Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Three nations control the global fleet - Greece in 1st place

Source: Voronoi app by Visual Capitalist

OpenAI deals this year (@KobeissiLetter)

• Stargate $500 billion • Nvidia $100 billion • AMD $100 billion • AWS $38 billion • Intel $25 billion • TSMC $20 billion • Microsoft $13 billion • Broadcom $10 billion • Oracle $10 billion ➡️ Total Value: $816 billion Source: Morning Brew ☕️@MorningBrew

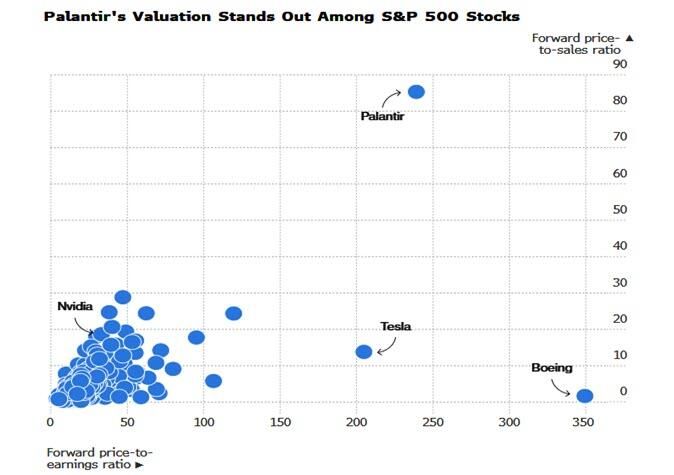

PALANTIR $PLTR Q3 EARNINGS ARE OUT, 2X BEAT

🟢 EPS: $0.21 vs. $0.15 expected 🟢 REVENUE: $1.18B vs. $1.09B expected PALANTIR Q3 2025 EARNINGS: - $1.18B revenue, +63% YoY - $883M U.S. revenue, +77% YoY - $397M U.S. commercial revenue, +121% YoY - $486M U.S. government revenue, +52% YoY - GAAP net income $476M, 40% margin - Rule of 40 at 114% - $6.4B in cash CEO Alex Karp: "Some of our detractors have been left in a kind of deranged and self-destructive befuddlement. This remains the beginning, the first moment of a first chapter." $PLTR IS UP +4% IMMEDIATELY AFTER-HOURS Source: amit

BREAKING: The Big Short is back…

Michael Burry’s 13F shows he’s betting heavily against AI favorites 66% of his entire portfolio is in $PLTR puts, and another 13.5% is in Nvidia $NVDA puts That’s nearly 80% of Scion Asset Management betting against two of the biggest names in AI Source: Stocktwits on X

BREAKING: U.S. Banks

FED just did it again! Another $24 Billion injection into the U.S. Banking system Make that $125 Billion over the last 5 days Source: zerohedge

We need $BTC to announce a strategic partnership with OpenAI ASAP.

Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks