Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

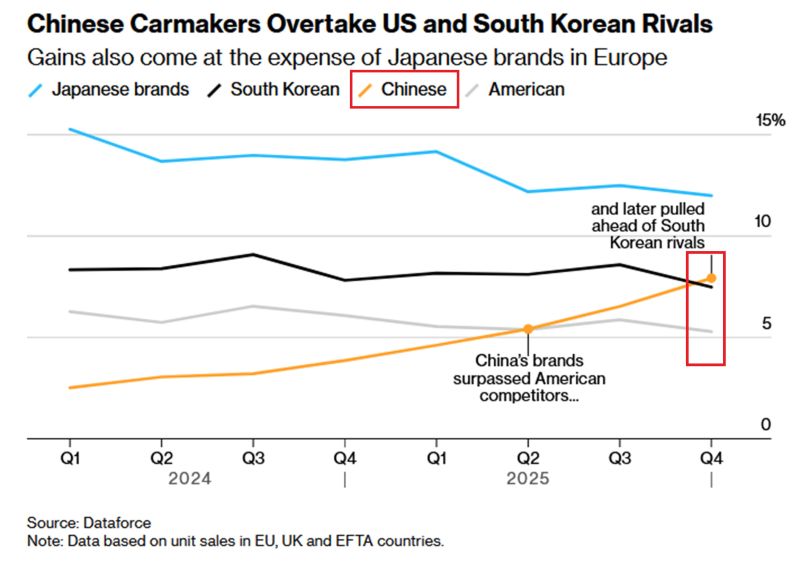

🚨Chinese carmakers are taking over Europe:

Chinese brands now represent a RECORD ~10% of all passenger cars sold in Europe. This surpassed both US and South Korean rivals for the 1st time EVER. Their EV market presence more than DOUBLED in 2025, to 11%, and hit 16% in December alone. Japanese brands remain the leaders at ~13% but at this pace China will overtake Japan as early as 2026. China is starting to dominate the global car market. Source: Global Markets Investor Bloomberg, Dataforce

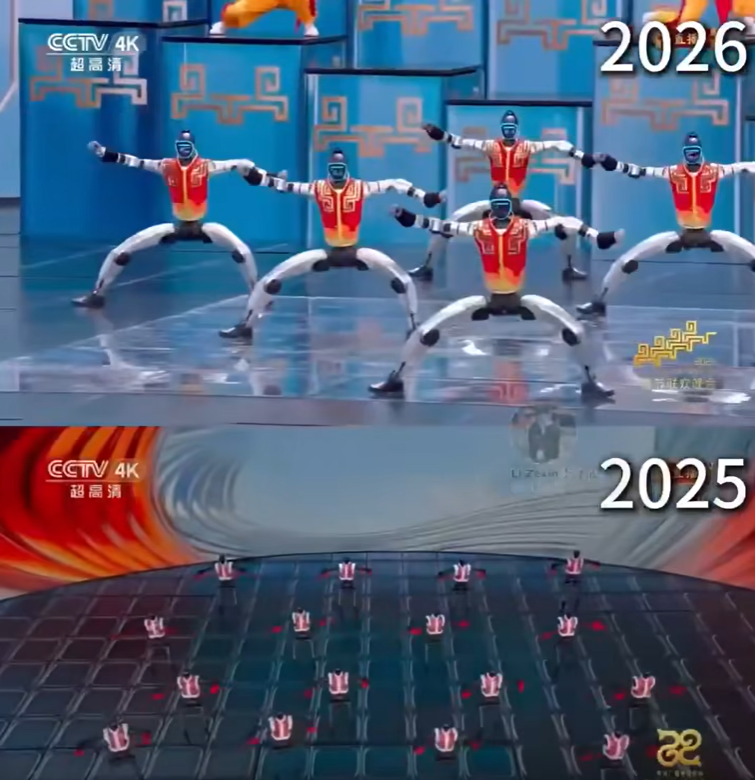

A mind-blowing robot kung fu show took place during China’s 2026 Spring Festival Gala (Lunar New Year Gala) on February 16.

It was entirely real not AI or CGI. Humanoid robots from Unitree Robotics performed synchronized martial arts routines with swords, poles, and nunchucks alongside children on live national television. Described as the world’s first fully autonomous humanoid robot kung fu performance, it highlighted major advances in balance, precision, and hardware within just 12 months. While commercialization still faces challenges like cost and reliability, the performance signals China’s rapid progress in humanoid robotics. Source: Evrim Kanbur (@WhileTravelling), Cyrus Janssen on X (@thecyrusjanssen)

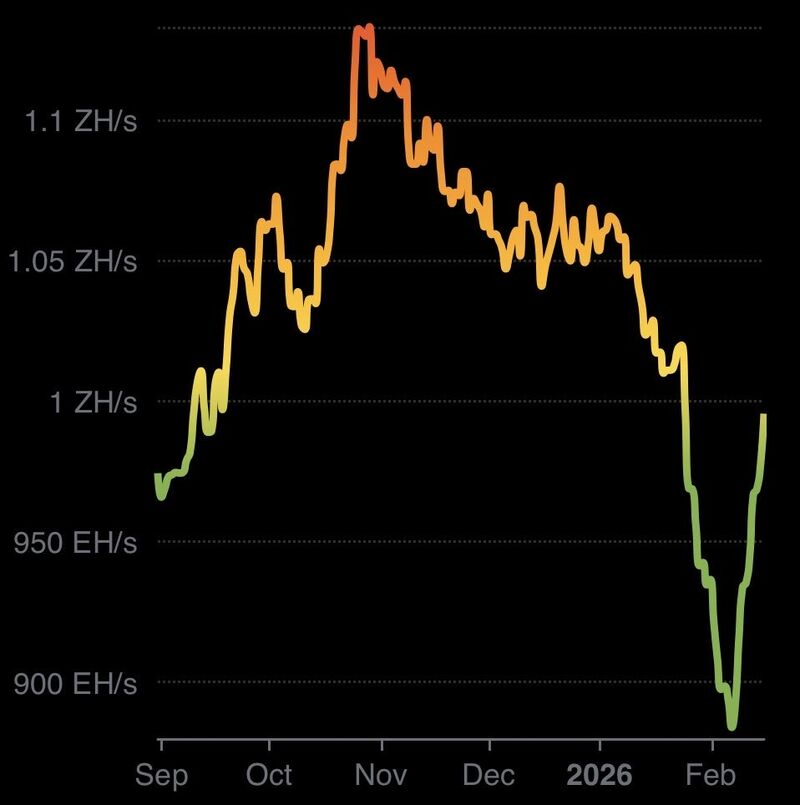

The February hashrate drop was a "perfect storm" that triggered an 11.4% downward difficulty adjustment, the largest since 2021.

Why it happened: - Texas Weather: Severe winter storms forced industrial miners to shut down to save the power grid (or sell their energy back for higher profits). - Price Correction: Bitcoin’s drop toward $60,000 made older rigs unprofitable. Some firms pivoted their hardware toward AI training for better margins. - Regulation: Renewed crackdowns on "gray" mining in Russia and China removed significant hardware from the network. The Result: The network has already begun a "V-shaped" recovery. The lower difficulty has made mining profitable again for the remaining operators, and hashrate is already bouncing back. This is actually one of the sharpest V shape recovery in hashrate we've ever seen. Source: ₿ Isaiah ⚡️ @BitcoinIsaiah

Investing with intelligence

Our latest research, commentary and market outlooks