Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Regulation: this is where Europe want to take lead globally...

the rest of the world (especially the #us) wants to lead on #innovation and #growth but Europe wants to become the champion of #regulation... Indeed, U.S. tech giants are facing stricter rules in Europe with more regulation (the Digital Markets Act or DMA) announced this week. The European Commission, the executive arm of the EU, named six “gatekeepers” on Wednesday — these are companies that have an annual turnover above 7.5 billion euros ($8 billion) or 45 million monthly active users inside the bloc. They are Amazon, Alphabet, Apple, Microsoft, Meta and ByteDance, who now have six months to comply with stricter market rules — such as not being able to prevent users from uninstalling any pre-installed software or apps, or treating their own services more favorably. Source: CNBC, politic.eu

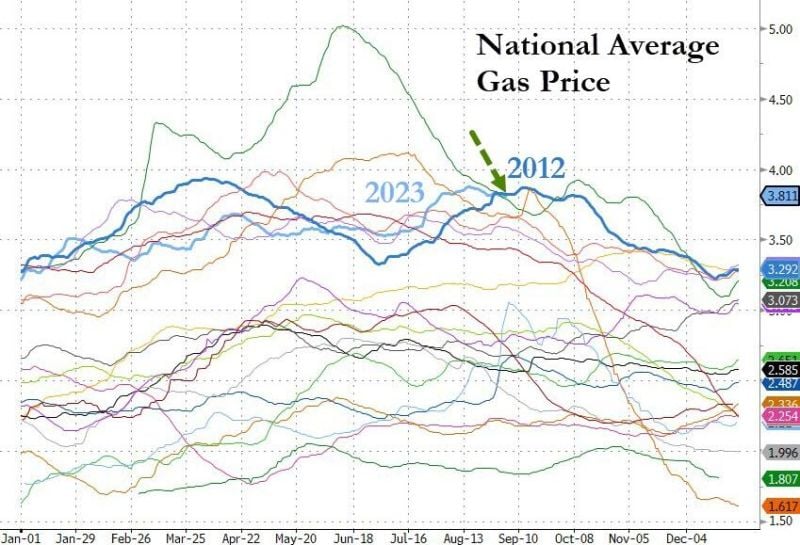

An immediate consequence of soaring oil prices mean -> Soaring gas prices in the US

Now at their highest for this time of year since 2012 (and 2nd highest ever)... not great for headline inflation and consumer purchasing power Source: Bloomberg, www.zerohedge.com

While WTI oil hit $86, the rig count is still in plunge mode...

*A cumulative $4.9T of investments in global upstream oil and gas are needed by 2030 to meet market needs and prevent a supply shortfall" ---International Energy Forum (IEF) and S&P Global Commodity Insights. Source: Lawrence McDonald, Bloomberg

If you think housing in the US is not affordable anymore take a look at New Zealand, Canada and Sweden 👇

BCA research through Michael A.Arouet

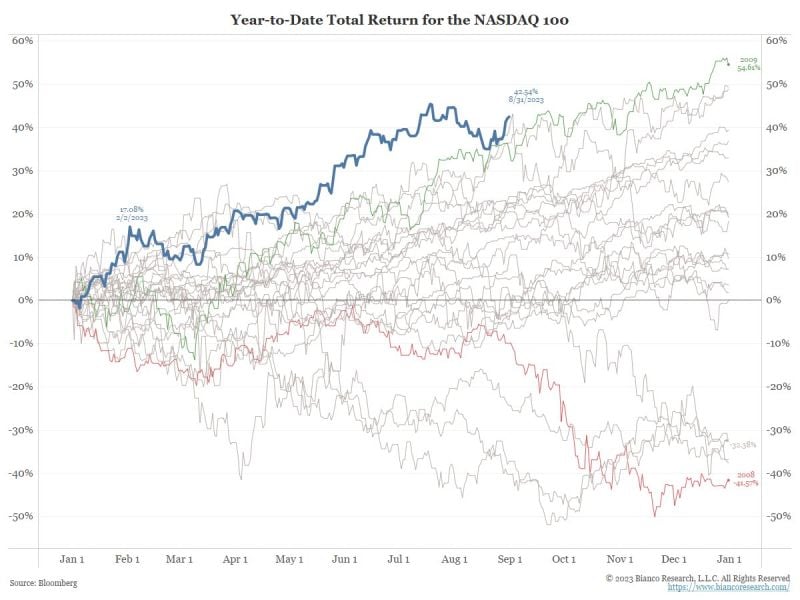

With total return data going back to March 1999, the Nasdaq 100 (NDX)’s 42.54% YTD total return is the best on record (2020’s post-Covid bounce in tech stocks came close)

Source: Jim Bianco

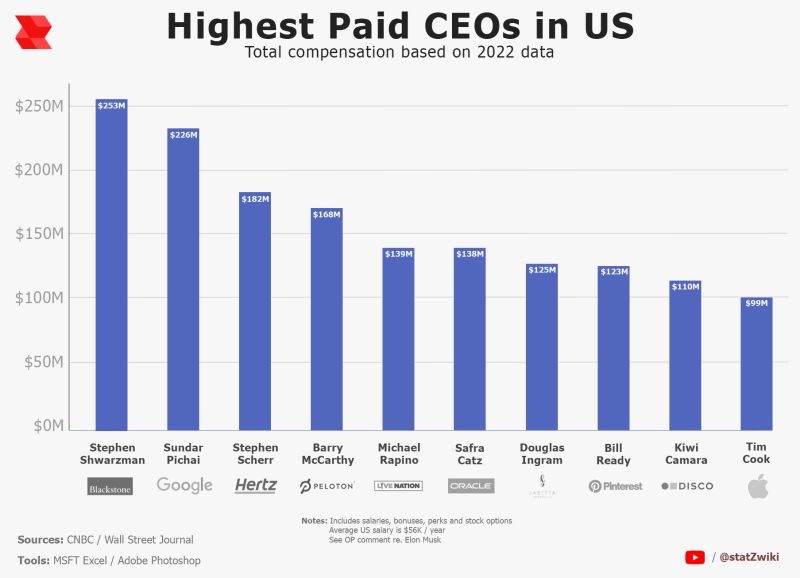

Highest paid CEOs in the US

Source: Visual Data, data_rep, u/statZwiki)

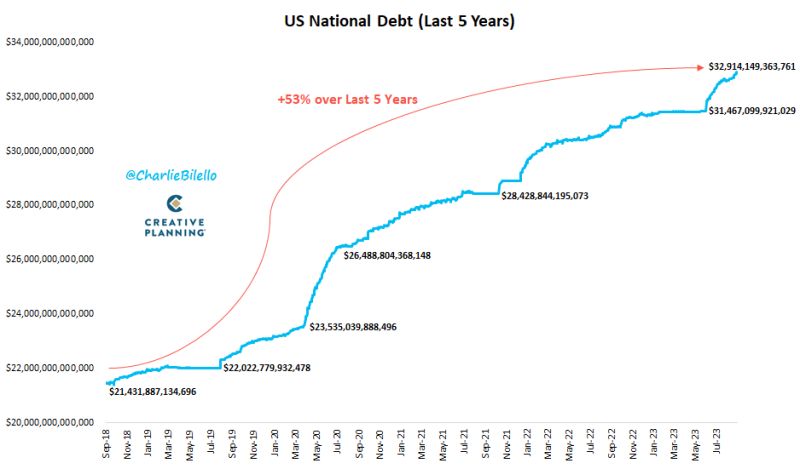

US National Debt has now increased by $1.45 trillion since the debt ceiling was suspended 3 months ago and is fast approaching $33 trillion

In the past five years the national debt has increased by 53%, from $21.4 trillion to $32.9 trillion. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks