Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

China's retaliatory tariff will hit the United States today.

Here is how the U.S Corporations and consumers will be impacted. Source: Unicus @UnicusResearch

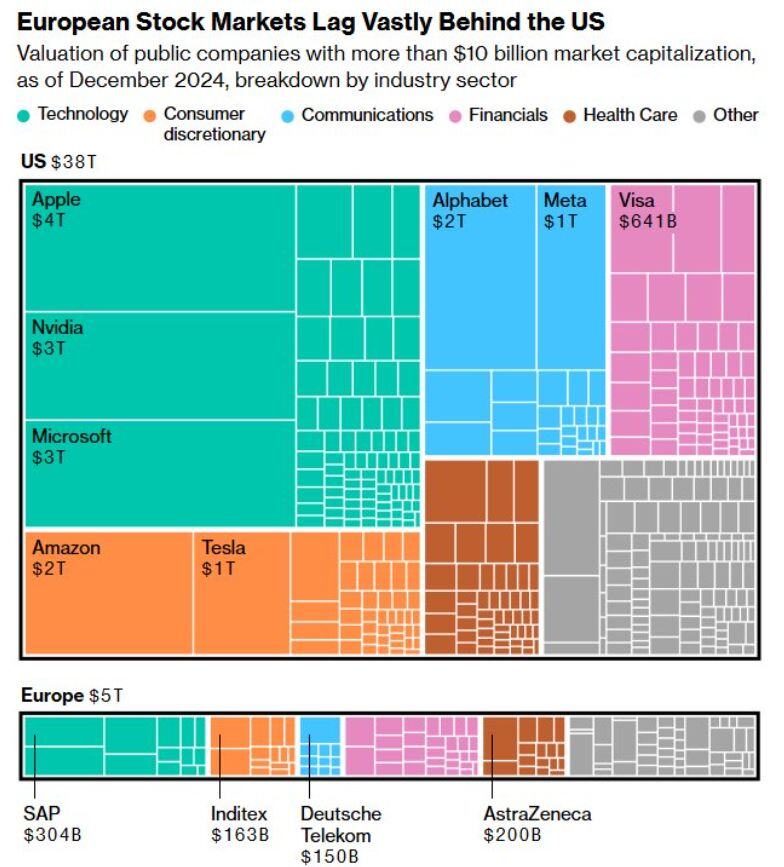

Valuation of Public Companies with Market Caps Over $10B

The gap between European and U.S. equities continues to widen. While U.S. stocks trade at historically high valuations, their European counterparts lag significantly behind. source: A.Arouet

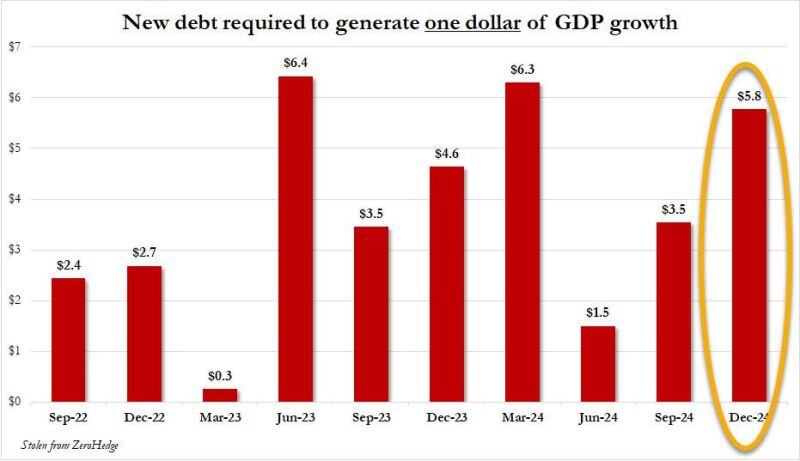

The US economy has been driven by a massive DEBT BUBBLE: In 2024, to generate 1 unit of GDP growth it took $3.8 of national debt...

In Q4 alone, it took $5.8 of debt to create $1 of economic growth. If not for the huge debt, the US economy would have been in a recession. Source: Global Markets Investor

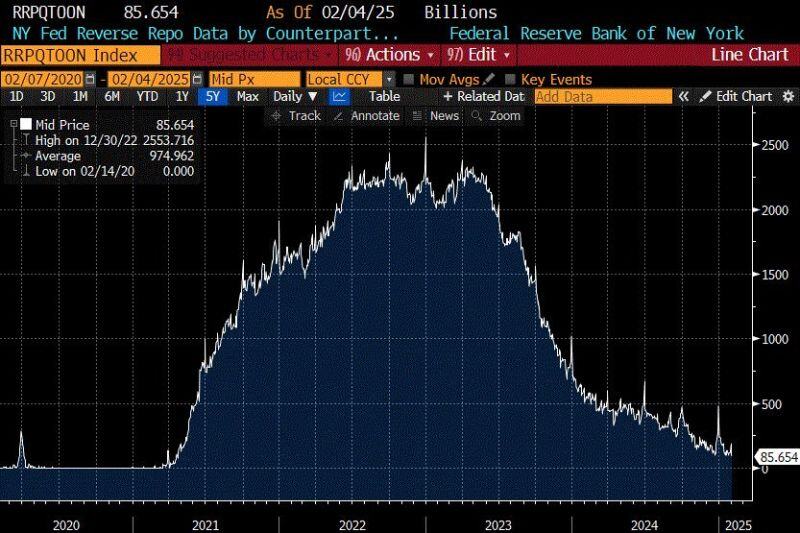

Federal Reserve's Reverse Repo Facility is plummeting

QE & money printing might start aggressively when this drains to 0 Source: Quinten | 048.ethm@QuintenFrancois, Bloomberg

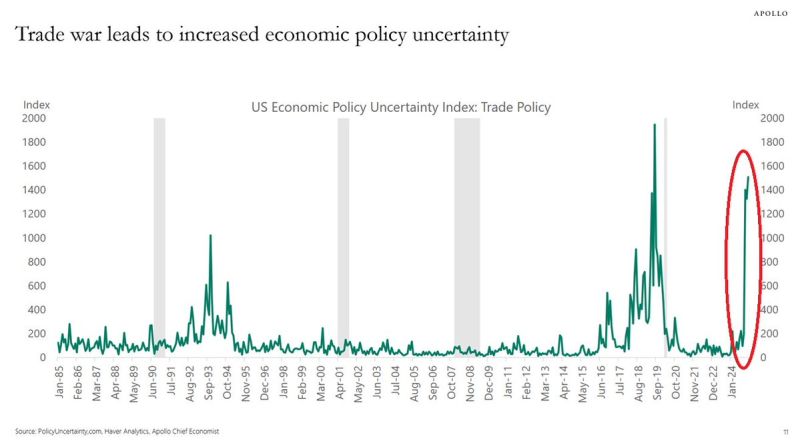

‼️US economy policy uncertainty is SPIKING:

This means economic environment will be challenging to predict and may impact investments and spending, as well as trigger more volatility in the markets. The index is only below the 2018 levels when the previous trade war took place. Source: Global Markets Investor

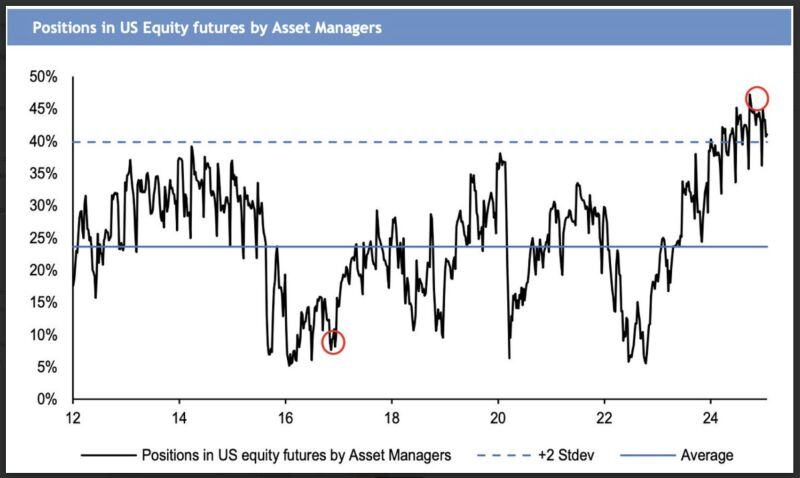

Trump 2.0 is definitively starting off differently.

The speed of announcements and changes has been staggering. JPM notes that Trump 1.0 started with asset managers' positioning much lighter than this go around. Source: JP Morgan, RBC

Roughly 20,000 federal employees have accepted President Trump's buyout offer to leave their jobs and receive an 8-month severance.

The goal is to reduce the federal budget by removing unnecessary bureaucrats. Source: Wall Street Mav

Investing with intelligence

Our latest research, commentary and market outlooks