Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

As highlighted by Caleb Franzen, the relative chart of SP500 / M2 money supply is trading at the exact same level as July 2007

This range also coincided with market peaks in: • Feb.'20 • Q4'21 While the S&P 500 itself has gained +181% in the past 16 years, $SPX/M2 has made no progress. Should this be seen as a logical resistance zone?

10-Year Treasury Yield is now 4.28%, the highest level since October 2007

From a total return perspective, the 10-Year Treasury Bond is now down 1% in 2023, on pace for its third consecutive negative year. With data going back to 1928, that's never happened before. Source: Charlie Bilello

Saudi Arabia reduced its US treasury holdings by $3.2 Billion in June to the lowest level in nearly 7 years.

Source: FT

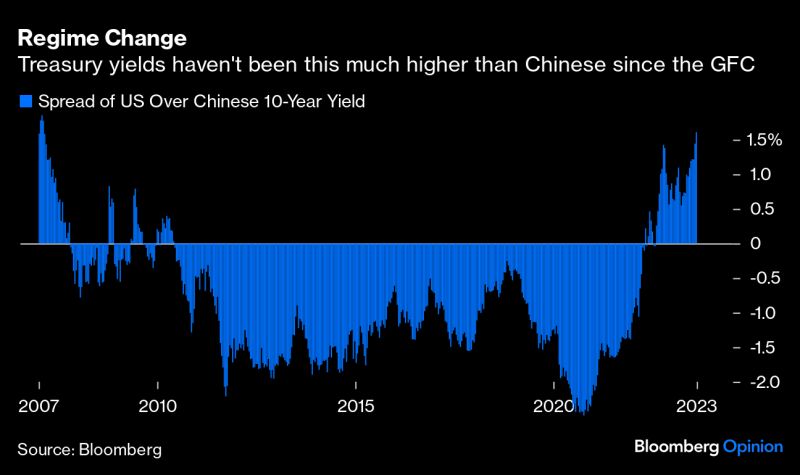

The yield gap between 10y US and Chinese government bonds is now >160bps, widest since 2007

Source: Bloomberg

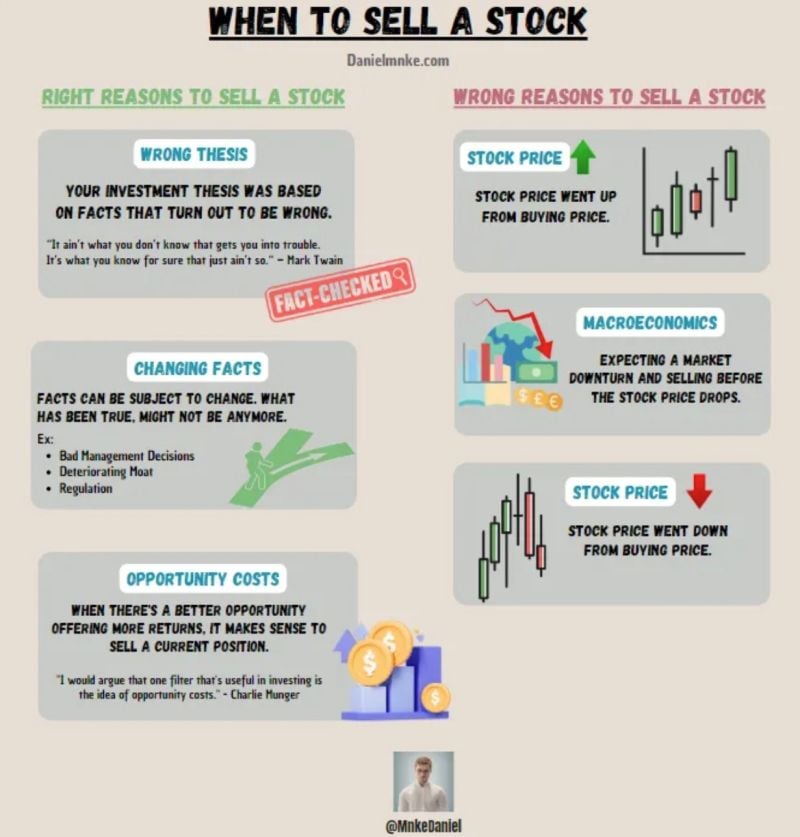

Nice infographic about the right and wrong reasons to SELL a stock

Source: Danielmnke.com

Investing with intelligence

Our latest research, commentary and market outlooks