Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US stock market current mood in one picture

Source: Heisenberg - Mr_Derivatives

Michael Burry is an outstanding contrarian investor and did exceptionally well during the 2006-2008 US housing crash

However, performance is not always repeatable and his next bets haven't paid off that well (at least the market views shared publicly - hedge fund long-term performance looks quite strong on a sharper ratio basis). Adam Khoo had a look at all of Michael Burry's recent predictions and he shared it with a chart on X. Here's a summary: In 2005, Predicted the collapse of the subprime mortgage market -> Housing market crashes in 2008, Global Financial Crisis. On Dec 2015, he predicted that the stock market would crash within the next few months. -> SPX +11% Next 12 months. On May 2017, he predicted a global financial meltdown-> SPX +19% Next 12 months. On Sept 2019, he predicted that the stock market would crash due to a bubble in index ETFs -> SPX +15% Next 12 months. Source: Adam Khoo Trader

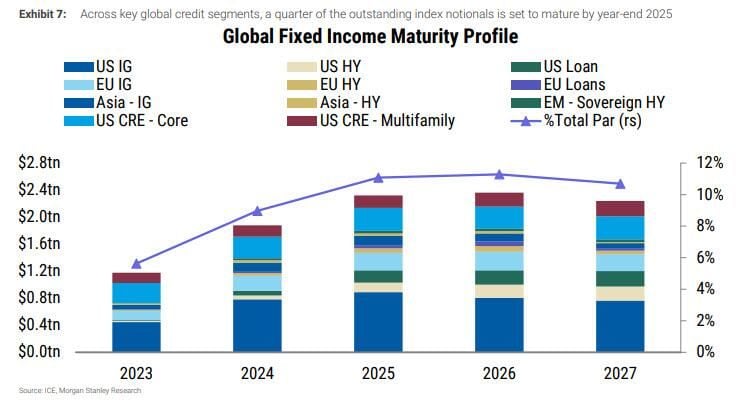

We are approaching quite a formidable global #debt maturity wall...

Source: Markets & Mayhem, Morgan Stanley

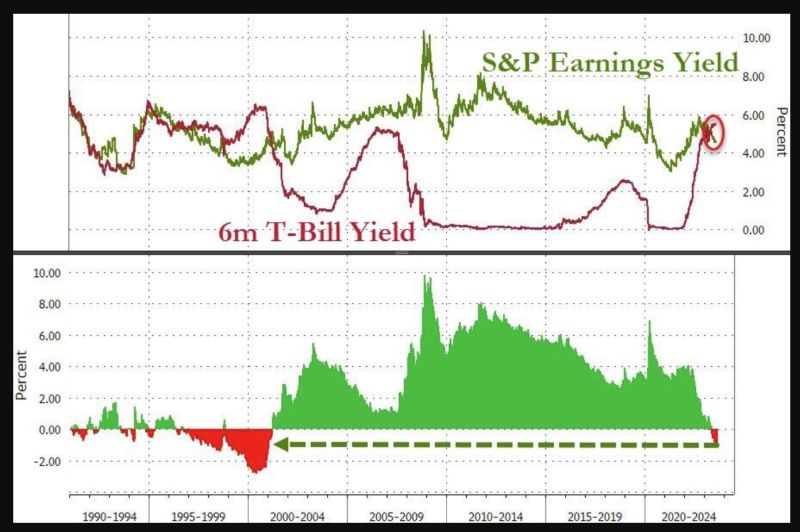

From T.I.N.A (There Is No Alternatives to Risk assets) to T.A.R.A (There Are Reasonable Alternatives)... 6-months US T-bills yield 94bps more than the S&P's earnings yield...

Source: Bloomberg

Warren Buffett's Berkshire Hathaway invested a total of $814 million in 3 home builder companies during the 2nd quarter. Those investments include D.R. Horton $DHI, Lennar $LEN, and $NVR

Warren Buffett’s Berkshire Hathaway on Monday unveiled an $814mn investment in three US housebuilders, a bet on a sector that has benefited from dearth of supply. Berkshire disclosed it had purchased 6mn shares of DR Horton, worth about $726mn at the end of the second quarter, as well as 152,572 shares in Lennar and 11,112 shares of NVR. Shares of housebuilders and companies who service the industry have rallied this year after a difficult 2022 during which higher interest rates crimped demand. However, while higher mortgage rates have cooled the pace of existing homes sales, new homes sales have remained surprisingly robust owing to the limited supply.

Investing with intelligence

Our latest research, commentary and market outlooks