Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Traders are boosting their bets against the US dollar.

Source: The Daily Shot

Something very unusual has been taking place since the start of the 2Q earnings season

US stocks that beat earnings are being sold... very unusual. Source: www.zerohedge.com

The median price of an existing home sold in the US is up 14% from the January low, now less than 1% below its all-time high from June 2022.

How could it be? Consider the #chart below courtesy of Charlie Bilello: The US Population is 19% higher than where it was in January 2000 while the inventory of Existing Homes for sale in the US is 37% lower. Economics 101 -> higher demand and lower supply drive prices higher.

There is always a bear market somewhere...

The meltdown in US commercial and industrial (C&I) loan growth is staggering. Cumulative C&I lending is -1.0% since the start of 2023 (red). Median growth by this point in the year is +4.5% (black), while 2022 was up +9.3% by this point (blue). Big US investment slump is underway... Source: Robin Brooks

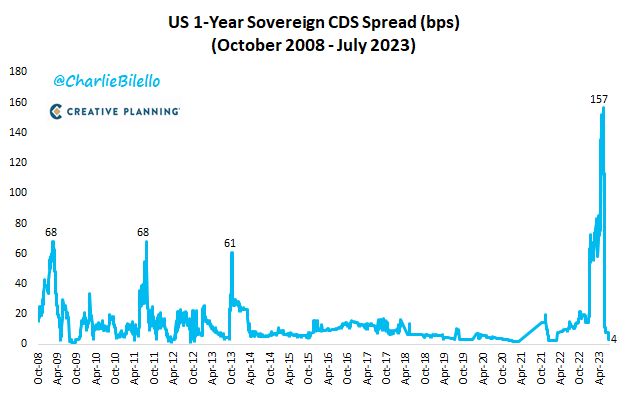

Remember the debt ceiling crisis?

Source: Charlie Bilello

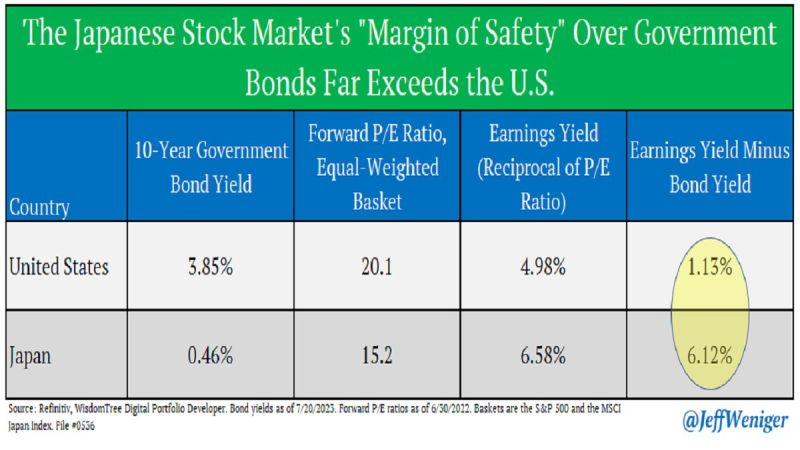

Japanese stocks have an earnings yield that is 612bps above the yield on 10-year Japanese government bonds

Put that in context; in the US, the gap is only 113bps. Little room for error in the US, plenty of room in Japan. This is a margin of safety concept. Source: Jeff Weniger

FED QT continues w/balance sheet dropped by $22.4bn past week.

It is 6th week in a row that total assets shrink. Fed more than leveled the increase in the wake of the banking crisis from March. Fed balance sheet now equal to 31% of US's GDP vs #ECB's 53%, SNB's 121%, BoJ's 128%. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks