Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

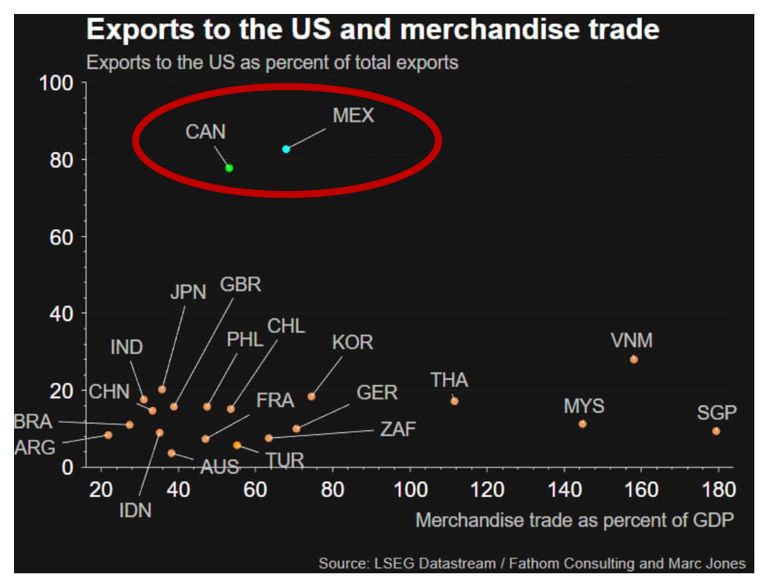

The chart below - courtesy of LSEG - explains why canada and mexico both "kiss the ring" yesterday...

Source: LSEG Datastream

Cboe Stock Exchange to Extend Trading to 24 Hours, 5 Days a Week

Cboe Global Markets Inc. is extending trading on its equities exchange to 24 hours on weekdays, the latest venue to take advantage of the growing global demand for US stocks. The exchange operator will offer trading on its Cboe EDGX Equities Exchange — its main equities venue — through the US daytime and overnight, according to company executives. The plan, which is subject to regulatory approval, calls for trading Sunday night through Friday night, with breaks only on the weekends. CBOE already provides some additional trading hours for US equities, with early orders accepted starting at 2:30 a.m. New York time and trading available from 4 a.m. to 8 p.m., Monday through Friday. During those extended hours, average daily trading volume increased 135% between 2022 and 2024, Cboe said. Regular trading takes place from 9 a.m. to 4 p.m. The New York Stock Exchange also filed its own application in October, looking to offer trading 22 hours on weekdays. Neither venue will be able to operate overnight until key infrastructure is in place that shows real-time trade data outside of normal trading hours. source : bloomberg

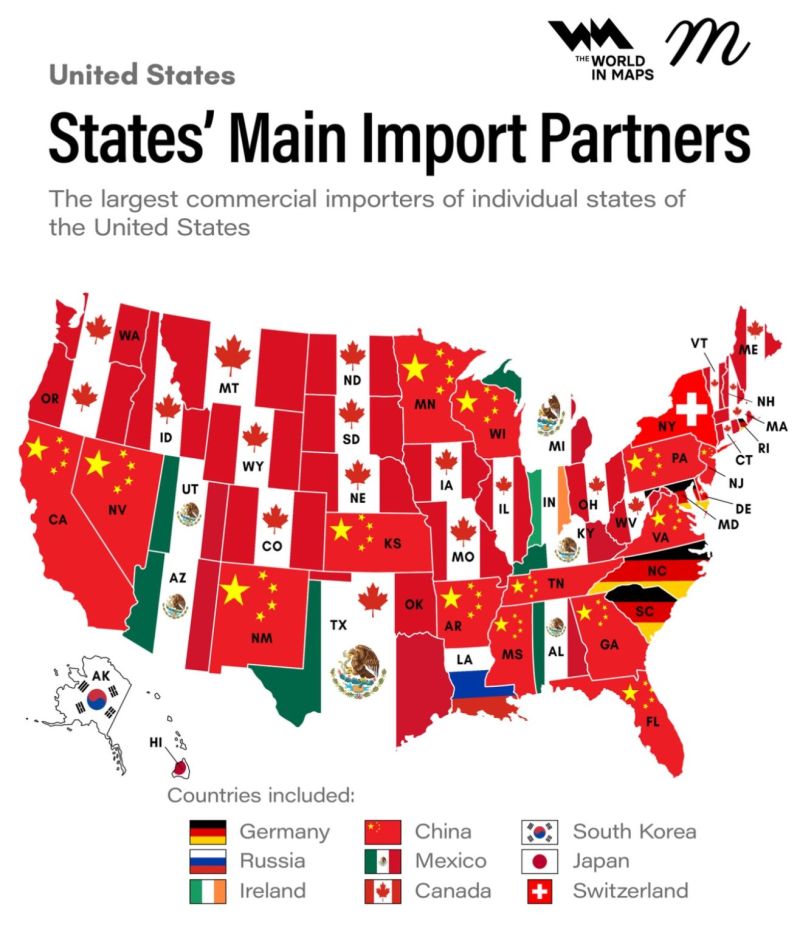

Great visual representation of tariffs impact on US states

By The World in Maps thru Tom Keene thru Joumanna Bercetche

Will the US have to crash stocks to save bonds ???

Source: Michael A. Gayed

This is what happened to US government revenues from tariffs during Trump's first tradewar.

Source: DB

TRUMP: "Am I going to impose tariffs on the European Union? Do you want the truthful answer or the political answer?

REPORTER: "The truthful answer." TRUMP: "Absolutely." source : unusual whales

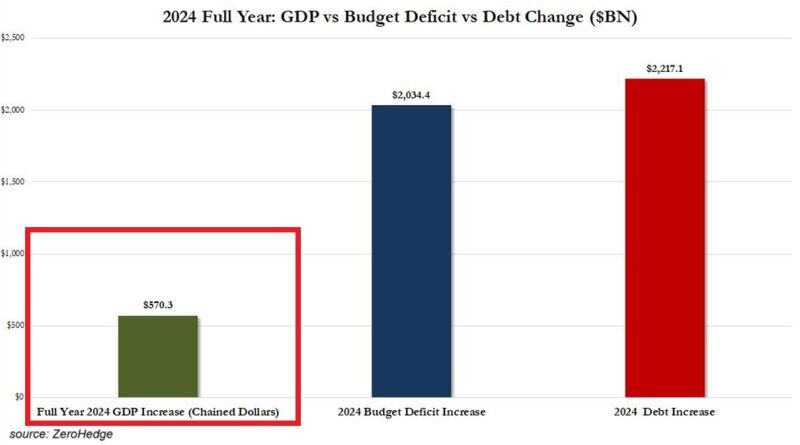

US growth is not a miracle, it is fully DEBT driven:

It took a MASSIVE $2.2 trillion in public debt to create $570 billion in GDP growth in 2024 (before revisions). In other words, it took $3.9 of debt to generate $1 of economic growth. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks