Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

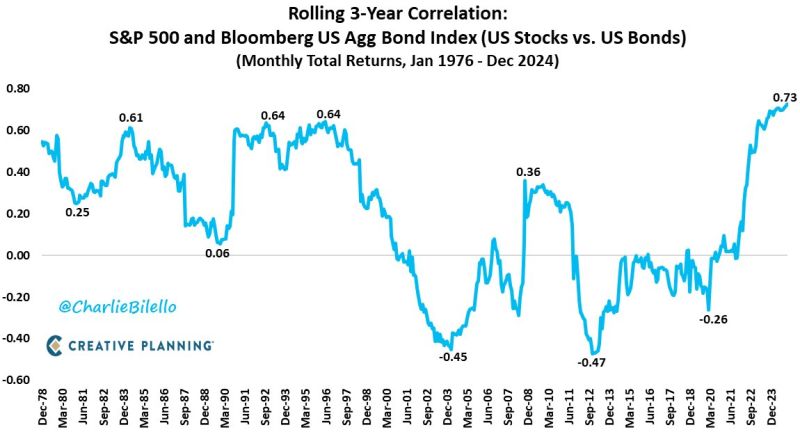

The correlation between US stocks and bonds over the last 3 years (0.73) is the highest on record.

Source: Charlie Bilello

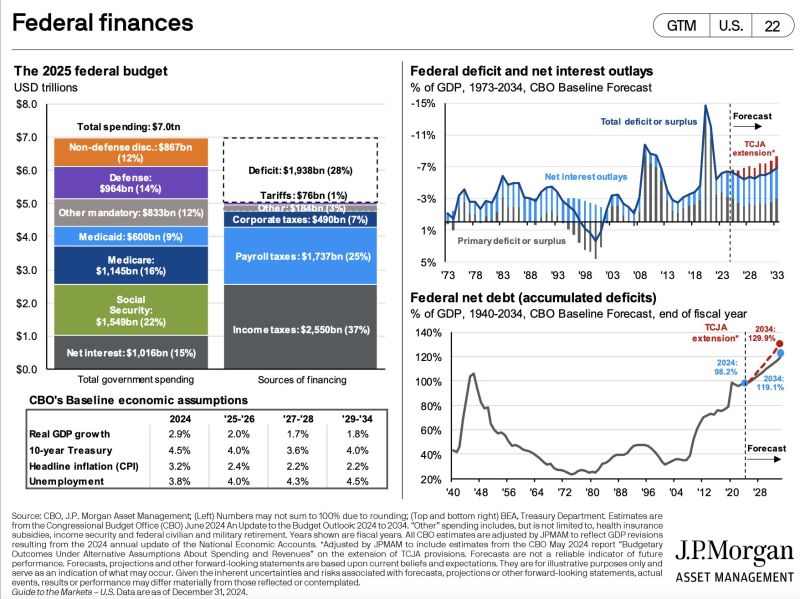

US Federal finances illustrated in one chart

Source: JP Morgan

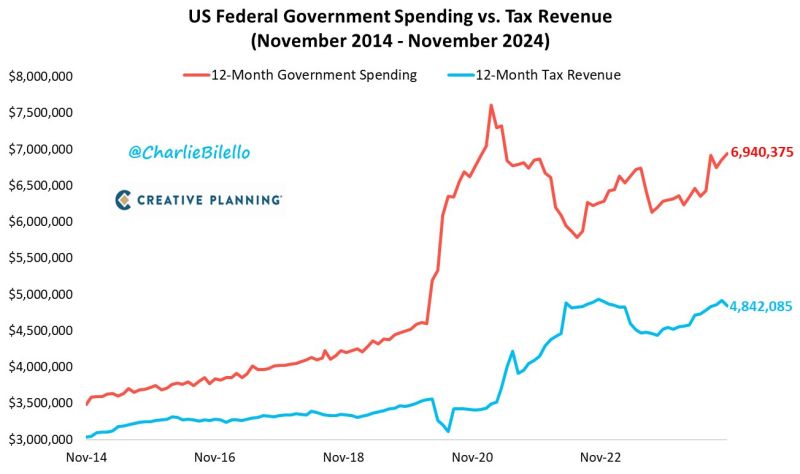

Over the last 10 years, US Federal Government Tax Revenue has increased 60% while Government Spending has increased 99%.

Does the US need higher taxes or less spending to balance the $2.1 trillion budget deficit? Source: Charlie Bilello

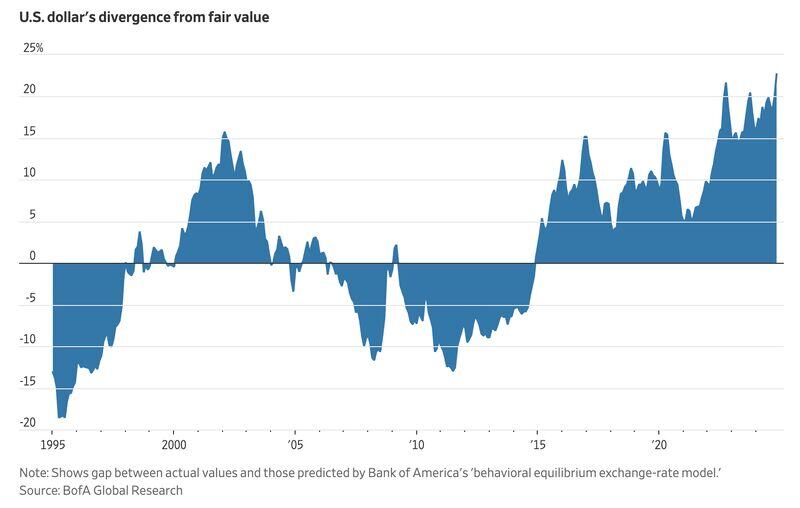

USDollar is now the most overvalued in history according to Bank of America.

Bank of America uses a "behavioral equilibrium exchange model (BEER)", an economic concept used to estimate the equilibrium exchange rate of a currency based on fundamental macroeconomic factors and behavioral relationships. BEER models derive the equilibrium exchange rate from observable economic fundamentals such as Terms of trade, Productivity differentials, Net foreign assets, Interest rate differentials and Trade balances Source: Barchart

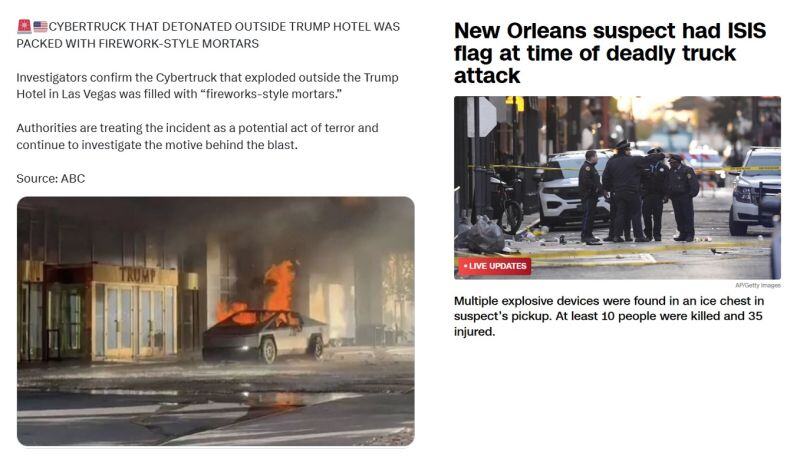

A new risk seems to be rising as we start 2025: terrorism on US soil

• NEW ORLEANS TERROR ATTACK: At least 10 people were killed and 35 injured when a driver rammed a pickup truck into a crowd during New Year’s celebrations on Bourbon Street in New Orleans early on Wednesday morning. The FBI is investigating it as an “act of terrorism.” • TESLA CYBERTRUCK EXPLOSION OUTSIDE TRUMP LAS VEGAS HOTEL: Government officials told ABC News that the Tesla Cybertruck explosion on Wednesday outside the Trump Las Vegas hotel in Nevada is being investigated as a "possible act of terror." Source: CNN, ABC, Mario Nawfal on X

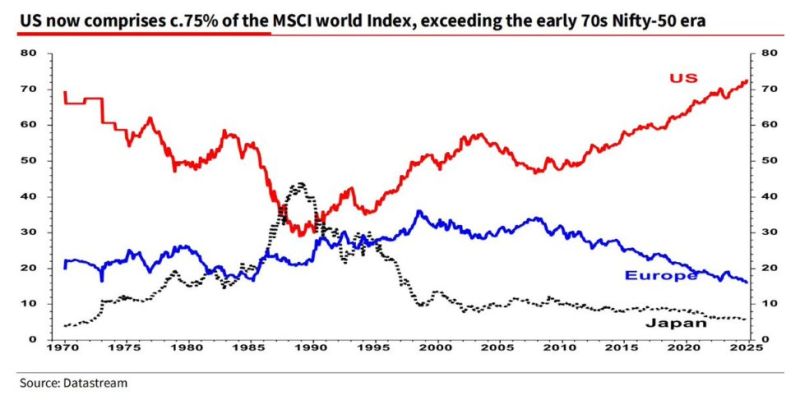

US is now 75% of MSCI World Index, a 55 Year High

Source: Datastream, Special Situations Research Newsletter on X

Canadian investor and “Shark Tank” star Kevin O’Leary said Thursday that he wants to help broker a deal with President-elect Donald Trump

that would create some sort of “economic union” between the US and Canada – declaring that at least half of his countrymen would support such a merger. "There's 41 million Canadians sitting on the world's largest amounts of all resources, including the most important, energy and water. Canadians over the holidays have been talking about this. They want to hear more. What this could be is the beginning of an economic union. Think about the power of combining the two economies and erasing the border between Canada and the United States. I like this idea and at least half of Canadians are interested. Nobody wants Trudeau to negotiate this deal. I don't want him doing it for me, so I'm going to go to Mar-a-Lago. I'll start the narrative".

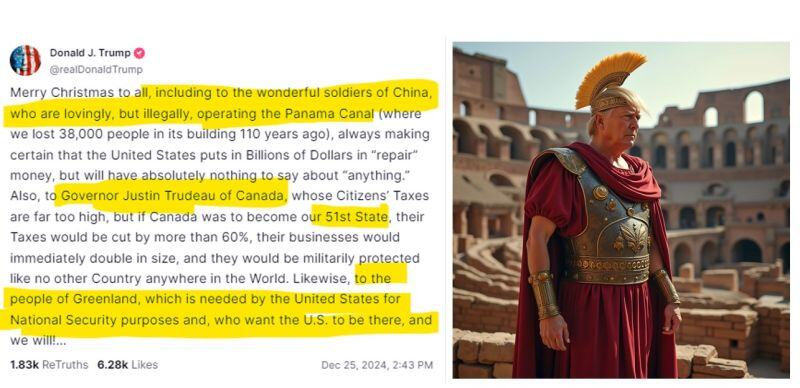

🚨TRUMP CHRISTMAS WISHES - A "MERRY CHRISTMAS" TO "EVERYONE"... WITH A MESSAGE TO THE WORLD

- On China and the Panama canal: “To the wonderful soldiers of China, who are lovingly, but illegally, operating the Panama Canal… the United States puts in Billions of Dollars in ‘repair’ money but will have absolutely nothing to say about ‘anything.’” - On Canada: “To Governor Justin Trudeau of Canada, whose Citizens’ Taxes are far too high, but if Canada was to become our 51st State, their Taxes would be cut by more than 60%, their businesses would immediately double in size, and they would be militarily protected like no other Country anywhere in the World.” - On Greenland: “To the people of Greenland, which is needed by the United States for National Security purposes and who want the U.S. to be there, and we will!” Closing Note: “We had the Greatest Election in the History of our Country… and, in 26 days, we will MAKE AMERICA GREAT AGAIN. MERRY CHRISTMAS!” Will US imperialism be one of the major theme of 2025??? Source: Truth Social, @mario nawfal on X

Investing with intelligence

Our latest research, commentary and market outlooks