Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

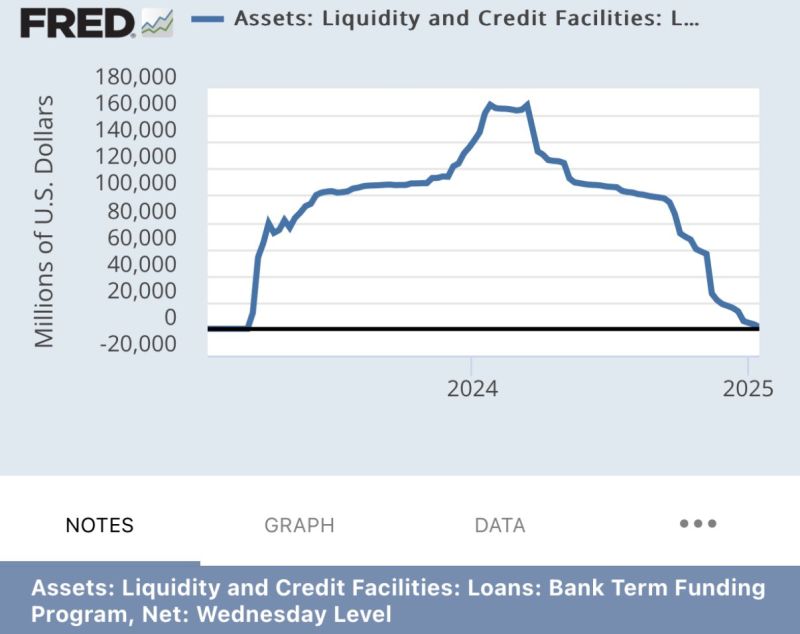

The BTFP, introduced under Biden, acted as a lifeline, letting regional banks trade toxic, low-yield debt for loans at par value, disguising their insolvency.

Now drained, what will happen to the program? Could this put the regional banking system at risk? Source: FRED, The Coastal Journal

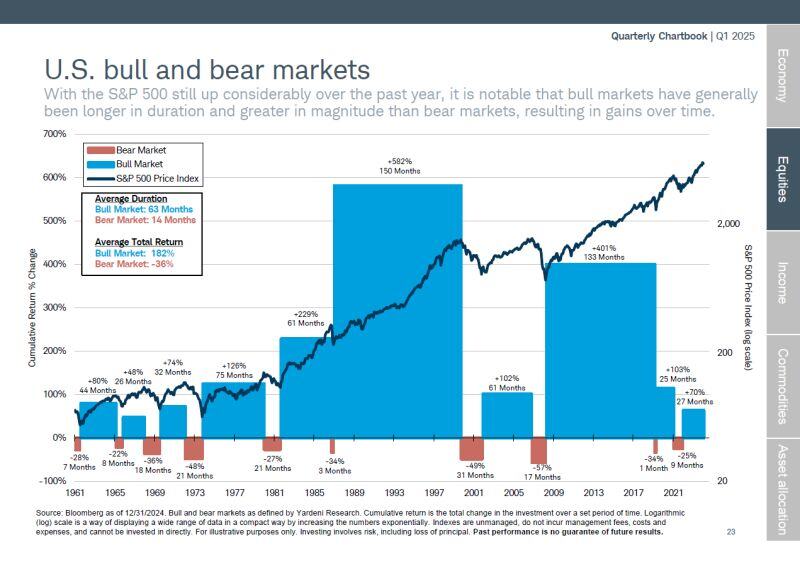

Bear markets pale in comparison to bull markets, both in market movement and duration.

Remember this chart during the next - and inevitable - correction or bear market. Source: Peter Mallouk

Strategic Bitcoin Reserve legislation is gaining momentum.

11 states, including Florida, Wyoming, and Massachusetts, have introduced bills to secure Bitcoin as part of their state reserves. Source: TFTC @TFTC21

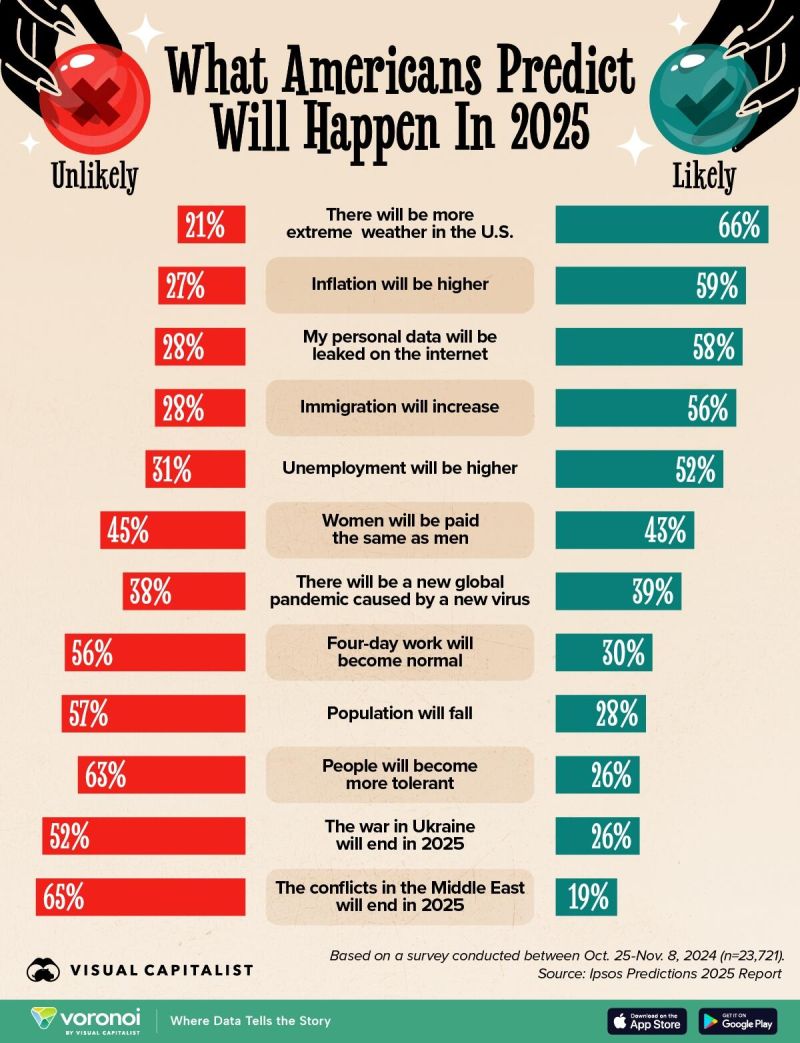

The year 2025 begins with a new president taking office, a ceasefire in Gaza, and wildfires causing extensive destruction in Los Angeles - all within the first month.

So, what can we expect from the rest of the year? This graphic, via Visual Capitalist's Bruno Venditti, presents predictions for 2025 on various topics, based on a survey conducted by Ipsos between October 25 and November 8, 2024, in the United States. Source: Visual Capitalist

New research published in the The Journal of Cleaner Production reports

"The findings of this study show that bitcoin mining can be used as an efficient alternative to extract added profits from various planned renewable energy facilities in the US." Source: Documenting ₿itcoin

JUST IN: 🚨TRUMP TO ANNOUNCE $500 BILLION AI INFRASTRUCTURE INVESTMENT

Trump is set to unveil a private sector-backed AI project called Stargate, led by OpenAI, SoftBank, and Oracle. The companies will invest $100 billion initially, with plans to reach $500 billion over 4 years, starting with a massive data center in Texas. SoftBank CEO Masayoshi Son, OpenAI’s Sam Altman, and Oracle’s Larry Ellison will join Trump at the White House for the announcement. Source: CBS News, Mario Nawfal

This may be the most perfect photo ever taken during trump inauguration.

The longer you stare at it, the more fascinating and remarkable it becomes. Source: Benny Johnson on X

Investing with intelligence

Our latest research, commentary and market outlooks