Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

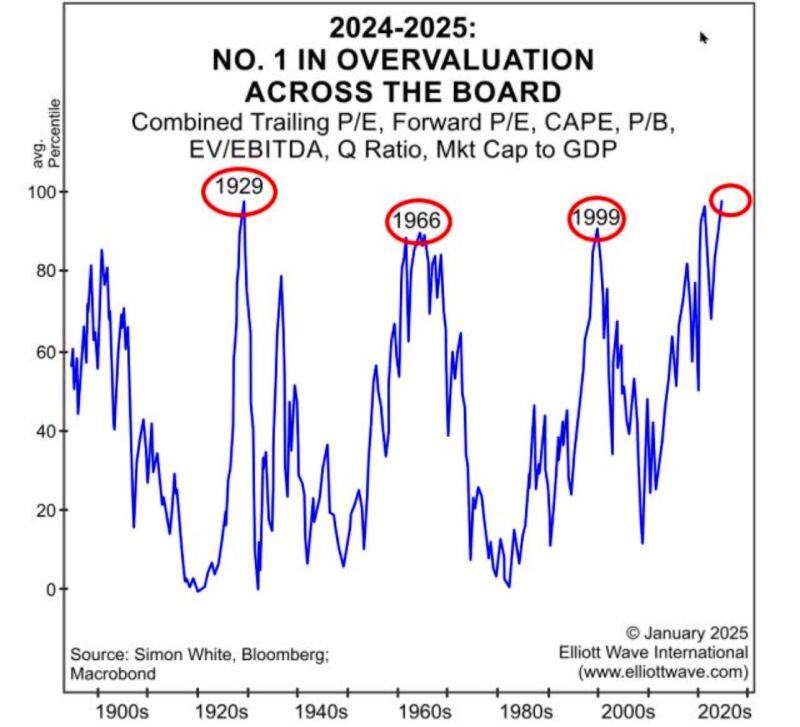

Market valuations are at their highest levels in history, when taking into account multiple methodologies

Source: MacroEdge Vision @MacroEdgeVision

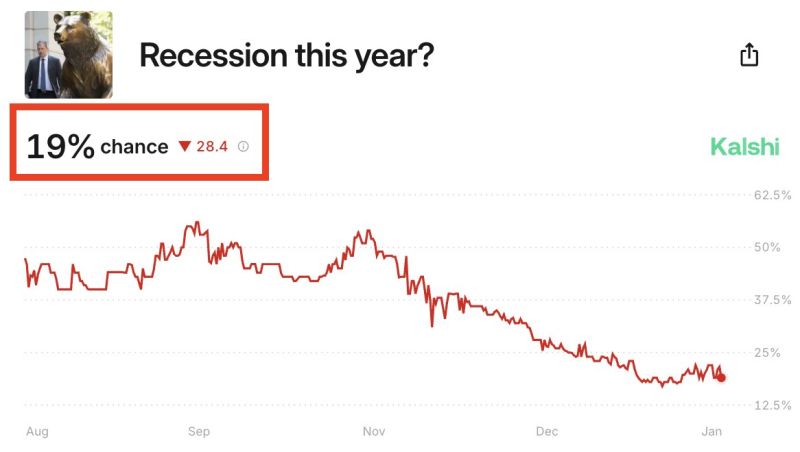

The odds of the US economy entering a recession in 2025 have fallen to a fresh low of just 19%.

Since Election Day, the odds of the US economy entering a recession are down 35 percentage points, per @Kalshi .This comes after the preliminary reading of Q4 2024 GPD showed the US economy grew by 2.3%. Even as interest rates remain elevated and inflation rebounds, the US economy is growing. Source: The Kobeissi Letter

🚨 US MACRO DATA & NFP RELEASED!

SOME SIGNS OF ECONOMIC SLOWDOWN BUT JOB MARKET AND CONSUMERS STAY STRONG 🚀 🔴 US GDP (Q4), 2.3% Vs. 2.6% Est (prev. 3.1%) Q4 GDP rose at an annualized rate of just 2.3% (lowest in 3 quarters), powered by a 4.3% surge in personal spending. Here are the details: - Personal consumption: 4.2% vs. 3.2% est. - Non-residential fixed investment: -2.2% (Q3: +4%) - Housing investment: +5.3% (Q3: -4.3%) - Exports: -0.8% (Q3: +9.6%) - Imports: -0.8% (Q3: +10.7%) 👉 Bottom-line: Consumption strong, but trade and business investment drag. 🔴PCE 4.2%, Exp. 3.2% (prev. 3.7%) Core PCE 2.5%, Exp. 2.5% (prev. 2.2%) 🔴US Jobless Claims, 207K Vs. 225K Est. (prev. 223K) 👉 Job market remains resilient ➡️ Overall, this still sounds like goldilocks. Growth is slowing down but remains resilient overall and the consumer is in good shape. Inflation risk remains but is not accelerating meaningfully with Core PCE in line with expectations.

BREAKING: All federal employees who do not work in person by February 6 will get FIRED - President Donald J. Trump

President Donald Trump warned US federal employees to return to in-person work by February 6 or face termination. The government is offering buyouts, with departures permitted under a deferred resignation programme. Trump aims to reduce the federal workforce. "If they do not agree to show up to work in their office by February 6, they will be terminated. Therefore, we will be downscaling our government, which is something that the last 10 presidents have tried very hard to do, but failed," Trump said. "We think a very substantial number of people will not show up to work, and, therefore, our government will get smaller and more efficient," Trump told reporters on Wednesday. "And that's what we've been looking to do for many, many decades," he added. We may ask these people to prove that they didn't have another job during their so-called employment with the United States of America, because if they did, that would be unlawful," Trump said Source: India Today Source image: Graphic of Donald J. Trump saying "You're fired". The Spiggle Law Firm Marketing Team thru Forbes

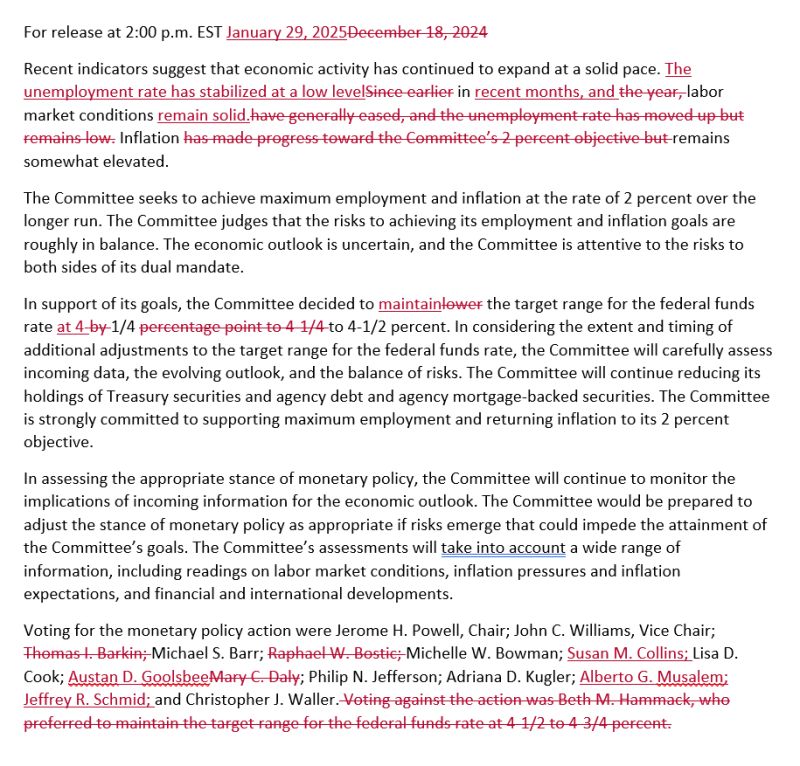

The Fed held rates steady as widely expected.

The FOMC statement contains only minor changes that mark to market recent economic developments: 👉 "Labor market conditions remain solid" = Hawkish❗ 👉 "Inflation remains somewhat elevated." (The central bank notably removed reference to inflation making progress towards the goal) = Hawkish❗ The Fed will continue its QT program at an unchanged pace of $60 billion a month. The market does not expect rate cuts at least until June 2025. Source: Nick Timiraos, The Kobeissi Letter

Trump is not happy with “hawkish” Powell.

Source: @realDonaldTrump

Investing in technology and specifically artificial intelligence (AI) also seemed to be front and center in the early days of the new administration.

President Trump signed an executive order to "make America the world capital in Artificial Intelligence." The order calls for agencies to craft policy to ensure U.S. dominance in AI. In addition, the new administration has proposed backing a private-sector investment of up to $500 billion to fund infrastructure for AI. The new venture, called Stargate, aims to build data centers – a huge need to support AI computing power – and potentially create up to 100,000 jobs. The investments in data centers and electricity are critical for the U.S. to maintain leadership and be a driver for AI technology and applications. The chart below shows the energy requirements measured in terawatt hours for U.S. datacenters is expected to rise over the coming years. Source: Edward Jones

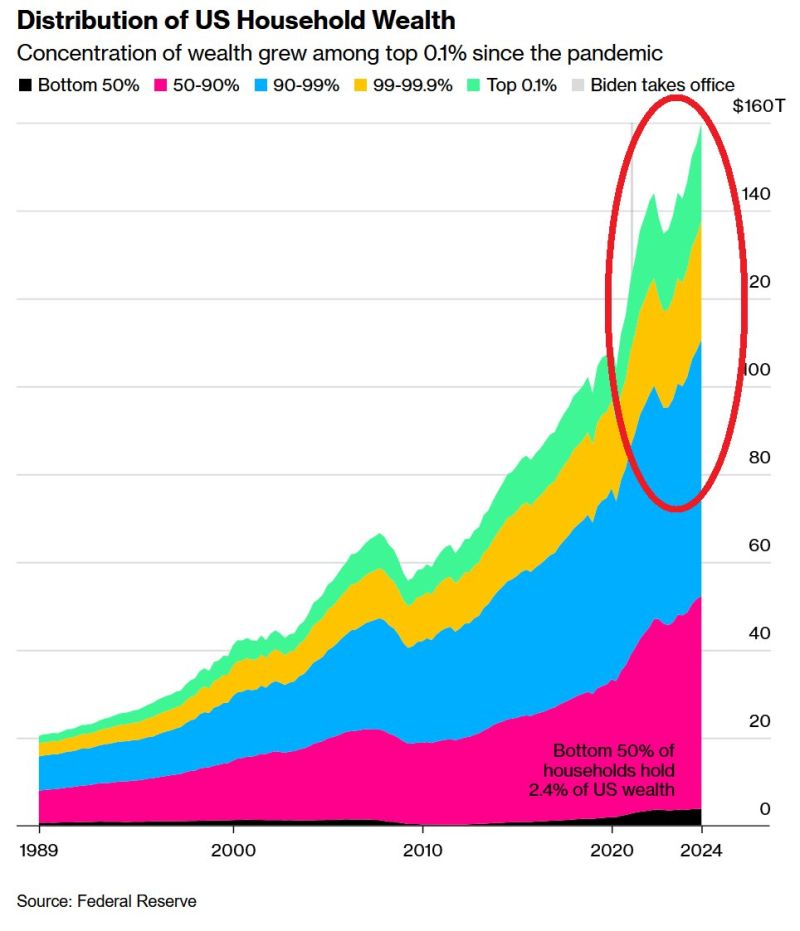

🚨The current financial system benefits the RICHEST and hits the poorest:

The Top 10% of US households now own $111 trillion of all wealth or 69% of the total. The Bottom 50% holds ONLY $3.9 trillion or 2.4% of wealth. Since 2021, their wealth adjusted for inflation DECLINED by 5%. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks