Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

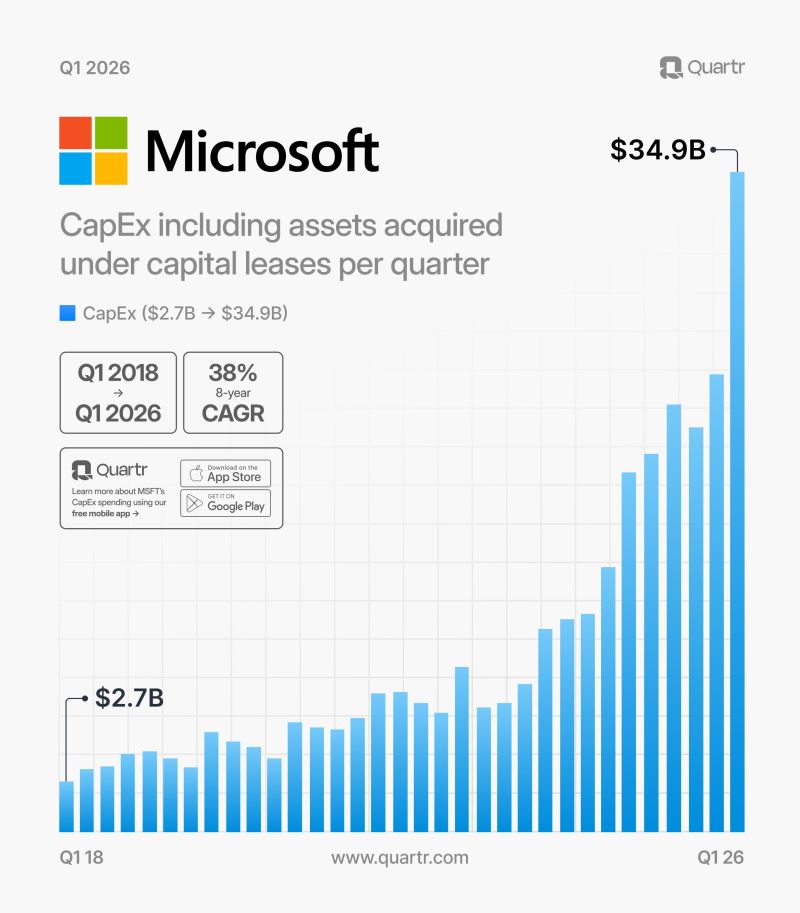

In Q1 2026, Microsoft $MSFT's CapEx totaled $35B, up 44% QoQ

That brings Last Twelve Months (LTM) CapEx to over $100B. Source: Quartr

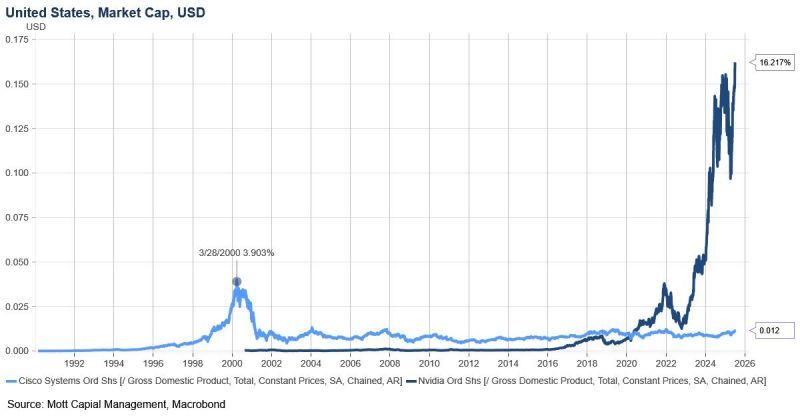

Cisco peaked at 4% of U.S. GDP.

Nvidia is currently 16% of U.S. GDP. Source: Spencer Hakimian @SpencerHakimian

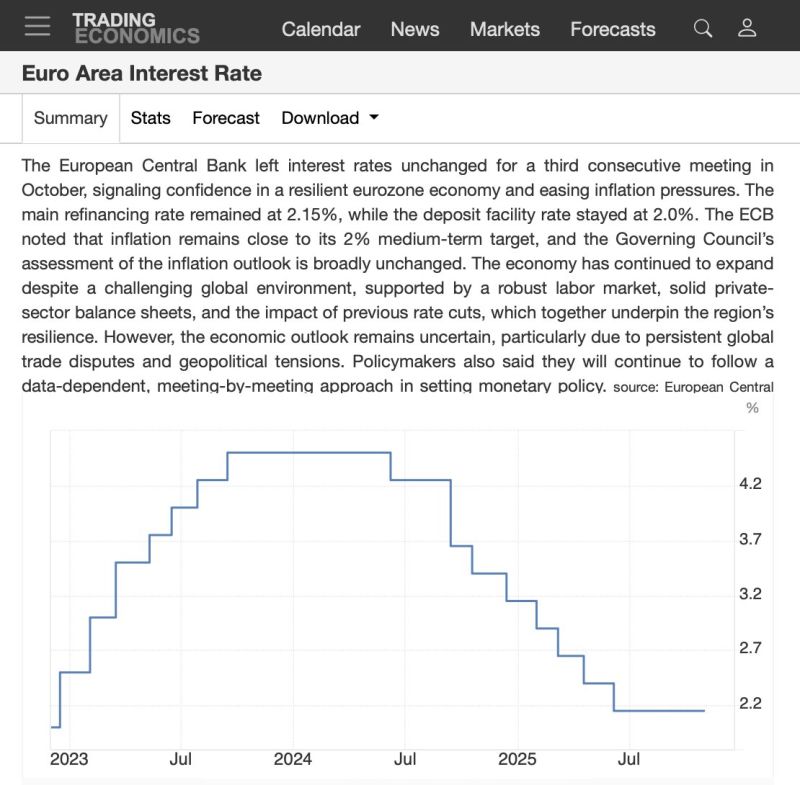

🚨 ECB hits pause again as economy shows resilience

The European Central Bank kept rates on hold at 2% for the third straight meeting. 💶 Inflation is right on target at 2% 📉 Rates down from last year’s 4% peak 💪 Growth still holding up The ECB says Europe’s economy is proving resilient — supported by strong labor markets and healthy private balance sheets. But beneath the calm? ⚠️ Uncertainty from global trade tensions and geopolitics still clouds the outlook.

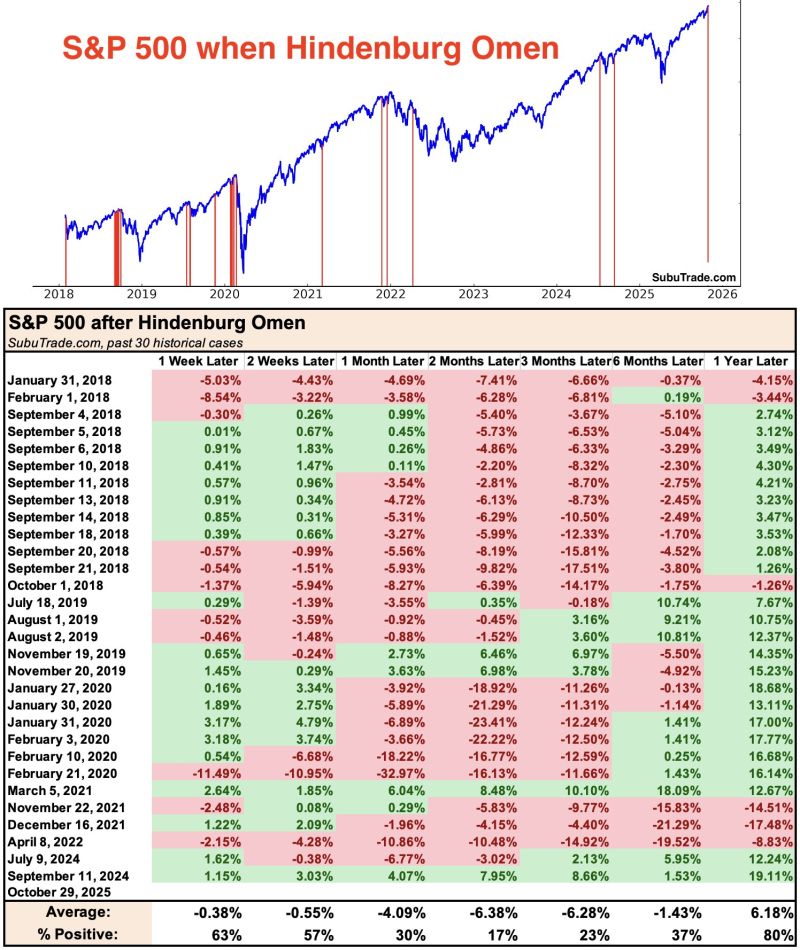

😨 Weak breadth: a Hindenburg Omen was triggered yesterday 🚨

The past 30 times this happened, $SPX fell 83% of the time 2 months later ➡️ What is a Hindenburg Omen ??? The Hindenburg Omen is a technical analysis signal that’s often cited as a warning of a potential stock market crash or major correction. It’s named (dramatically) after the Hindenburg airship disaster, implying that markets might be headed for a similar fiery fate when the signal appears. Here’s what it actually means 👇 ⚙️ The Mechanics The Hindenburg Omen triggers when a specific combination of conditions occur on the New York Stock Exchange (NYSE): 1. A large number of stocks hit new 52-week highs and a large number hit new 52-week lows — on the same day. 2. The number of new highs and new lows both represent more than 2.2% of all issues traded. 3. The NYSE composite index is above its level from 50 trading days ago (i.e., the market is still in an uptrend). 4. Market breadth (the McClellan Oscillator) is negative. 💡 What It Signals - This combo suggests internal conflict in the market — investors are both euphoric (driving some stocks to new highs) and fearful (dumping others to new lows). - That kind of divergence often happens before major turning points — when optimism and fear coexist uneasily. ⚠️ The Catch - It’s not a guaranteed crash predictor. - Historically, it’s produced lots of false alarms, but most major market crashes (like 2008) were preceded by one. So, think of it as a “storm warning” — not a crash forecast. When it flashes, investors tend to watch liquidity, breadth, and credit spreads much more closely. Source: Subu Trade: h/t @McClellanOsc

For 35 minutes, today’s FOMC meeting was painfully boring

The Fed cut rates ✅ Ended QT ✅ A few dissenters ✅ Markets? Totally unfazed. S&P flat. Yields steady. Commodities and crypto asleep. And then — 2:35 PM. Powell drops one line that flips everything: “December cut is not for sure, far from it.” Boom 💥 Rate-cut odds crash from 95% → 65% in minutes. Stocks wobble. Yields jump. Traders scramble. Moral of the story? In markets, boredom never lasts long — and one sentence from the Fed can move trillions.

THE FED WILL END QT ON DECEMBER 1ST

Moving from restrictive → supportive balance sheet policy. This is not QE, but it is definitely a positive development that provides a mild liquidity tailwind for markets. Source: Joe Consorti @JoeConsorti

Very important read-through of yesterday's mega cap tech earnings ➡️

Hyperscaler CapEx remains sky-high: • $GOOGL: FY $91–93B (vs $85B est) • $MSFT: Q1 $34.9B (vs $30B est) • $META: Expects higher CapEx in 2026 Note that Google raises 2025 Capex for the second time this year: “With the growth across our business and demand from Cloud customers, we now expect 2025 capital expenditures to be in a range of $91 billion to $93 billion." BULLISH 🚀 Source: Investing visuals @InvestingVisual Michael Horner @michaelbhorner

BREAKING 🚨 Trump–Xi Meeting: Big Moves, Bigger Signals

Fresh headlines from the Trump–Xi summit 👇 🇺🇸🤝🇨🇳 Key outcomes: - US & China will collaborate on Ukraine. - Trump to visit China (April 2026) — Xi to visit the US soon. - China to restart soybean purchases and resume rare earth exports. - Ongoing talks on Nvidia chip restrictions. - Tariffs cut: overall from 57% → 47%. - Fentanyl tariffs slashed to 10%, with a joint pledge to curb its spread. 💬 Takeaway: this marks a real thaw in U.S.–China relations — trade, tech, and geopolitics could all shift from confrontation → cautious cooperation.

Investing with intelligence

Our latest research, commentary and market outlooks