Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Trump is inheriting a Federal Reserve w/ not only unprecedented losses of $218 billion, but it's still losing money;

the Fed won't send the Treasury a dime for the entirety of Trump's term; that's never happened since the inception of the Fed - another challenge for Trump... Source: E.J. Antoni, Ph.D. @RealEJAntoni

President Trump official portrait is out.

Between 2017 and 2025, the body language looks different...

BREAKING: Donald Trump to designate crypto as a national priority, including the consideration of a "national Bitcoin stockpile"

— Bloomberg

In Germany, labor productivity has stagnated—or even declined—since 2020.

Meanwhile, US companies have embraced AI's benefits and recently achieved significant productivity gains. Notably, productivity trends in Germany and the US have been diverging since 1999. This divergence may also be linked to the introduction of the euro. Since the euro became undervalued for Germany—at least from 2004 onward—German companies may have felt less pressure to improve productivity. Source: HolgerZ, Bloomberg

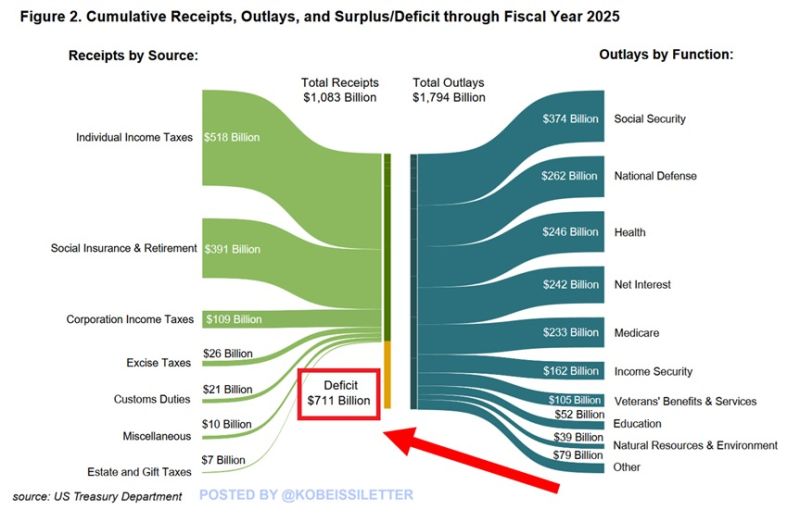

BREAKING: The US budget deficit hit a massive $711 BILLION for the first 3 months of Fiscal Year 2025.

This is ~$200 billion, or 39%, higher than in the same period last year. The deficit reached $2.0 TRILLION for the full calendar year 2024, up $248 billion YoY. Also, deficit spending rose from 6.4% to 6.9% GDP in 2024. Such a high percentage has never been seen outside of wars or major economic crises. Source: The Kobeissi Letter

Donald Trump's new SEC to begin overhauling the agency's crypto policies "as early as next week" 👀

Source: Reuters

Mortgage demand is collapsing:

US mortgage applications for single-family homes fell 3.7% last week, marking their 4th consecutive weekly decline. As a result, the mortgage demand index has fallen to the lowest since February 2024 and its 3rd lowest level in nearly 30 years. The index has now fallen a whopping -63% over the last 4 years. This comes as home financing costs have rapidly surged while prices remain at all-time highs. Since mid-September, 30-year fixed mortgage rates have risen ~110 basis points and are back above 7%. Mortgage demand is at 1990s levels. Source: The Kobeissi Letter, MBA Purchase index

Investing with intelligence

Our latest research, commentary and market outlooks