Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The US debt ceiling before and after...

Source: Jim Bianco

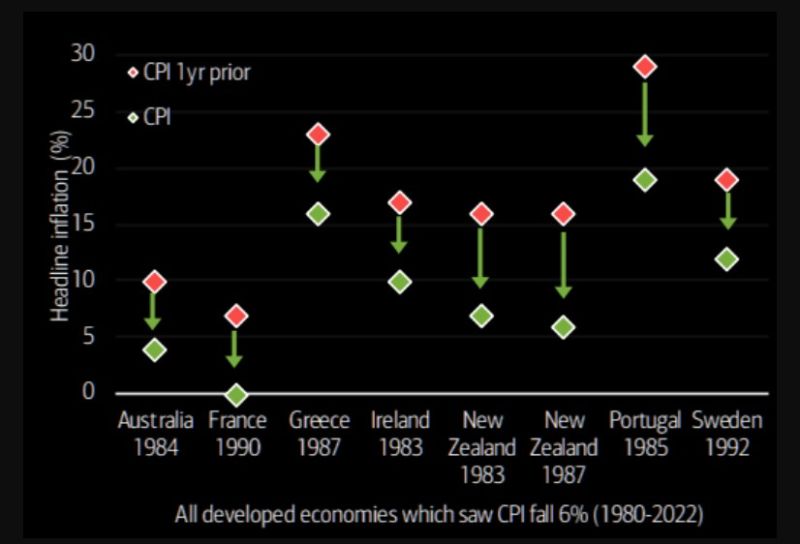

What goes up must come down...

The collapse in US CPI over the past year is extreme, falling from 9.1% to 3%. BofA writes: "...since 1980, only in 8 cases had inflation fallen by more than 6% in a year, and only in France in 1990 from a starting point lower than 10%." Source: TME, BofA

The hype surrounding "Threads," the new social network launched by Meta CEO Mark Zuckerberg, has collapsed

Threads has unraveled so quickly that new data shows active users have been halved. Threads launched in the US on July 5 and reached over 100 million sign-ups by that weekend. Shortly after, Zuckerberg wrote in a post, "Can't believe it's only been five days!" Zuckerberg appears to have prematurely taken a victory lap because early last week, data from SensorTower and SimilarWeb showed an exodus of users and a plunge in engagements. The note was titled Threads Unravels: So-Called 'Twitter Killer' App Sees Exodus Of Users, Plunge In Engagement. New data from SimilarWeb shows the exodus has worsened. As of last Friday, daily active users on the app collapsed from 49 million to 23.6 million in a week. Usage in the US peaked on July 7 at about 21 minutes of engagement. By Friday, that number plunged to just six minutes. SimilarWeb said the app lacks basic features that "offer a compelling reason to switch from Twitter or start a new social media habit." Also, some users found Threads has been dominated by censorship.

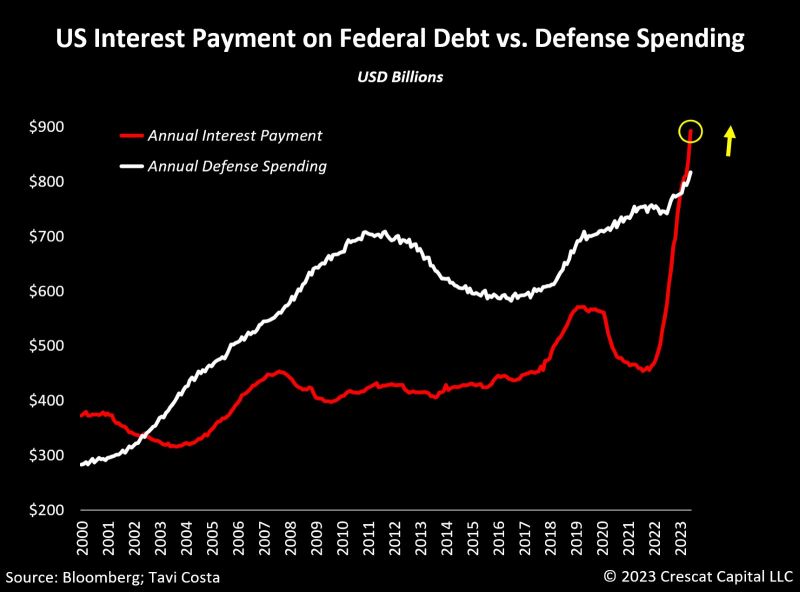

The US government interest payments on the Federal debt are now higher than the annual defence spending

Source: Tavi Costa, Crescat Capital, Bloomberg

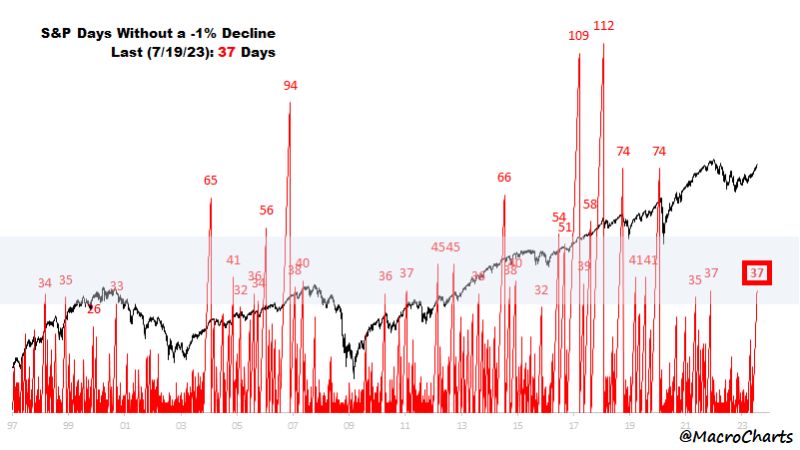

The S&P has gone 37 days without a 1% decline – last seen at the NOV 2021 Top

Many similar streaks ended with some big volatility spike. Source: Macrocharts

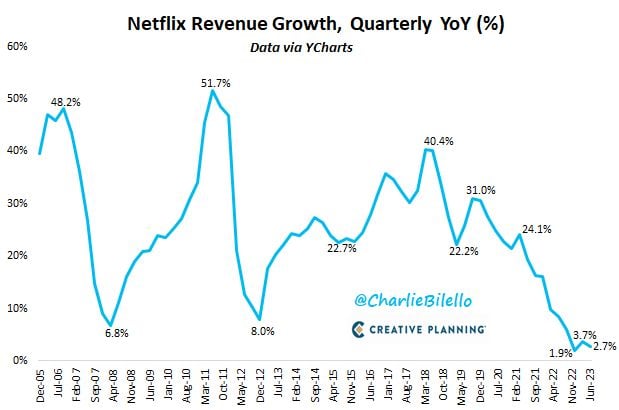

Is netflix still a growth stock?

Netflix Q2 revenues were 2.7% higher than a year ago, the second lowest growth rate in company history (lowest was 1.9% in Q4 2022). $NFLX Source: Charlie Bilello

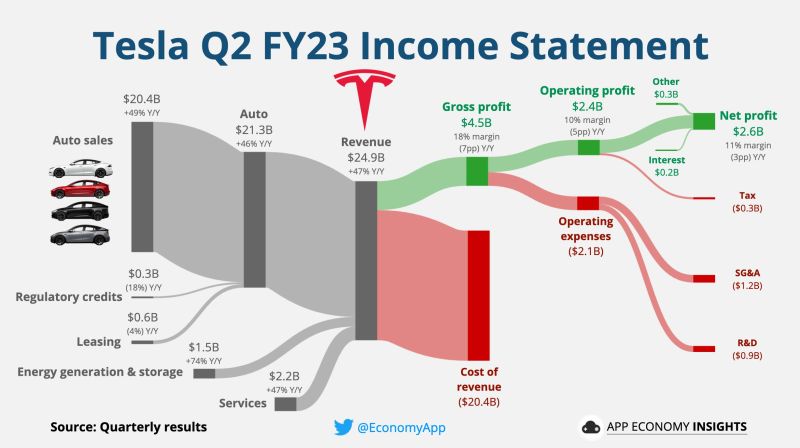

Tesla reported earnings after the bell, showing a record for quarterly revenue but lower margins thanks to price cuts and incentives.

The stock price remained flat after the initial report, but began dropping during the earnings call as CEO Elon Musk and other executives failed to deliver precise specs and start of delivery dates for the Cybertruck, and for a robotaxi-ready vehicle. Musk and other execs also said during the call that vehicle production would slow down during Q3 due to shutdowns for factory improvements. The stock was down as much as 5% after hours. $TSLA Tesla Q2 FY23: • Revenue +47% Y/Y to $24.9B ($200M beat). • Gross margin 18% (-7pp Y/Y). • Operating margin 10% (-5pp Y/Y). • Capex +19% Y/Y to $2.1B. • Free cash flow +62% Y/Y to $1.0B. • Non-GAAP EPS $0.91 ($0.09 beat). • Deliveries +83% Y/Y to 466,140. Source: App Economy Insights, CNBC

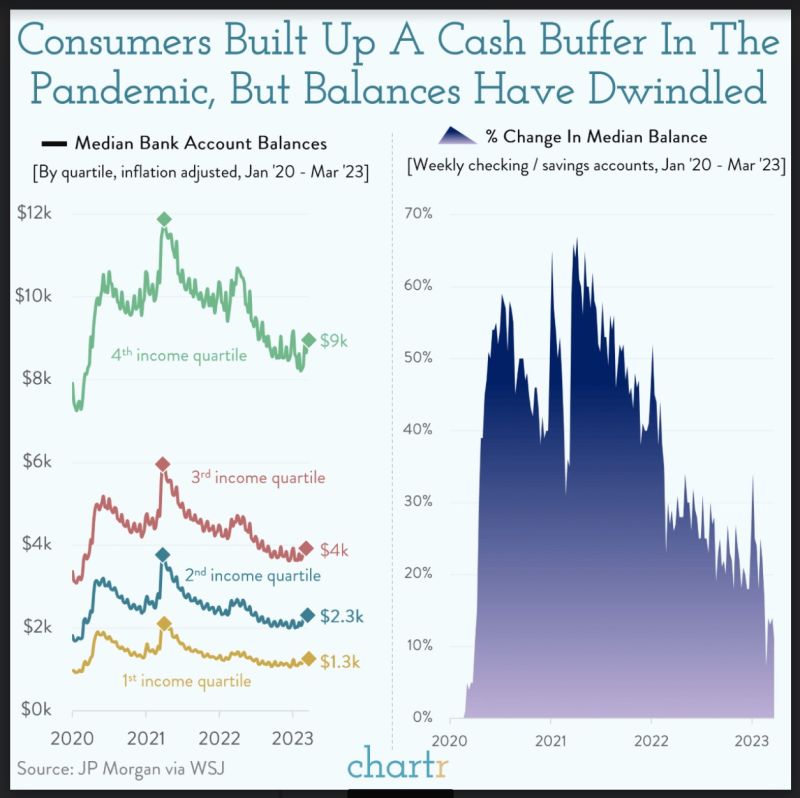

Interesting charts by Chartr on US consumers cash buffer

When the pandemic hit, many of us instinctively reigned in our spending — partly out of choice, and partly because there weren’t a lot of fun things to splurge on. That set of circumstances coincided with stimulus checks and tax credits in April 2021, leading to many Americans building up healthier-than-usual cash balances in their bank accounts. However, new data from JPMorgan reveals that much of the buffer has now disappeared. Although US households still hold approximately 10% to 15% more cash in their savings accounts than before the pandemic, analysis of 9 million Chase customers reveals that the median account balance has dropped significantly in the last 2 years. That could help explain why the much-feared recession has yet to materialize, as consumers have had strong reserves to combat rampant inflation and rises in borrowing costs. Interestingly, the trend is seen across all income brackets. The nation's top quarter of earners have seen their savings accounts decline from a median high of nearly $12,000 to $9,000, as of March this year — though their 25% decrease is a smaller relative drop than that experienced by lower earners. Indeed, people in the lowest income quartile — who likely have to allocate a larger portion of their income to essentials — have seen a 41% decline since their savings peaked.

Investing with intelligence

Our latest research, commentary and market outlooks