Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

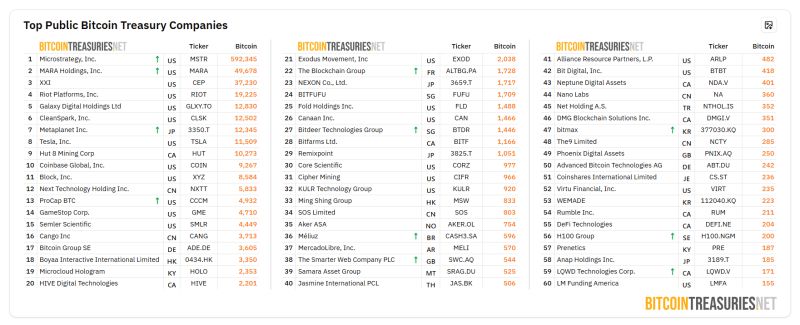

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Treasury Secretary Scott Bessent asked Republicans in Congress on Thursday to remove the so-called “revenge tax” from President Trump’s “big, beautiful” bill

The provision would grant Trump the authority to tax foreign holdings of US investments as a way to retaliate against countries imposing new taxes on US companies operating overseas. Bessent argued that the provision, known as Section 899, was no longer necessary after the Trump administration reached a deal with G7 nations at last week’s summit to exempt US companies from a 15% global corporate minimum tax championed by the Biden administration. “After months of productive dialogue with other countries on the OECD Global Tax Deal, we will announce a joint understanding among G7 countries that defends American interests,” the Treasury secretary wrote on X. “President Trump paved the way for this historic achievement.” Source: New York Post

U.S. Durable Goods Orders Soar Much More Than Expected In May - thanks to huger aircraft orders from the Middle East.

New orders for U.S. manufactured durable goods spiked by much more than expected in the month of May, according to a report released by the Commerce Department on Thursday. The report said durable goods orders soared by 16.4 percent in May after tumbling by a revised 6.6 percent in April. Economists had expected durable goods orders to surge by 8.5 percent compared to the 6.3 percent slump that had been reported for the previous month. Excluding a substantial increase in orders for transportation equipment, durable orders climbed by 0.5 percent in May after coming in unchanged in April. Ex-transportation orders were expected to come in flat. Here is the surge in aircraft (Boeing) orders following Trump's trip to the middle east Source: zerohedge @zerohedge, RTTNews

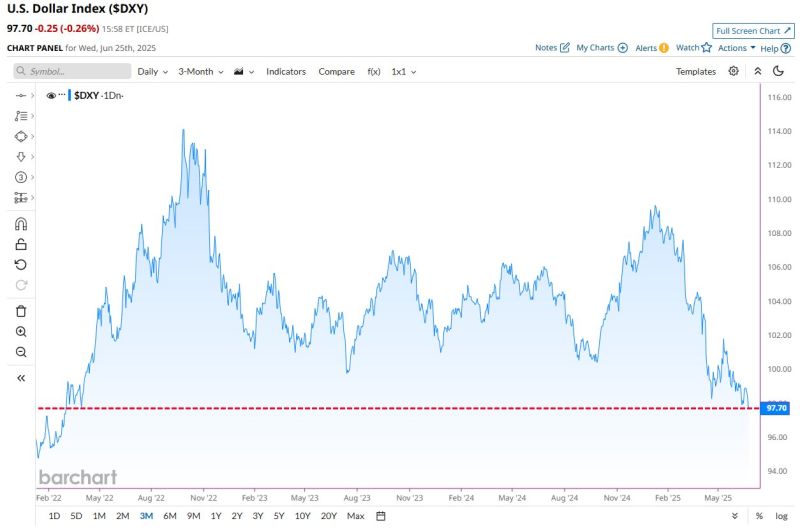

BREAKING 🚨: U.S. Dollar

The lowest close since March 2022 for the U.S. Dollar Index $DXY on track its 📉📉 Source: Barchart

Foreigners will sell all of US bonds they say...

Source: Bloomberg, Ryan Detrick

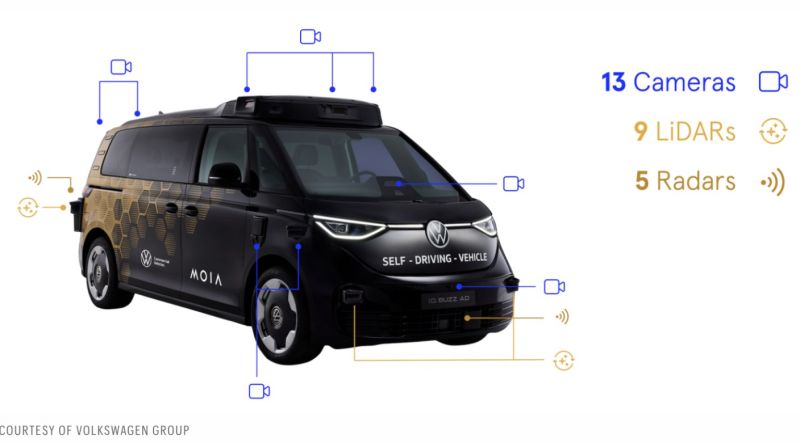

Volkswagen unveils robotaxi destined for $UBER

Volkswagen unveiled its white-label robotaxi the people of Los Angeles will be able to hail via $UBER next year. Unlike its tech competitors, VW aims to be a supplier and leave the actual business of managing the fleets to $UBER. Source: Wolf of Harcourt Street @wolfofharcourt

Israel says ceasefire has been violated — Iran denies

The Israel Defense Forces have accused Iran of violating the ceasefire announced by U.S. President Donald Trump “In light of these severe violation of the ceasefire carried out by the Iranian regime, we will respond with force,” the IDF’s Chief of the General Staff Eyal Zamir said, according to a Telegram update from the Israeli military. Earlier, the IDF had reported it was working to intercept missiles launched by Iran toward Israel, with sirens blaring in the north of the Jewish state. News of Iran carrying out a missile attack against Israel after the ceasefire came into effect is “denied,” Reuters cites Iranian media as refuting. Source: CNBC

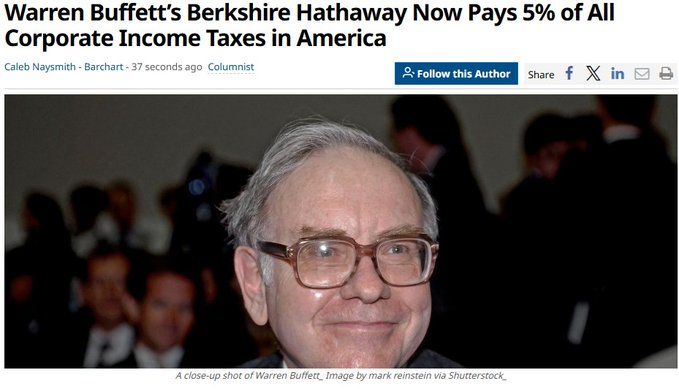

🤯Warren Buffett's Berkshire Hathaway Now Pays 5% of All U.S. Corporate Income Tax.

A 'record-shattering' $26.8 Billion: 🧵 Source: Caleb Naysmith @ccnaysmith

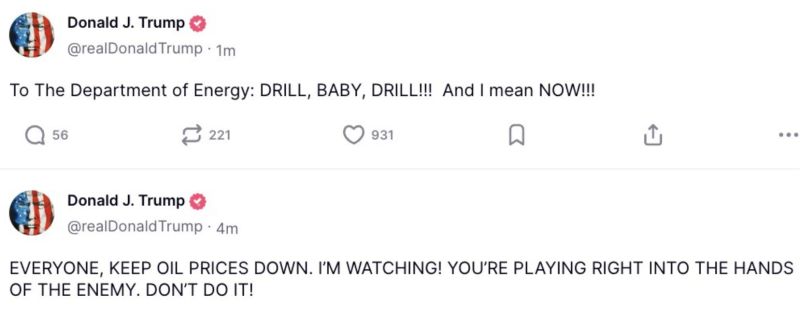

⚠️ President Trump just put out these comments about oil and energy

President Donald Trump on Monday demanded that “everyone” needs to “keep oil prices down” or they would play “into the hands of the enemy.” ➡️“EVERYONE, KEEP OIL PRICES DOWN. I’M WATCHING! YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!,” the president said in a post on his social media platform Truth Social. Trump’s message comes after his decision to bomb Iran’s key nuclear sites over the weekend has put the world on edge that the Islamic Republic might target energy supplies in the Middle East. It wasn’t clear who specifically Trump was speaking to in his post, though he was likely addressing the U.S. oil industry. Some oil companies had warned earlier in the year that they might have to cut production after prices tumbled to multiyear lows on Trump’s tariffs and OPEC+ boosting supply. ➡️“To The Department of Energy: DRILL, BABY, DRILL!!! And I mean NOW!!!,” Trump said in a subsequent post on Monday.

Investing with intelligence

Our latest research, commentary and market outlooks