Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

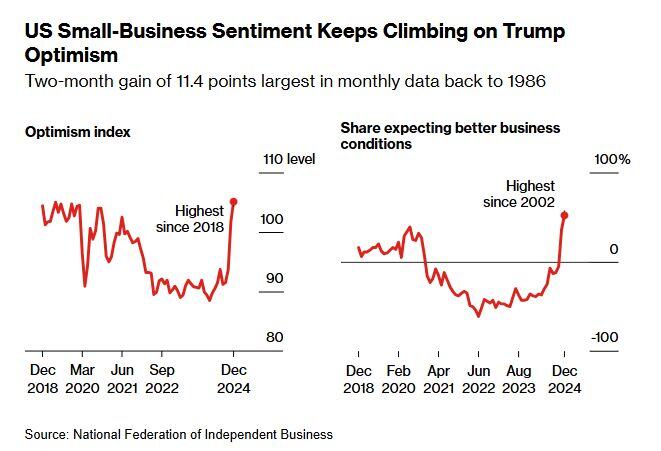

US Small-Business Optimism Hits Highest Since 2018 Post Election

- Bloomberg thru Christophe Barraud on X

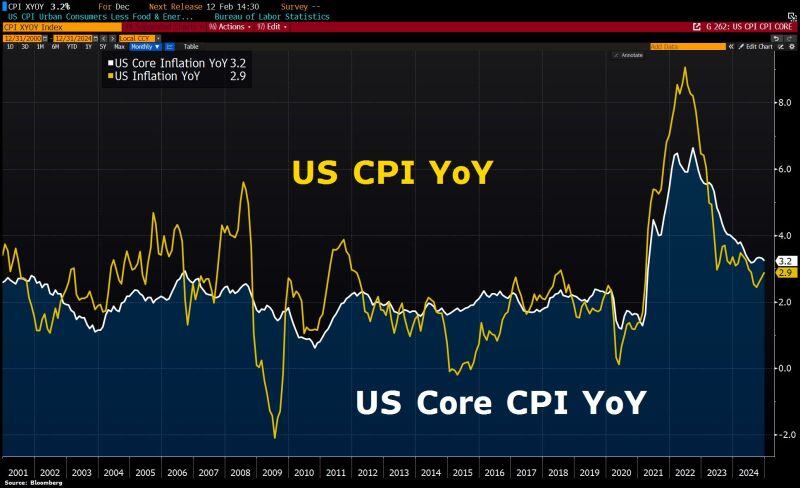

Good news are coming... while US Q4 earnings season is off to a strong start thanks to banks beating estimates, US inflation numbers came in somewhat cooler than expected:

Core CPI slows to 3.2% in December from 3.3% in November. Analysts had expected the rate to remain unchanged at 3.3%. Overall CPI is unchanged at 2.9% as forecasted. Headline CPI inflation is up for 3 straight months, but core inflation is falling again. It seems enough to please investors: S&P 500 futures are surging over +85 points - the equivalent of a $750B market cap gain - as 10y US bond yields are tumbling by 10 basis points. The dollar is easing, gold is shining and cryptos is surging with bitcoin back to $99K. Alles gut... Source: Bloomberg

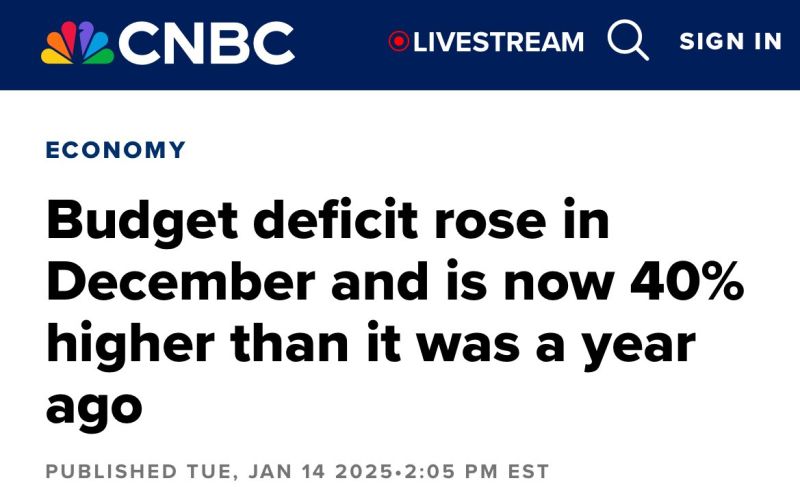

The first quarter of FY 2025 produced a deficit of $710.9 Billion.

That’s $200B more than the first quarter of fiscal 2024, or a 39% increase YoY. The US is now running a ~$3 TRILLION annual deficit...

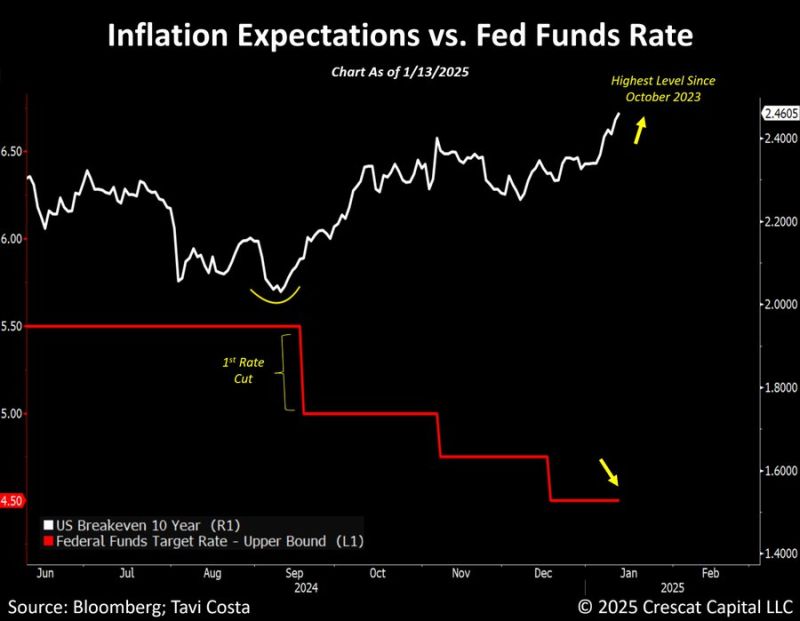

Inflation expectations have almost perfectly bottomed exactly when the Fed started to cut rates.

10-year breakeven rates are now at its highest level since October 2023. As highlighted by Tavi Costa, this is a reminder that when debt limits a monetary authorities actions, inflation becomes the path of least resistance. Source: Tavi Costa, Bloomberg

🚨US PPI DATA SHOULD PLEASE POWELL! December US PPI annual inflation rises 3.3%, below expectations for 3.5%.

vCore PPI inflation increased 3.5% Y/Y, compared to forecasts for a gain of 3.8%. BULLISH🚀 YoY Growth: 🇺🇸 PPI (Dec), 3.3% Vs. 3.5% Est. (prev. 3.0%) 🇺🇸 Core PPI, 3.5% Vs. 3.8% Est. (prev. 3.4%) MoM Growth: 🇺🇸 PPI (Dec), 0.2% Vs. 0.4% Est. (prev. 0.4%) 🇺🇸 Core PPI, 0.0% Vs. 0.3% Est. (prev. 0.2%)

Real yields on 30-year US treasury bonds are now at 2008 levels.

It seems that bond markets are worried about much more than just inflation... Source: Adam Kobeissi, Bloomberg

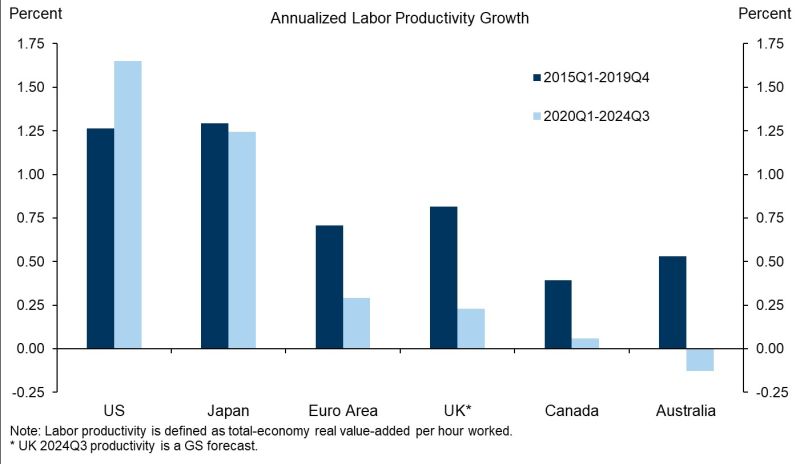

A stunning chart by Goldman: the outperformance of US productivity growth is remarkable, particularly in the COVID/post-COVID era.

Source: GS, Tony Pasquariello, Giovanni Pierdomenico

"....the selloff in US bonds is driving yields higher everywhere, including in economies where the growth outlook hasn’t improved.

Of course, this second point isn't hard to explain. US Treasuries act a generic riskfree asset for the global financial system. When US yields move higher, it creates pressure on bonds everywhere." - TS Lombard, Perkins thru The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks