Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Donald Trump’s inauguration will include a “Crypto Ball,” with technology industry leaders celebrating him as "the first crypto president”.

Here's an extract from Brave New Coin: 👇 "In a move that blends politics and technology, Washington D.C. will host the inaugural “Crypto Ball” on January 17, 2025, in honor of the inauguration of Donald J. Trump as the first "crypto president." The event, poised to be one of the most exclusive celebrations in political history, is set to take place at the historic Andrew W. Mellon Auditorium, a venue befitting the occasion's grandeur and significance. The Crypto Ball is being spearheaded by David Sacks, Trump’s newly appointed AI & Crypto Czar. Known for his deep ties to Silicon Valley and the venture capital world, Sacks’ involvement underscores the administration’s commitment to embracing blockchain technology and digital innovation. This gala event serves not only as a celebration of Trump’s return to the presidency but also as a declaration of intent for a pro-crypto agenda in the United States. Tickets to the event are as exclusive as the concept itself. General admission starts at $2,500, but the true allure lies in the VIP and private packages. For $100,000, VIP guests gain access to exclusive networking opportunities with leading figures in the crypto space. Meanwhile, a $1 million private dinner package with Trump himself offers unparalleled access to the president—a rare opportunity for those deeply invested in shaping the future of the blockchain industry. The event is being sponsored by some of the biggest names in the crypto world, including Coinbase, MicroStrategy, and Galaxy Digital. Their sponsorship not only highlights their support for a crypto-friendly administration but also signals a broader alignment between the private sector and public policy under Trump’s leadership. MicroStrategy’s Michael Saylor, a long-time advocate for Bitcoin, and Coinbase CEO Brian Armstrong are expected to attend, cementing the event’s stature as a convergence point for the world’s crypto elite. As part of the evening’s program, attendees can expect keynote speeches from Trump and Sacks, celebrating the administration’s vision for integrating blockchain technology into national policy. News reporting suggests that President Trump will sign pro-crypto executive orders on day one of his administration, Rumors also hint at the unveiling of a government-backed digital currency initiative, potentially revolutionizing the global financial landscape. Musical performances and an array of high-tech showcases will punctuate the evening, blending entertainment with cutting-edge demonstrations of blockchain applications". Source: Brave New Coin

Donald Trump is expected to issue executive orders on the first day of his presidency regarding Bitcoin and crypto

— The Washington Post

ELON MUSK BUYING RIGHTS TO TIKTOK?

Chinese officials are evaluating a potential option that involves Elon Musk acquiring the US operations of TikTok if the company fails to fend off a ban - Bloomberg thru Evan on X

Are Insurance stocks set to collapse?

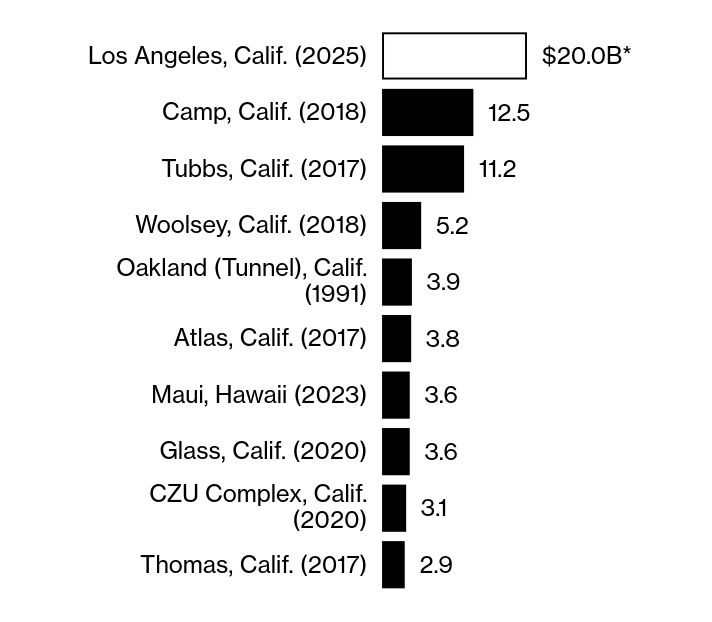

LA wildfires have officially spread over 40,000 acres with INSURANCE LOSSES crossing $20 billion. Since the market closed on Friday, ESTIMATED DAMAGES have TRIPLED to $150 billion. Insurance, power company, and other corporate bankruptcies could emerge from this. As seen with the PG&E bankruptcy in 2019 after the Camp Fire disaster, these events can create economic ripple effects. E.g many bonds will be downgraded to "Junk" rating in the near future. Could LA wildfires cause an economic ripple effect? Source: The Kobeissi Letter

Insured losses from the California wildfires are estimated to be the highest ever

Source: Markets & Mayhem

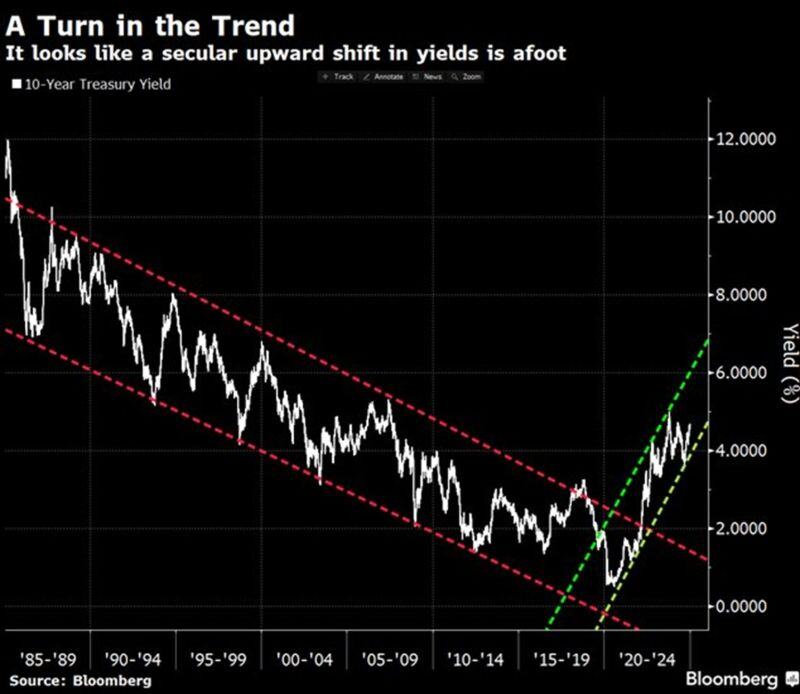

A turn in the trend? US 10-year Treasury yield has risen ~440 basis points over the last 5 years to 4.76%.

If this trend continues that will materially shift the investing landscape with many investors being caught off guard. Source. Bloomberg, Global Markets Investor

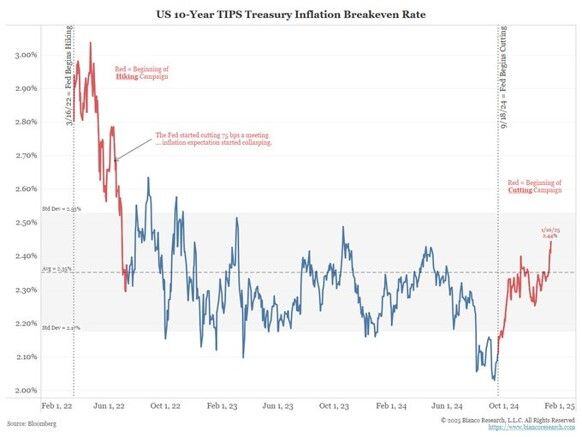

🚨 Great chart and post by James Bianco about US 10-year TIPS breakeven during inflationary time.

👉 The chart below shows the 10-year TIPS breakeven. The LEFT part of the line in RED shows the first 115 days after the Fed started HIKING in 2022. Expectations went straight DOWN. See the RIGHT part of the line in RED, the first 115 days after the Fed started CUTTING in September. Expectations are going straight UP and are at a 15-month high. 👉 Restated, the Fed hikes and inflation expectations GO DOWN. The Fed cuts and inflation expectations GO UP. This is classic "inflationary environment" behavior. 👉Markets were disappointed that the Fed did not cut enough is a previous cycle (pre-2020) reaction. This cycle (post-2020) is about dealing with inflation, and cutting is NOT dealing with inflation. Source: Bianco Research

The $TLT chart shows a significant 52% decline from its peak, highlighting the harsh effects of increasing rates.

Investing in long-duration US Treasuries is advisable only under specific circumstances: - When a recession is on the horizon. - When inflation is quickly slowing down. Currently, neither of these scenarios is unfolding. Source: Kurt S. Altrichter, CRPS® on X

Investing with intelligence

Our latest research, commentary and market outlooks