Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

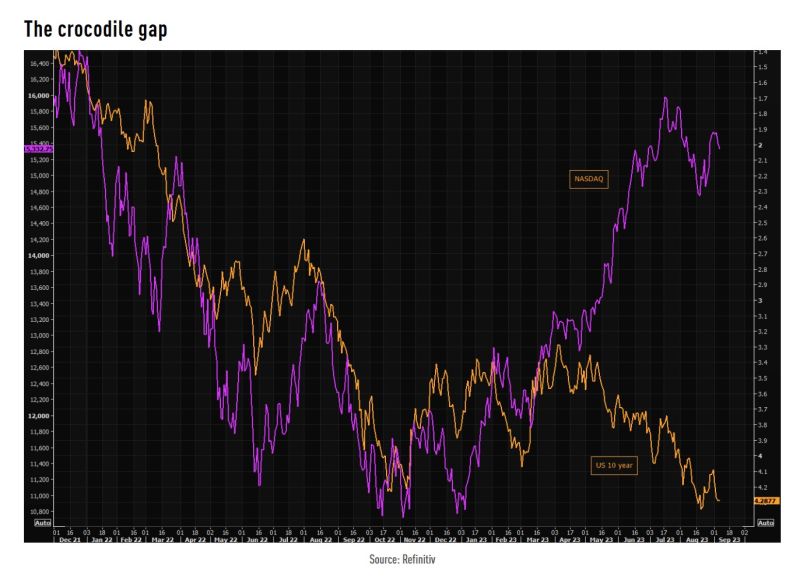

The sp500 P/E ratio used to be tightly correlated to the US 2 year yield (inverted on the chart), i.e the lower the 2 year yield, the higher the P/E ratio and vice versa

Well, this is no longer the case as a giant crocodile jaw has been forming. Which of the 2 will bind firts? Source. Jeroen Blokland, True Insights

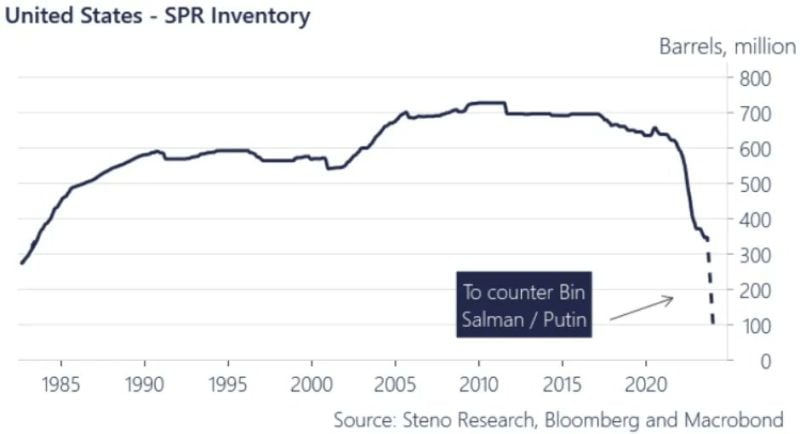

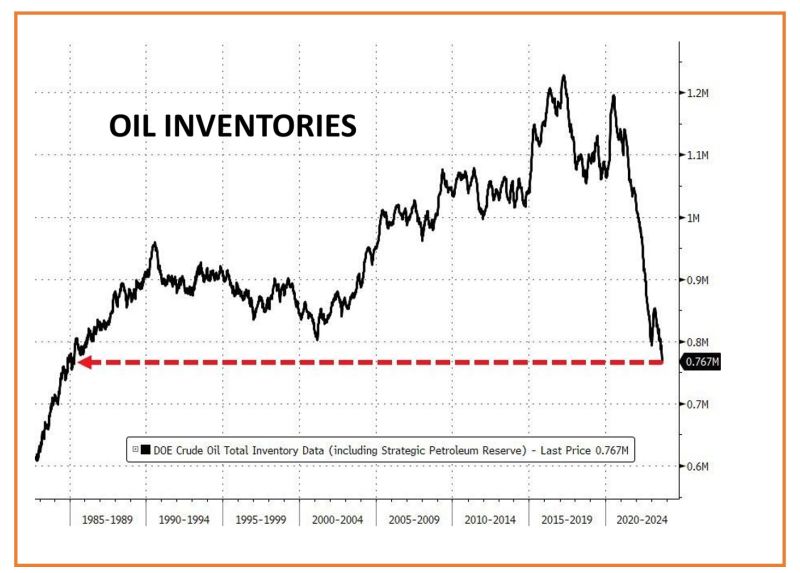

With a supply deficit of more than 2.5mn barrels a day through Q4, it is probable that Biden administration will not draw on the SPR so far ahead of the actual election date

Especially given the fact that SPR (Strategic Petroleum Reserve) are already running low. It seems more plausible that Joe Biden will concentrate the SPR ammunition around Q2-Q4 next year. This creates another supply risk in the short-run for the oil market Source: Andreas Steno

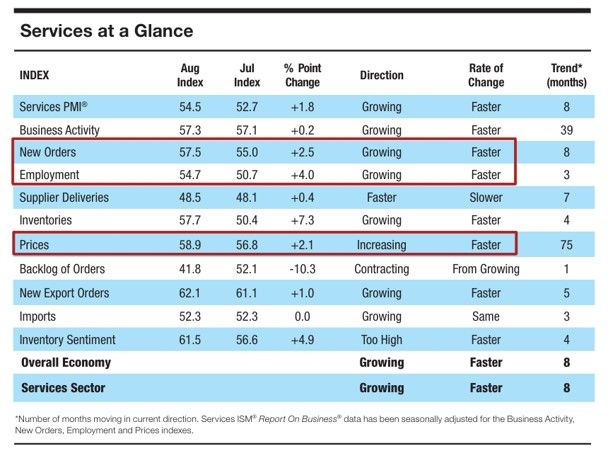

One key development of the week (beyond brent hitting $90) has been stronger than expected macroeconomic data - e.g the ISM services (see data table below from Markets & Mayhem)

Indeed what we are seeing in the last ISM Services PMI reading may not be the best news for the inflation situation: 1) New orders growing faster 2) Employment growing faster (from being nearly flat m/m) 3) Prices rising faster And the market reaction - stocks pulling back - means that good macro news is bad news for the market again. Indeed, while a growing economy supports rising corporate profits (which is a positive), a too strong economy would imply a more hawkish FED than it is currently anticipated by the market.

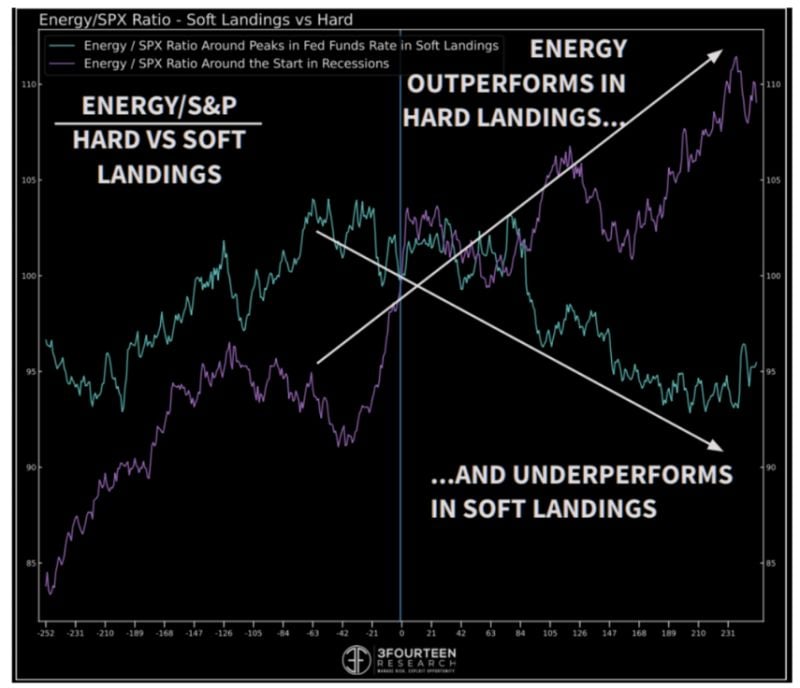

Hard landing - Energy leads. Soft landing - energy lags. What will be the message from Mr Market?

Source chart: 3Fourteen, Warren Pies

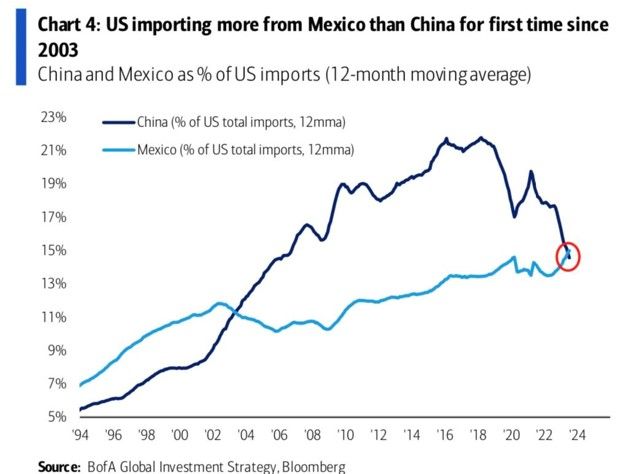

Nearshoring / Friendshoring in action... For the 1st time since 2003, the US is importing more from Mexico than from China

Source: BofA, Bloomberg

Is oil going to $100?

U.S Crude inventories fell by WAY more than expected ( -6.3mm (-2.1mm expected) to their lowest since early December - and are well below their five-year average for this time of year as the summer driving season ends. Including the SPR (Strategic Petroleum Reserve), this is the lowest level of total crude inventories in America since 1985... Source: Bloomberg, www.zerohedge.com

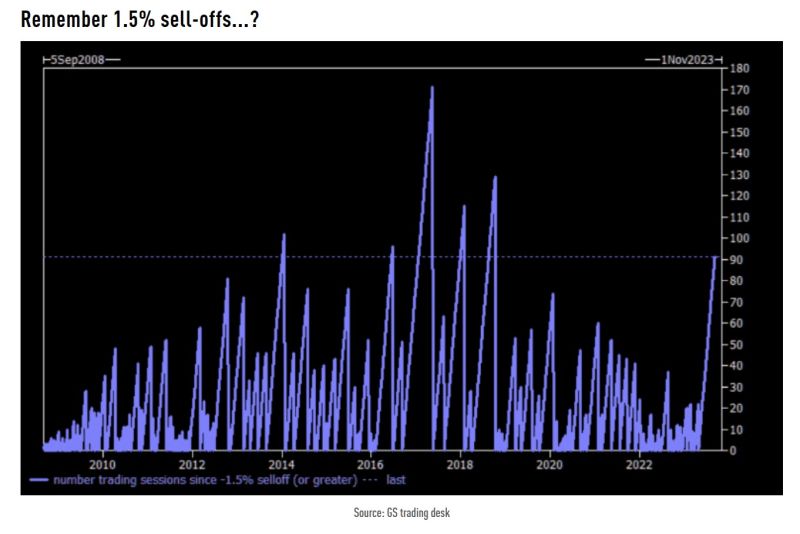

91 is the number of trading sessions since at least a 1.5% sell off session in SPX

This length of time without a 1 day equity shock is rare ... has happened ~five times in the last 15 years. Source: Goldman Sachs, TME

The longer term gap between NASDAQ and the US 10 year remains huge

Source: TME, Refiitiv

Investing with intelligence

Our latest research, commentary and market outlooks