by 2025. Meanwhile, rates on the commercial real estate loans have more than doubled since they were issued. Last but not least, vacancies in commercial real estate are skyrocketing (which means rent revenue is down). The coktail of rising rates on loans that need to be refinanced and declining income looks like a rather toxic one. Source: The Kobeisi Letter

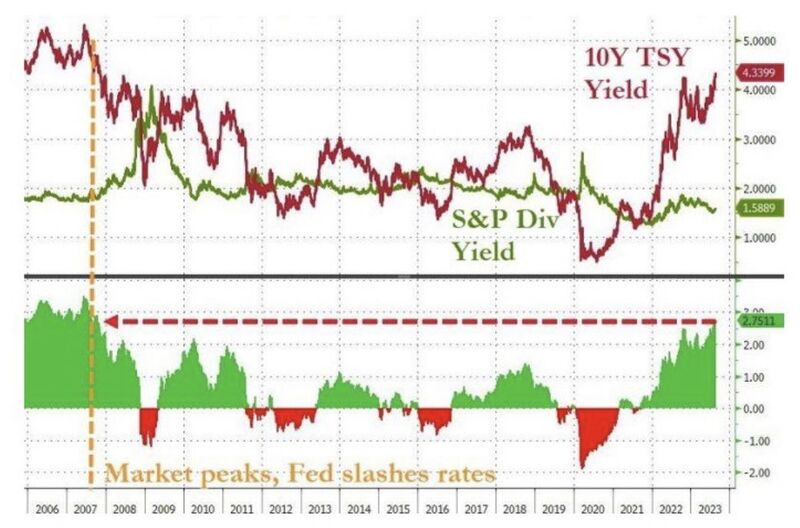

The last time 10Y yields were this far above $SPX dividend yields was September 2007, the month stocks peaked

Source: zerohedge

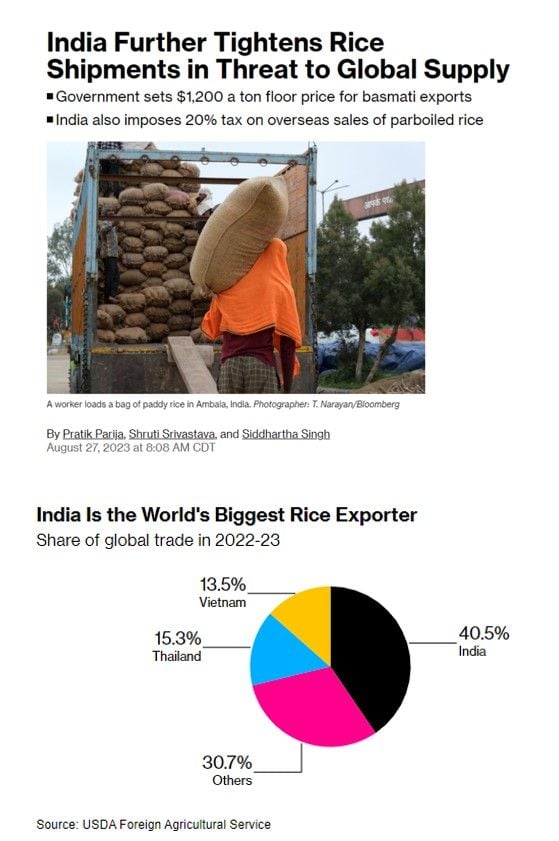

Rice likely to get even more expensive as India imposes additional restrictions

India further tightens rice exports as the government sets a floor price of $1,200 per tonne for basmati rice exports. India also imposes a 20% tax on rice sales abroad. Rice is a staple food for half the world. Source: Barchart, Bloomberg

Zillow expects U.S. home prices to jump by 6.5% over the next 12 months

Source: Barchart, Fortune

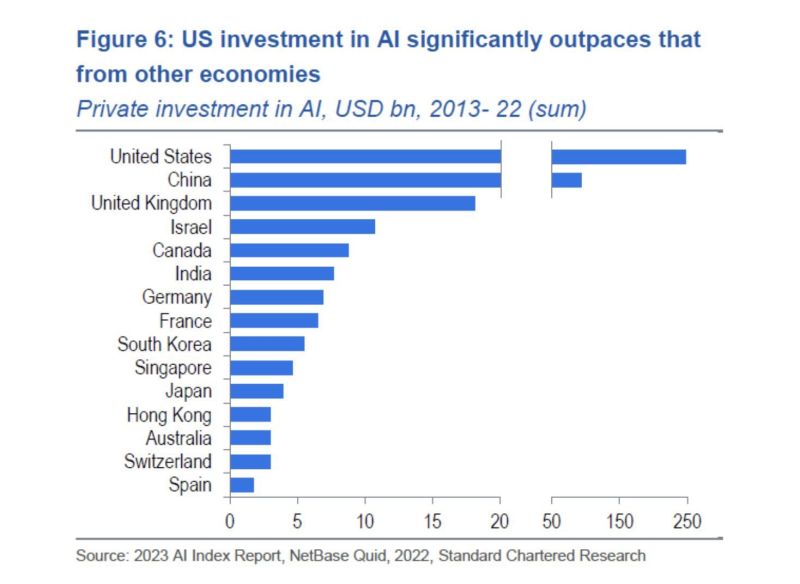

The US and China are the ones investing massively in innovation and the future

Europe is lagging and prefer first to debate about regulating AI. Thsi could have serious consequences in terms of competitivity, productivity and economic growth. Source: Standard Chartered, Michael A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks