Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

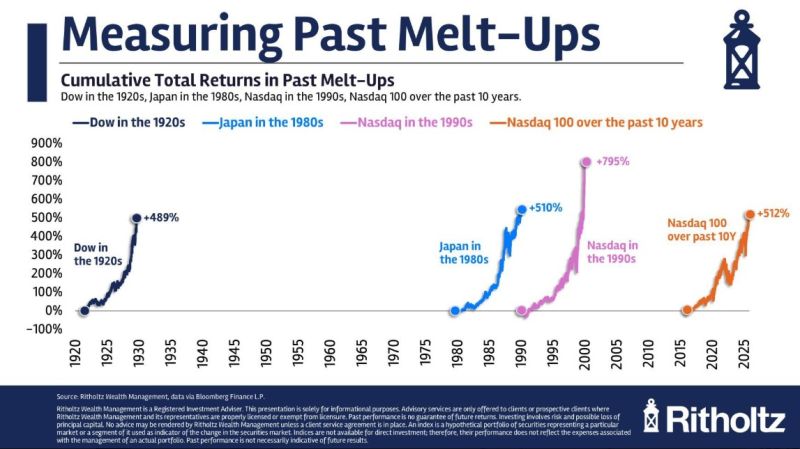

The Melt-Up

"However you measure it, tech stocks are on an all-time heater. This is one of the great bull markets we’ve ever witnessed. So now what? Source: Ritholtz @RitholtzWealth

The total value of the US stock market is now ~245% of the country’s GDP – far above the 100% level that Warren Buffett considers a sign of a market bubble.

Source: HolgerZ, Bloomberg

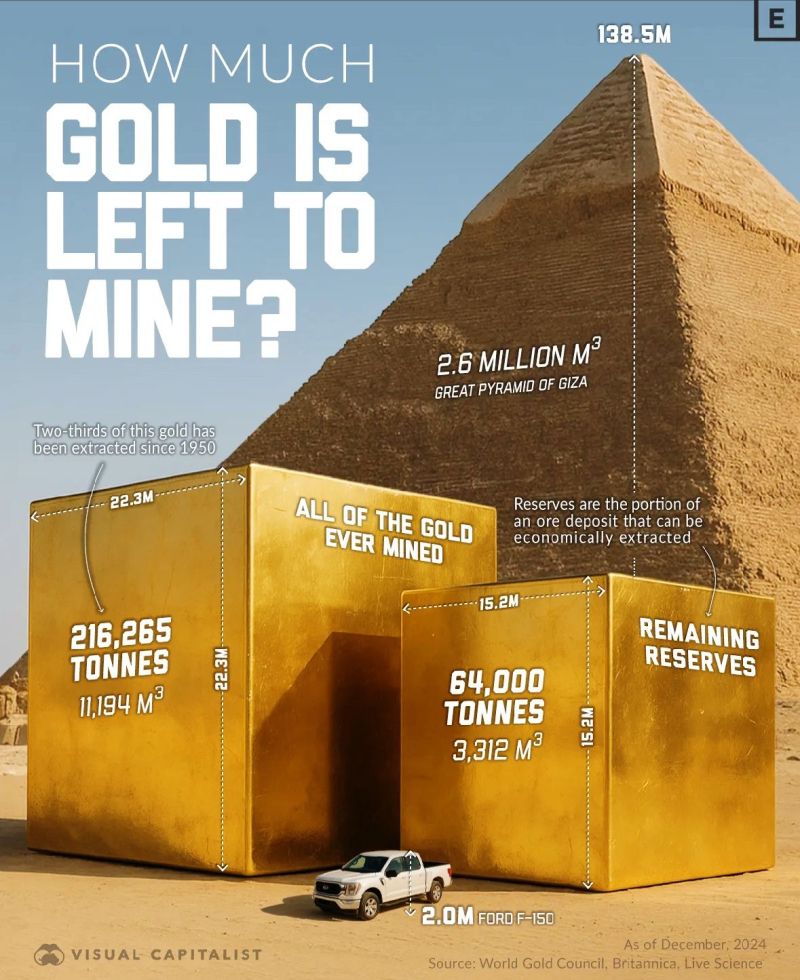

💰 How Much Gold Is Left to Mine?

To visualize: • 🟨 All the gold ever mined would fit inside a cube just 22.3 meters wide — smaller than the Great Pyramid of Giza. • 🟨 Remaining reserves would form a cube of 15.2 meters per side. • ⛏️ Two-thirds of all gold in human history has been extracted since 1950, a period of accelerated mining and financialization. 📊 Source: World Gold Council, Britannica, Live Science Source: INVEST

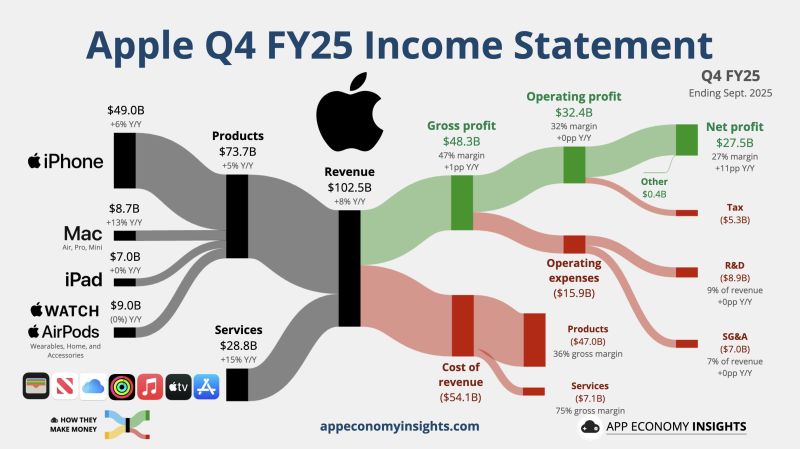

APPLE $AAPL JUST REPORTED EARNINGS EPS of $1.85 beating expectations of $1.75

Revenue of $102.5B beating expectations of $101.8B🟢 Stock is up 5% in after hours 🚀 The company's chief financial officer said Apple expects total company revenue to grow 10 to 12% year over year in the three months to December, with iPhone revenue growing double digits $AAPL Apple Q4 FY25 (Sept. quarter): 💳 Services +15% Y/Y to $28.8B. 📱 Products +5% Y/Y to $73.7B. • Revenue +8% Y/Y to $102.5B ($0.2B beat). • Operating margin 32% (+0.5pp Y/Y). • EPS $1.85 ($0.08 beat). Source: App Economy Insights @EconomyApp

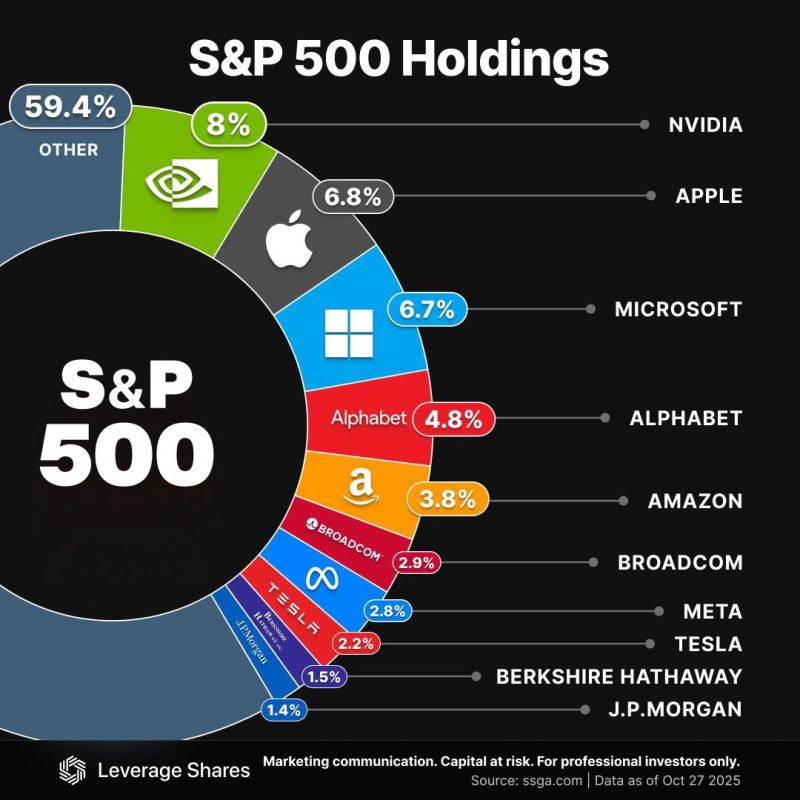

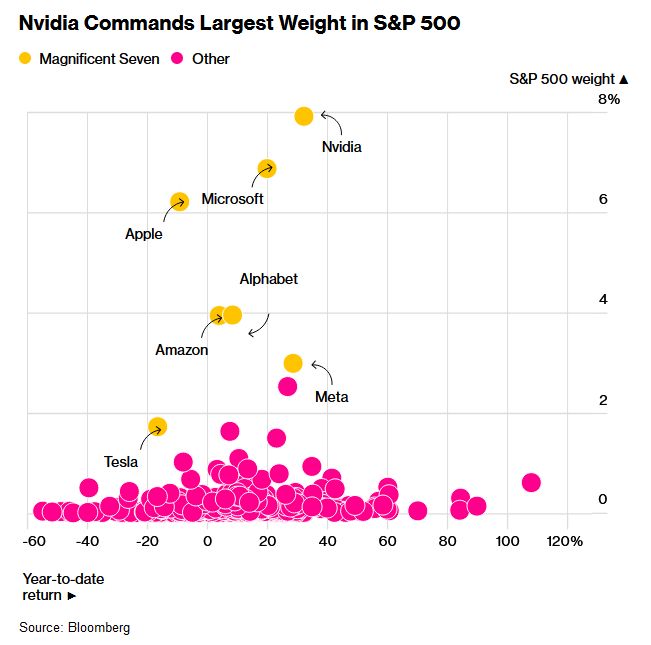

🚨 Such concentration has almost NEVER happened:

NVIDIA accounts for 8% of the S&P 500's market cap, the highest for any company in history. Microsoft’s and Apple’s shares are 6.5% and 6.0%, respectively. The top 10 companies represent a record 40% of the index's total value. Source: Global Markets Investor

In case you missed it... Soybeans jump to highest price since July 2024 📈📈

Source: Barchart

Samsung bets big on AI 🇰🇷 Korean tech giant

Samsung just announced plans to buy and deploy 50,000 Nvidia GPUs — a massive move aimed at supercharging its chip manufacturing for mobile devices and robotics. 💡 The partnership is another win for Nvidia, whose GPUs remain the gold standard for building and deploying advanced AI systems. 🔧 Samsung also confirmed it’s working with Nvidia to optimize its 4th-gen HBM (High Bandwidth Memory) for next-generation AI chips — a move that could reshape the global AI hardware landscape. 👉 The AI arms race just got another heavyweight upgrade.

Investing with intelligence

Our latest research, commentary and market outlooks