Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

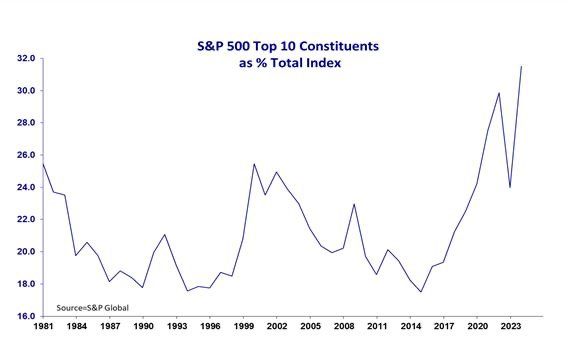

The top 10 stocks in the S&P 500 now account for a record 31% of the ENTIRE index

Just 8 years ago, the top 10 stocks accounted for 17% of the index. A few stocks continue to drive the entire market. Source: The Kobeissi Letter

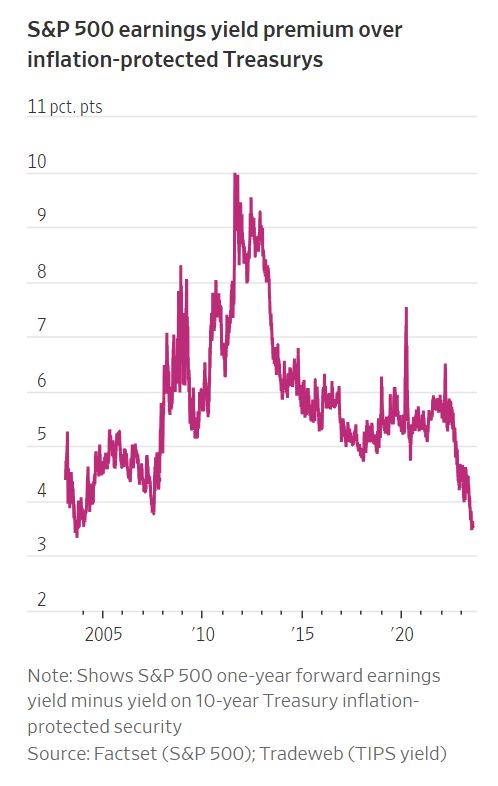

Bonds are looking the most attractive vs stocks in decades, according to one metric

The gap between the earnings yield of the S&P 500 and the yield on the 10-year Treasuries dropped to around 1.1 percentage point last week, its narrowest since 2002. Source: Lisa Abramowicz

The Top Performing S&P 500 Sectors Over the Business Cycle

Source: Barchart, Markets in Minute

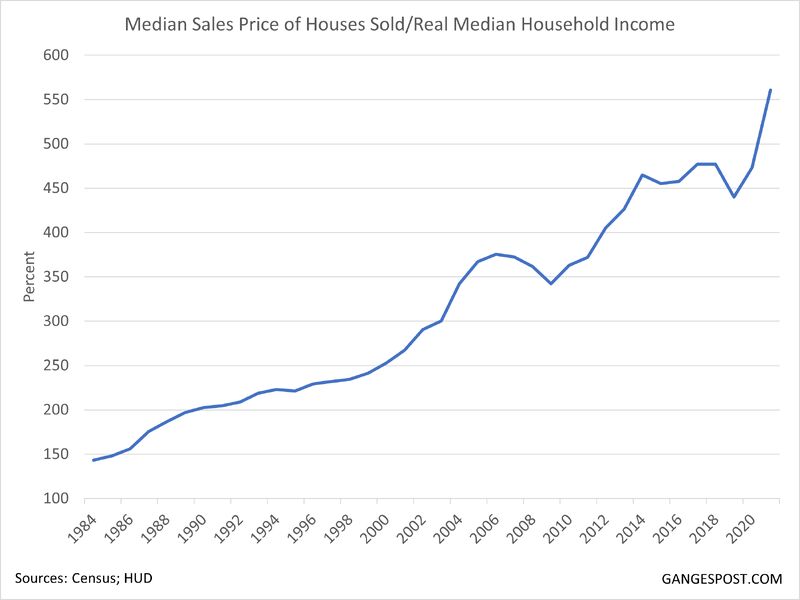

The median sales price of a home in the US is now 560% of the median household income.

In 2008, it was 360% of the median household income. This is the least affordable housing market in history. Source: The Kobeissi Letter

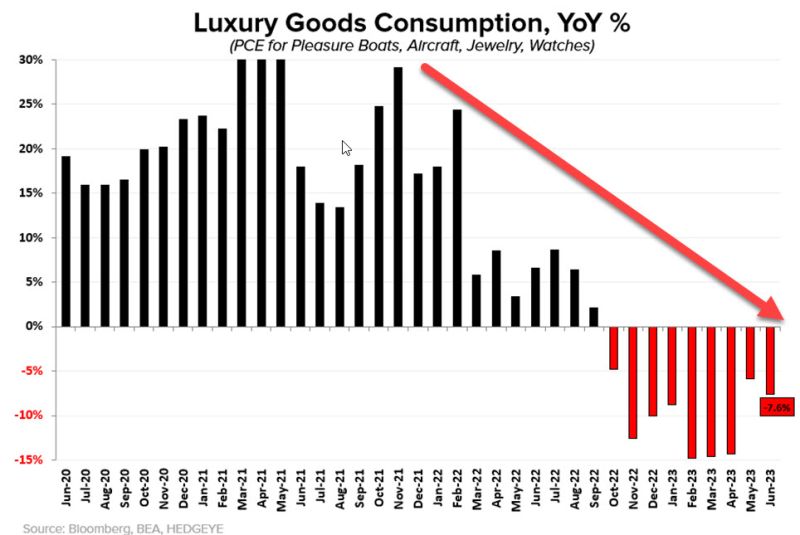

REPORTED RECESSIONS: in US Luxury Goods...

Congruent with dour commentary out of LVMH, luxury spending slowed to a -7.6% Y/Y Recession in June = 9th month of negative Y/Y growth. Source: Keith McCullough

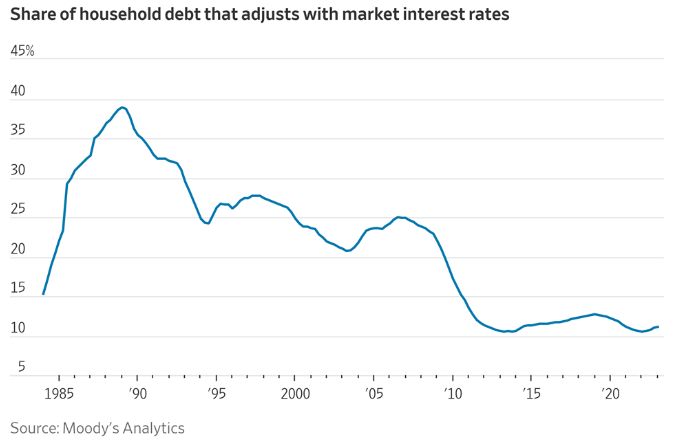

Only 11% of US household debt has an adjustable interest rate

That means the vast majority of Americans with existing fixed rate mortgages/auto loans/student loans have not been impacted by the Fed's 11 rate hikes. Source: Charlie Bilello

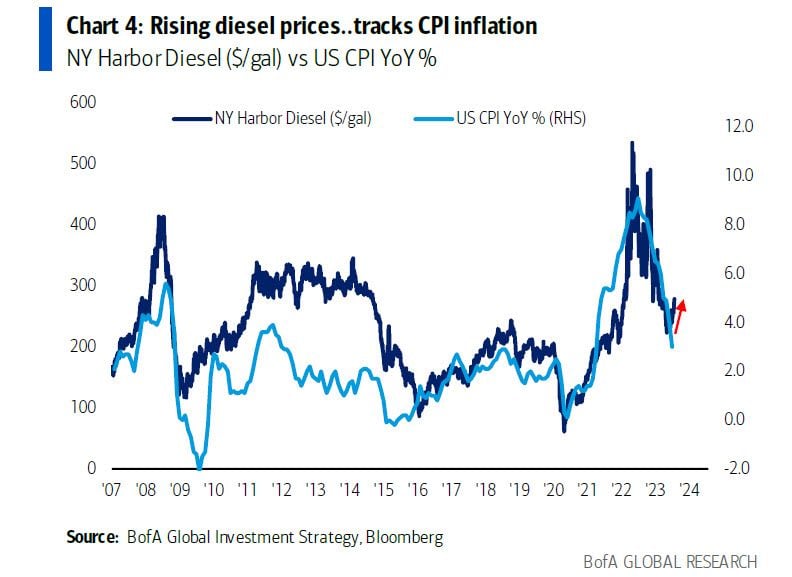

US diesel vs inflation: if history is any guide, recent pop of US diesel prices could imply CPI going back over 4%

Source: BofA

Investing with intelligence

Our latest research, commentary and market outlooks