Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Vietnamese EV maker VinFast is now worth more than Ford and GM after Nasdaq debut - CNBC article

VinFast’s shares jumped some 270% after its U.S. trading debut, vaulting its total market value past some of the world’s largest automakers. On Tuesday, the Vietnamese #electricvehicle maker listed on Nasdaq following the completion of its merger with the U.S.-listed #SPAC (special purpose acquisition company) Black Spade Acquisition. Shares of VinFast closed at $37.06 on Tuesday — 270% higher than Black Spade Acquisition’s IPO price of $10. Following the market debut, VinFast is now currently worth $85 billion, according to CNBC calculations. The SPAC merger previously valued VinFast at approximately $23 billion, according to a June filing with U.S. securities regulator. Source: CNBC

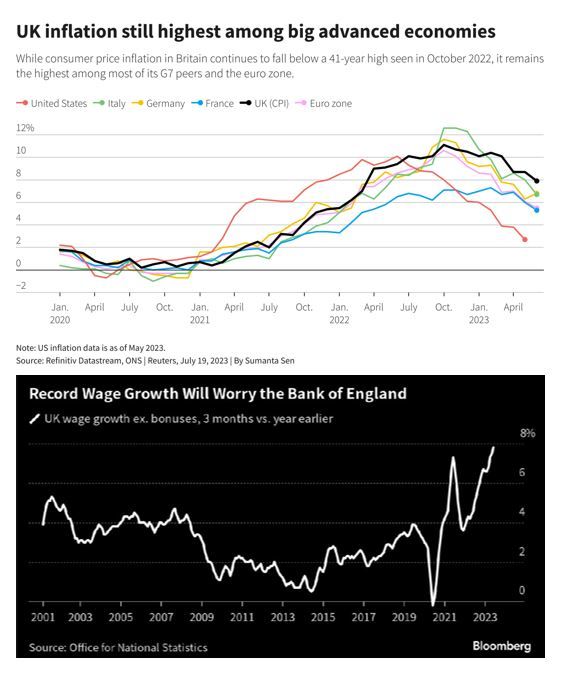

UK headline inflation cooled sharply in July to an annual 6.8%, but the core consumer price index remained unchanged, posing a potential headache for the Bank of England

The headline CPI reading was in line with a consensus forecast among economists polled by Reuters, and follows the cooler-than-expected 7.9% figure of June. Despite the decline, UK inflation is still the highest among "advanced" economies (see upper chart below). On a monthly basis, the headline CPI decreased by 0.4% versus a consensus forecast of -0.5%. However, core inflation — which excludes volatile energy, food, alcohol and tobacco prices — stayed 6.9%, unchanged from June and slightly above a consensus forecast of 6.8%.

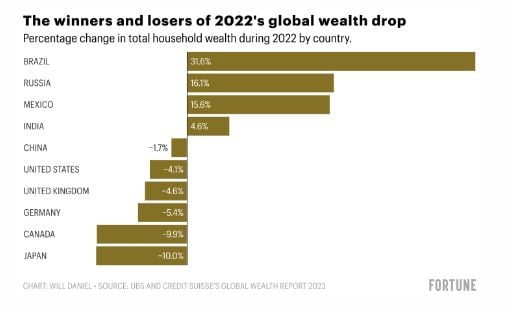

Global Wealth declined by $11.3 trillion last year, the first annual drop since the Global Financial Crisis

Here are the biggest winners and losers Source: Barchart, Fortune

China Shadow Banking Giant Alarms Investors With Missed Payments

One of China’s largest private wealth managers is triggering fresh anxiety about the health of the country’s #shadowbanking industry after missing payments on multiple high-yield products. Zhongrong International Trust Co. missed payments on dozens of products and has no immediate plan to make clients whole, indicating troubles at the embattled Chinese shadow bank are deeper than previously known. Wang Qiang, board secretary of the firm partly owned by financial giant Zhongzhi Enterprise Group Co., told investors in a meeting earlier this week that the firm missed payments on a batch of products on Aug. 8, adding to delays on at least 10 others since late July, according to people familiar with the matter. At least 30 products are now overdue and Zhongrong also halted redemptions on some short-term instruments, one of the people said. Source: bloomberg

Watchcharts Rolex and Patek second-hand indices are dropping rapidly, down -11.5% and -16.8% respctively over the last 12 months

This is an interesting smooth time series for global economy as it is independent from manipulation and less prone to day-to-day shift in sentiment. Source: www.watchcharts.com

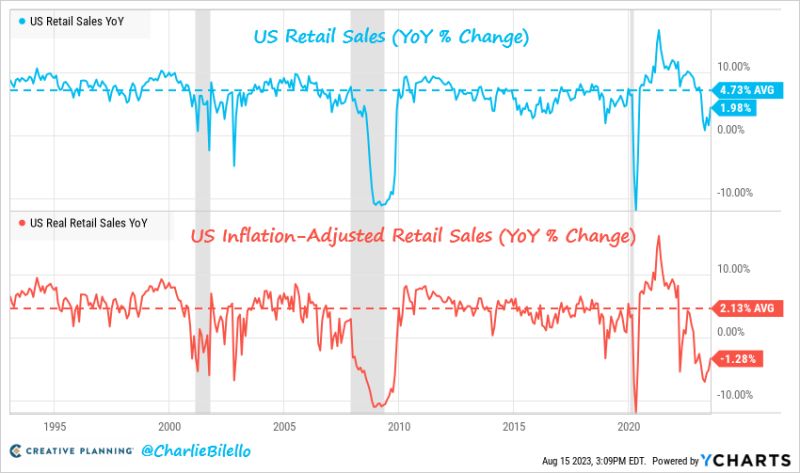

After adjusting for inflation, US retail sales fell 1.3% over the last year, the 9th consecutive YoY decline

That's the longest down streak since 2009. Nominal retail sales increased 2% YoY vs. a historical average of 4.7%. Source: Charlie Bilello

Hedge funds top 5 holdings Q2 2023

Recurring #themes: Hyperscalers $AMZN $GOOG $MSFT Semiconductor $AMD $NVDA $TSM Consumer tech $AAPL $TSLA Specialty Retail $BBWI $RH Global apps $META $NFLX Payments $MELI $V Source: App Economy Insights

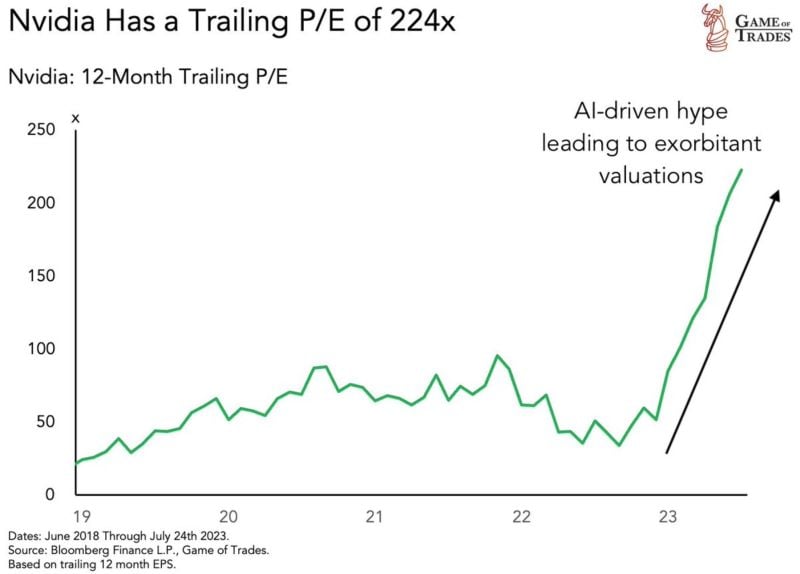

The AI-hype has driven some stocks valuations to extreme levels

The most emblematic one among large-caps is Nvidia with a P/E ratio which went from under 50x to 224x in just 8 months. Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks