Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

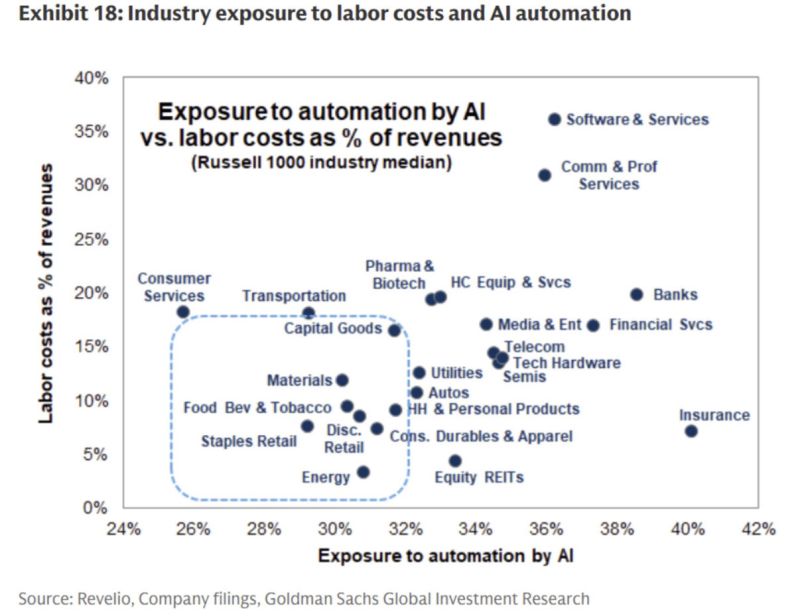

Banks and insurers might be longs as structural beneficiaries in the AI era.

Back office tasks get automated and margins improve. Software has a large opportunity to improve efficiency as well. Source: Greg @GS_CapSF

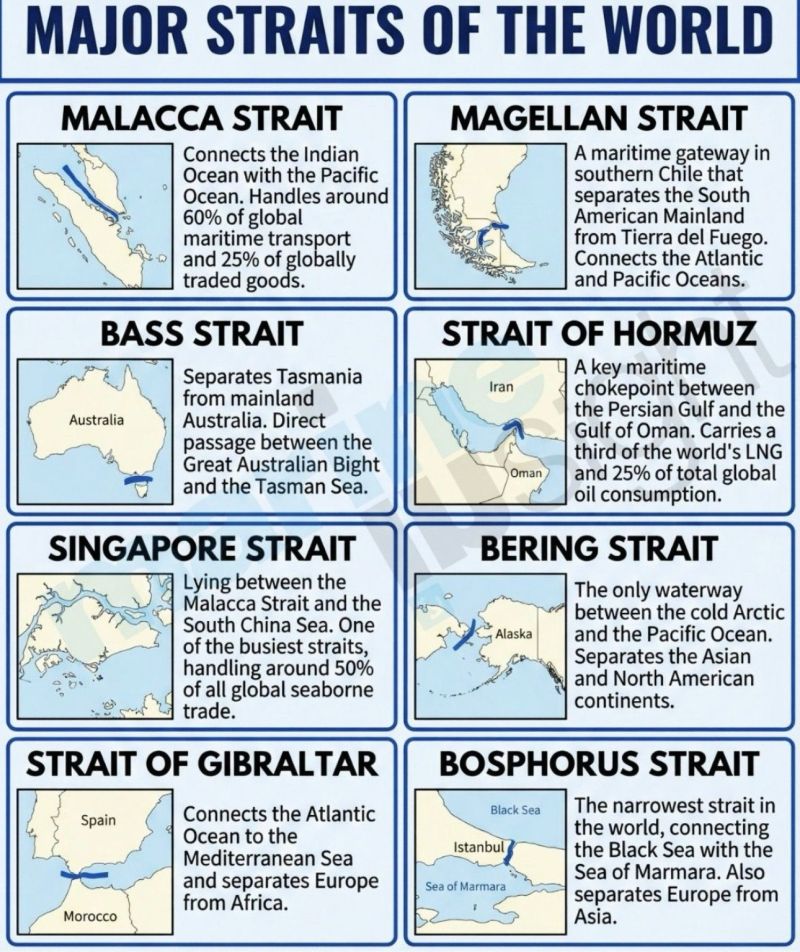

THE WORLD RUNS THROUGH 8 STRAITS

Here are the key chokepoints: • Malacca ~25% of global traded goods • Hormuz ~25% of global oil, ~⅓ of LNG • Singapore ~50% of global seaborne trade • Gibraltar Atlantic ↔ Mediterranean • Bosphorus Black Sea outlet • Magellan Atlantic ↔ Pacific backup • Bering Arctic gateway • Bass Australian passage These are pressure points. Close Hormuz... Oil spikes. Disrupt Malacca... Asia freezes. Block Bosphorus... Black Sea trade halts. Geopolitics isn’t abstract. It’s maritime geometry. Source: Jack Prandelli @jackprandelli on X

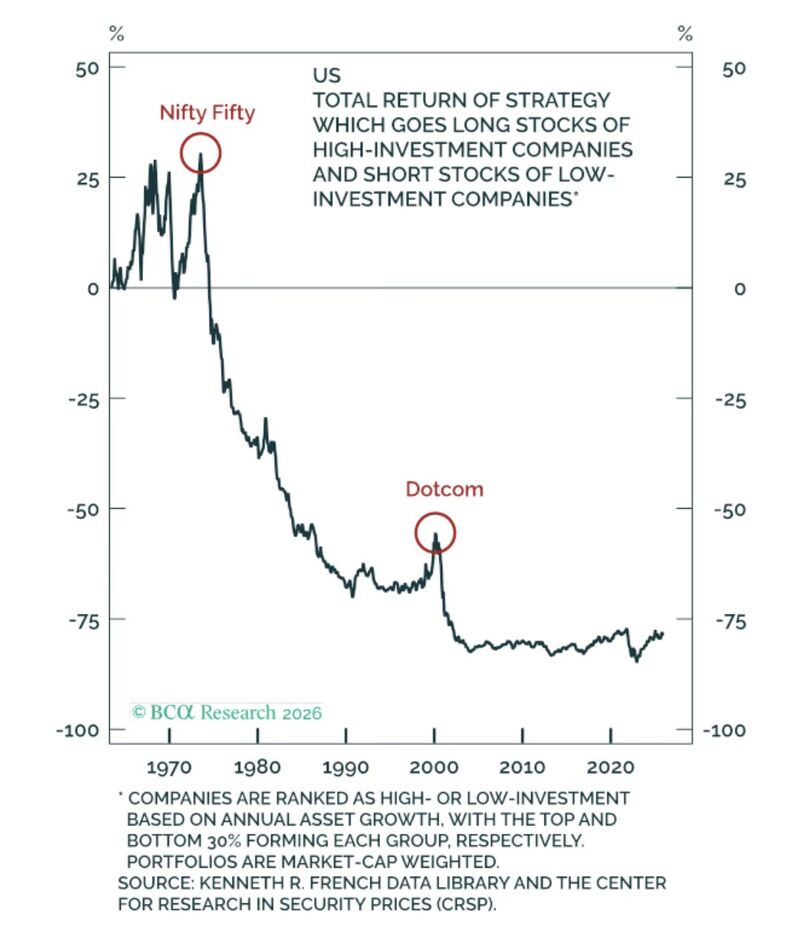

hey, capex is good. It will pay off” consider the historical record

Source: Peter Berezin @PeterBerezinBCA

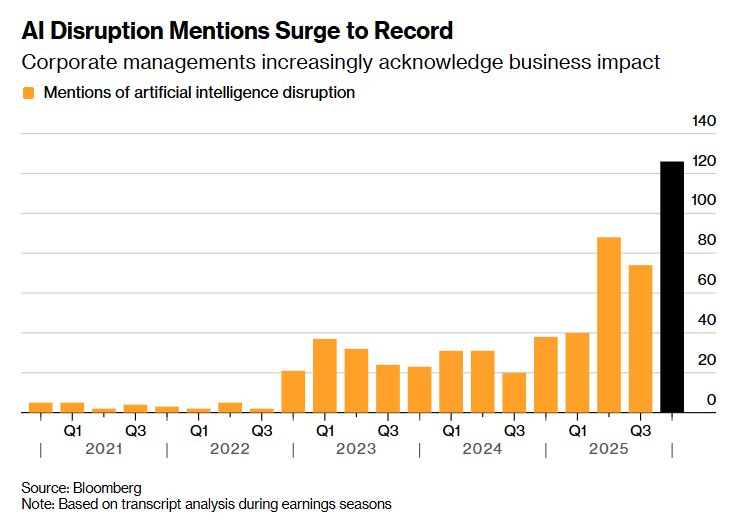

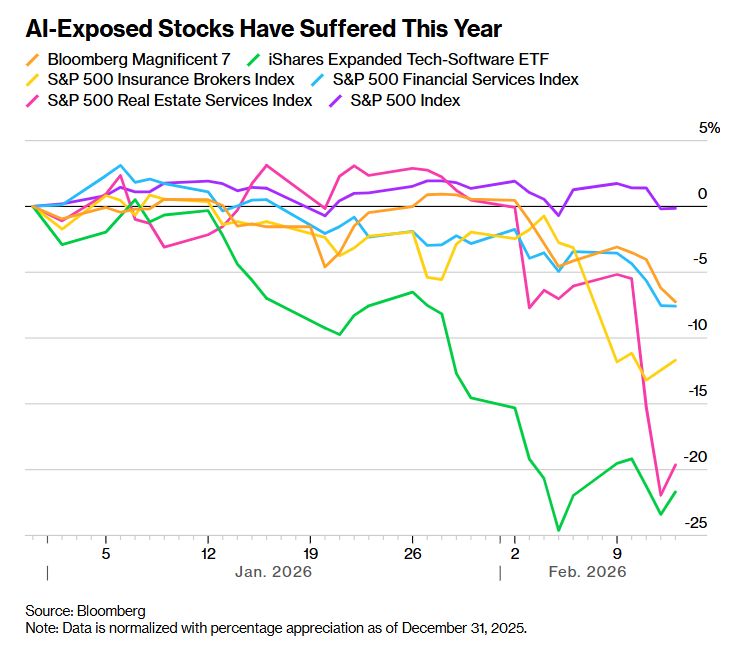

AI Risk Is Dominating Conference Calls as Investors Dump Stocks

Source: Bloomberg

A Stock Market Doom Loop Is Hitting Everything That Touche AI

Source: Bloomberg

~$9.6 trillion of U.S. marketable government debt will mature over the next 12 months, the most ever.

That’s roughly 1/3 of ALL outstanding public debt that needs to be refinanced. Most of it was originally issued when rates were near zero. Now it refinances at 4–5%. The math: even a 2% average rate increase on $9.6T = ~$192B in added annual interest costs alone. For context, net interest on U.S. debt is already on pace to exceed $1 trillion/year in 2026, more than the defense budget. The largest refinancing wall in history is here. Source: @NoLimitGains on X

Investing with intelligence

Our latest research, commentary and market outlooks