Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

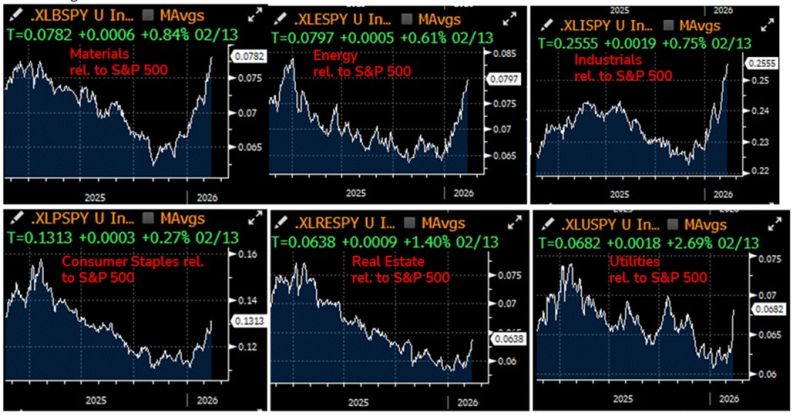

US equities market broadening in a few pics.

“Old economy” and interest-rates sensitive sectors have been outperforming lately Note there are also parts of the economy which are LESS subject to AI-disruption Source: Bloomberg, RBC

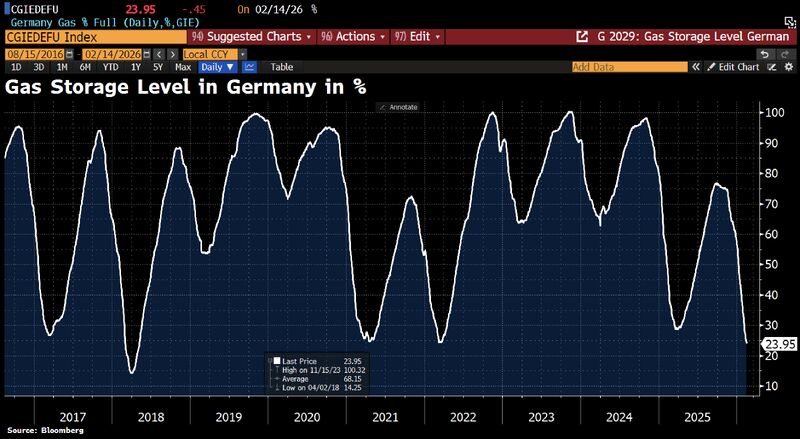

In Germany, gas storage levels have fallen below 24%

a record low for this time of year. Typically, storage levels average around 50.7% at this point. At 23.95%, inventories are also at their lowest level since May 2018. Source: Bloomberg, HolgerZ

The "Feel good story of the day".

If you invested $10,000 in Beyond Meat in 2021, today you would have $41. The stock was as fake as the meat. Source: Brew Markets @brewmarkets Wall Street Mav

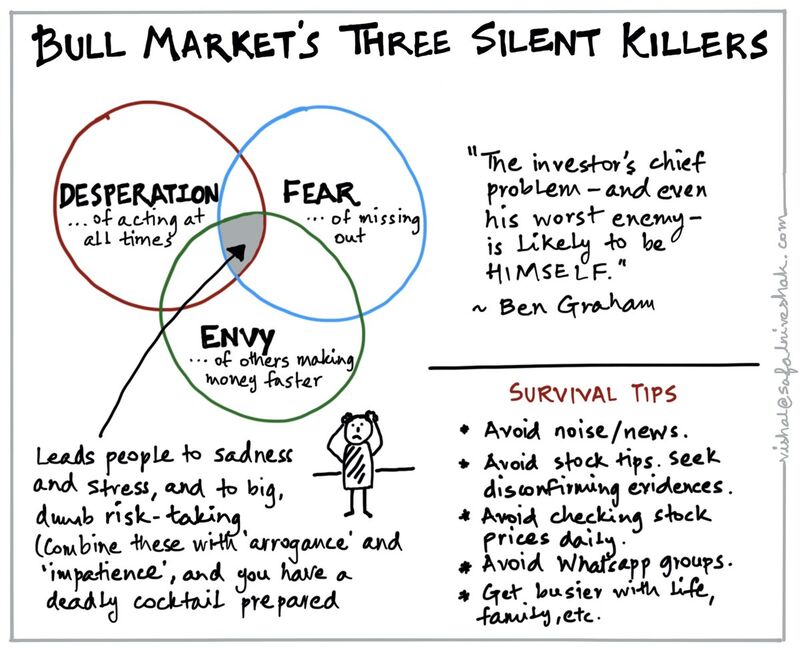

Three silent killers of bull markets.

"The investor's chief problem - and even his worst enemy - is likely to be HIMSELF" - Ben Graham Nice visual by @safalniveshak

Anthropic has raised $30bn from investors including GIC, Coatue, Founders Fund and Nvidia

reaching a $350bn pre-money valuation ahead of a potential IPO. Founded in 2021 by former OpenAI researchers, the company focuses on enterprise AI tools. About 80% of its $14bn revenue run rate comes from business clients. Its Claude Code product has gained strong adoption, with over 500 customers spending more than $1mn annually. Source: Financial Times

Over the last two days (February 11–12, 2026),CBRE Group Inc. (CBRE) stock plummeted approximately 25% to 30% from its recent all-time highs.

CBRE stock fell despite record revenue and strong core earnings due to shifting investor narratives and accounting impacts. AI disruption fears triggered multiple contraction, reducing valuation. GAAP net income declined 14.6% due to one-time pension and safety charges, creating negative headlines. Revenue slightly missed expectations, disappointing a market pricing perfection. High institutional ownership amplified technical selling through stop-loss triggers. Overall, sentiment, valuation reset, and temporary accounting effects—not business weakness—drove the sharp decline recent market reaction after earnings announcement period release. Source: CBRE Group

Investing with intelligence

Our latest research, commentary and market outlooks