Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

TRUMP'S NEW CABINET: A DIVERSE MIX OF POLITICS AND BUSINESS.

Nice infographic by The Epoch Times. thru Mario Nawfal on X Trump's second administration introduces a cabinet of varied backgrounds, including former Democrats and business leaders. Robert F. Kennedy Jr., a former Democrat, joins after endorsing Trump and navigating political backlash from his family. Tulsi Gabbard, once a progressive Democrat, now champions conservative causes alongside the administration. This team blends political outsiders with seasoned operatives, shaping a cabinet that reflects Trump's unconventional approach. Source: The Epoch Times https://lnkd.in/exsmcfen

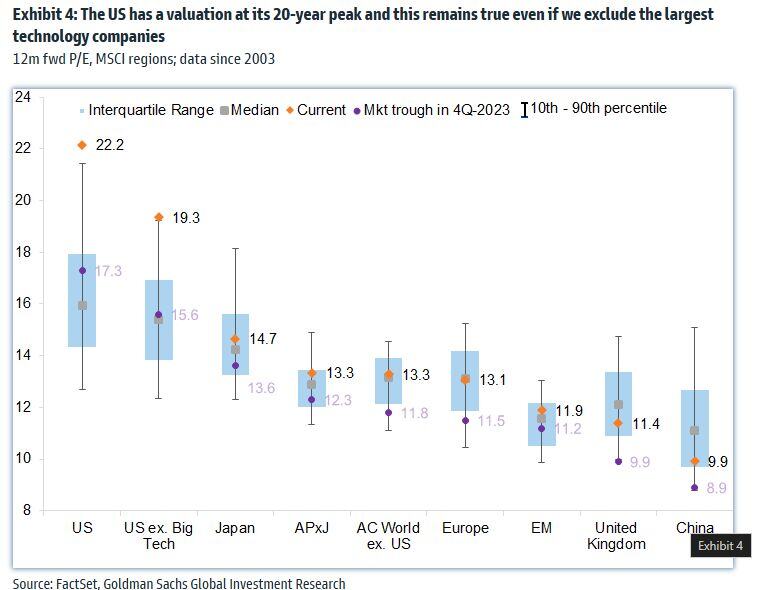

GS: The US has a valuation at its 20-year peak and this remains true even if we exclude the largest technology companies

Source: Mike Zaccardi, CFA, CMT, MBA

2024 is shaping up to be a big year for privately-held companies, with over 1,200 unicorns globally, up from just 590 in 2021!

(A "unicorn" refers to privately held companies valued at over one billion dollars). Leading the charge is ByteDance (TikTok's parent) at a whopping $220B 💰, followed by SpaceX 🚀 at $180B and OpenAI 🤖 at $100B. Noticeably, the US and China lead the world in both the number of unicorns and their combined market value. Source: Genuine impact

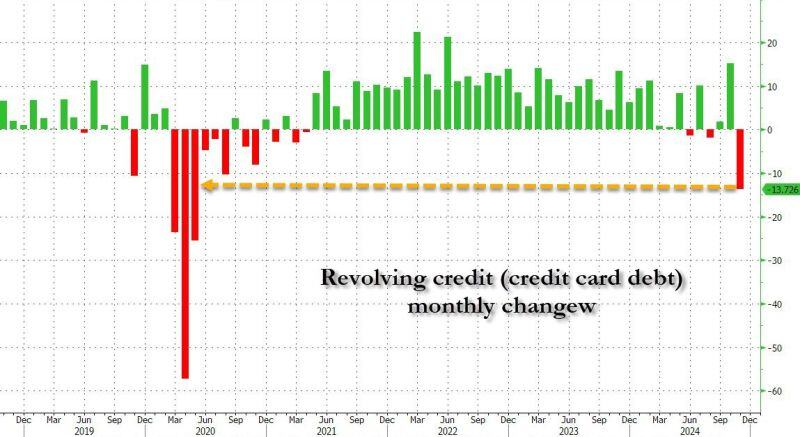

🚨 "Klarnageddon": Consumer credit card debt just plunged the most since covid; these prints are usually negative just ahead or inside of deep recessions.

🔈 According to the Fed's latest consumer credit data, in November consumer credit across US households tumbled by $7.5 billion to $5.102 trillion, a 1.8% annual rate of contraction and usually something one only sees in the middle of recessions (or worse). ❗ While non-revolving debt (i.e. student and auto loans) rose modestly, it was revolving, or credit card debt, that cratered by a whopping $13.8 billion the biggest drop since the covid crash shut down the economy and the prospect of future income for millions of Americans (hence the collapse in spending). ⚠️ It is not clear what sparked this sudden reversal in the favorite American pastime - i.e., to buy stuff one can't afford and hope to pay it back some time in the future for a modest 29.95% APR - but we know what didn't: falling rates... because they didn't. ❗ Three months after the Fed cut rates, taking them 100 bps below where they were in September, the average interest on credit card accounts across the US banking system as tracked by the Fed is at 22.8%, the second highest reading on record and a drop of 57bps from the highest rating on record taken in Q3 2024... Source: Bloomberg, www.zerohedge.com

BREAKING: The EU ”won’t tolerate" a takeover of Greenland by the US.

France says Europe is a strong continent and won’t be intimidated. It’s warning Trump against threatening the bloc's "sovereign borders" Source: Telegraph, Visegrád 24

FOMC Minutes Show 'Almost All' Fed Members See Higher Inflation Risks, Cite Trump Policies

👉 RATE POLICY: — A 25bps rate cut was broadly supported, with the majority favoring a cautious approach to further easing. — Many participants suggested that a variety of factors underlined the need for a careful approach to monetary policy decisions over coming quarters — Some participants noted it might be prudent to pause rate cuts if inflation readings remain above target or economic momentum persists. — A few officials highlighted potential scenarios to accelerate cuts if inflation trends lower or labor market softens more than expected. — Many emphasized the importance of carefully assessing the neutral rate and moving gradually to avoid policy missteps. 👉RISK OUTLOOK: — Inflation risks remain balanced, though higher-than-expected recent readings warrant close monitoring. — Labor market risks were deemed manageable, with no rapid deterioration expected. 👉ECONOMIC CONTEXT: — Inflation progress has slowed but remains on a downward path; core PCE inflation was noted at 2.8% in October. — Labor market conditions have eased slightly, but unemployment remains low at 4.2%. — Participants expect solid GDP growth to continue, though some noted financial strains for lower-income households. 👉BALANCE SHEET AND TECHNICAL ADJUSTMENTS: — Continued reduction in Treasury and mortgage-backed securities reaffirmed, with caps set at $25B and $35B per month, respectively. — Discussed adjusting the overnight reverse repo (ON RRP) rate to align with the bottom of the federal funds rate range. 👉 ADDITIONAL NOTES: — Fed emphasizes data-dependent decision-making, balancing risks to inflation and employment. — Gradual easing remains the likely path, with flexibility to adapt if economic or inflation conditions shift. - source: Wall St Engine @wallstengine

YELLEN: "FISCAL POLICY NEEDS TO BE PUT ON A SUSTAINABLE COURSE"

As a reminder, Mrs Yellen was Fed vice chair and chair from 2010 to 2018 and has been treasury secretary since 2021. On an aggregate basis, she has been directly overseeing and presiding over a $15 TRILLION increase in US debt... Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks