Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Another massive us earnings week ahead

Tuesday: $UBER, $AMD, $PINS Wednesday: $PYPL, $SHOP, $U Thursday: $AMZN, $AAPL, $COIN, $SQ, $ABNB, $NET Friday: $FUBO, $NKLA Source: Earnings Whisperers

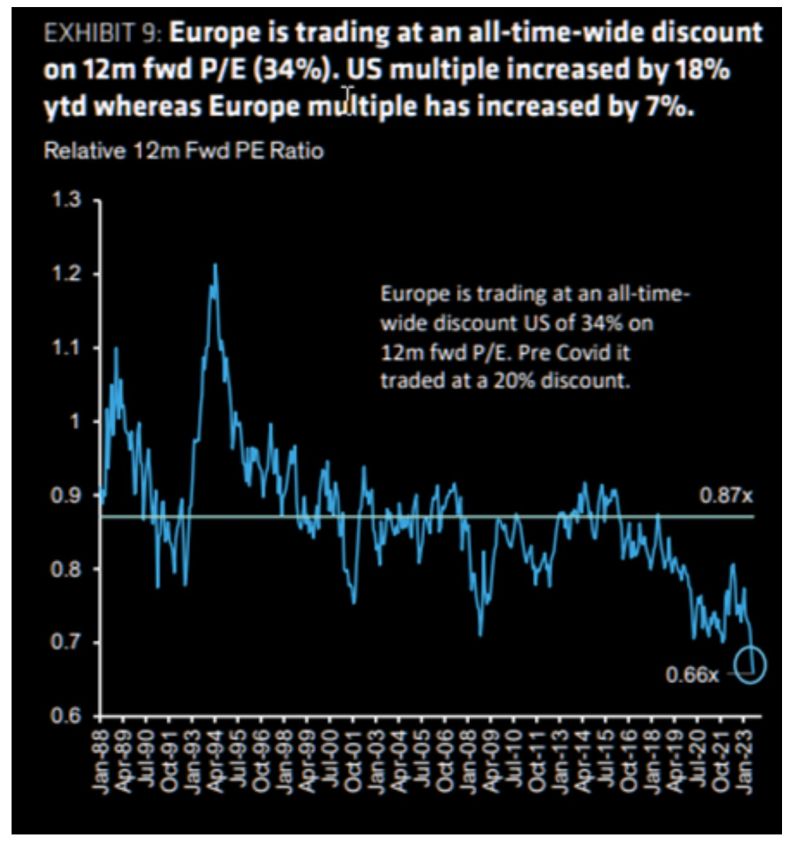

The gap in valuation discount between US and European equities has never been wider

Source: TME, Sanford Bernstein

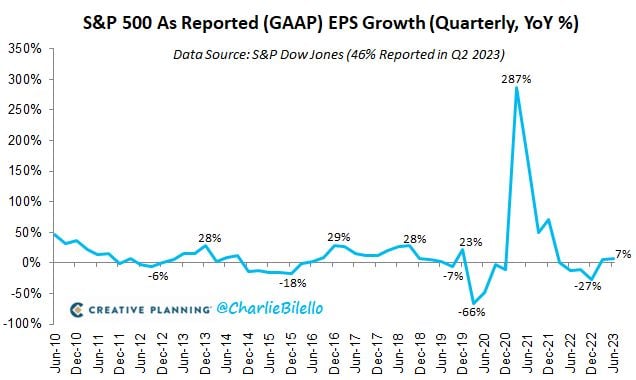

With 46% of companies reported, S&P 500 Q2 GAAP earnings per share are up 7% over the last year, the highest YoY growth rate since Q4 2021.

Source: Charlie Bilello

US Treasuries sold off yesterday and are now on the verge of a breakdown from support

The chart below courtesy of Crescat Capital / Tavi Costa is a reminder of the divergence between rising yields and the highly valued Nasdaq index. Is this divergence sustainable? Source: Bloomberg, Tavi Costa

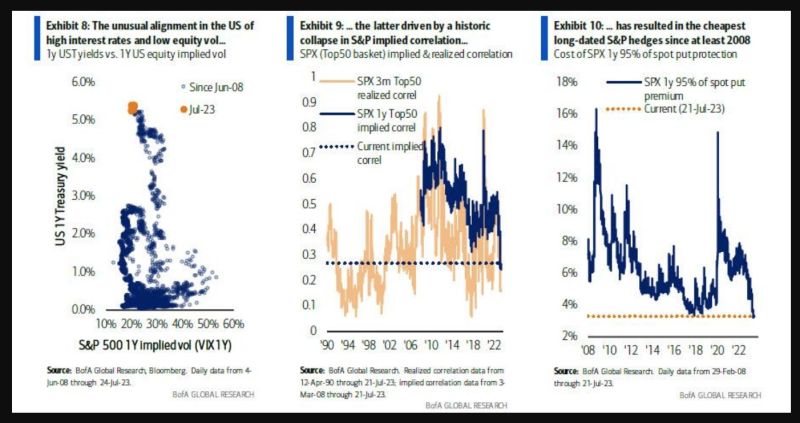

It has never been cheaper to hedge against a market crash

According to Bank of America's derivatives strategists, it has never cost less to protect against an #sp500 crash drawdown in the next 12 months. Why is the cost of longer-dated S&P protection at record lows today? The most common explanations are a mix of fundamentals (e.g. a recession, if it materializes, will be short-lived and shallow; or, realized correlation is too low to warrant higher implied correlation) and vol technicals (e.g. the supply of vega on US underlyings for yield remains robust; or, due to the rise of short-dated option selling, the next shock will likely be a “gamma event” in which systemic tenors of risk don’t react strongly). Source: BofA, www.zerohedge.com

U.S. earnings Revisions Index from Citi has been in negative territory for past six weeks …

Longest streak since beginning of this year. Source: Bloomberg, Liz Ann Sonders

S&P 500 hits fresh 52-week high while the Dow heads for 13th straight daily gain as markets hope that the US interest rate hikes cycle is over.

The Fed just said they are taking a "meeting by meeting" approach to future interest rate policy. As expected, the Fed raised interest rates to the highest level in 22yrs as expected and left the door open to additional increases as officials fine-tune their effort to further quell inflation. The quarter percentage-point hike, a unanimous decision, lifted the target range for the Fed’s benchmark federal funds rate to 5.25% to 5.5%, the highest level since 2001. It marked the 11th increase since March 2022, when the rate was near zero. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks