Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US Manufacturing Recession:

The ISM Manufacturing Index fell to 48.7 in October, marking the 8th STRAIGHT month of contraction. The US manufacturing sector has been in recession for 34 of the last 36 months. Backlogs of orders have been contracting for 3 years STRAIGHT. Source: Global Markets Investor @GlobalMktObserv

Lots of questions on the back of the recent stress we have been seeing in markets over the last few sessions

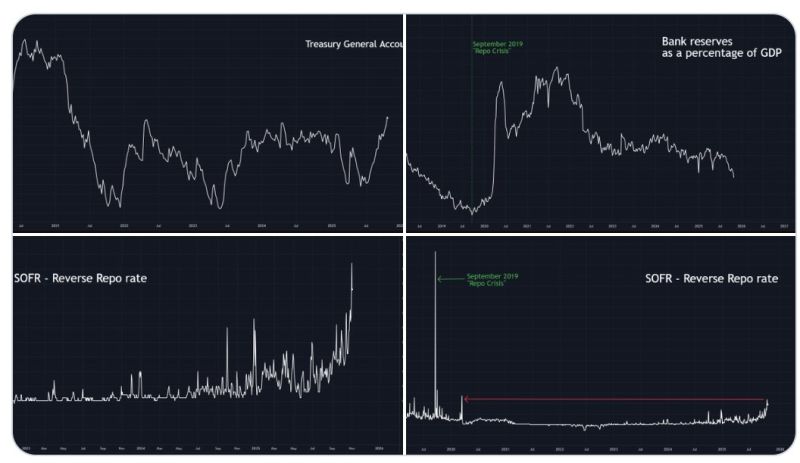

💥 Is there a banking crisis? Nope. 💵 A dollar funding crisis? Not really — at least, not yet. 🏦 Is the Fed secretly doing QE again? Also no. So… what’s actually going on? Here’s the real story 👇 After the U.S. government raised the debt ceiling in June, it started rebuilding its Treasury General Account (TGA) — basically Uncle Sam’s checking account at the Federal Reserve. The target? $850 billion. When money flows into that account, it’s pulled out of the financial system. Think of it as a liquidity drain — cash that could’ve been circulating in markets is now just… sitting there. 💧 Roughly $700 billion has been drained so far. And when that happens, bank reserves fall — which is exactly what we’re seeing today. Reserves are now sitting near multi-year lows (as a % of GDP). Less liquidity = more pressure in dollar funding markets. We can actually see that stress: ➡️ SOFR (the Secured Overnight Financing Rate — basically what banks pay to borrow short-term dollars) has ticked higher. Is it panic time? Not really. The current move is small compared to the September 2019 Repo Crisis, when the entire funding market froze and the Fed had to pivot hard from QT to QE overnight. So no, there’s no crisis — but there is a tightening squeeze in the plumbing of the financial system. Source: Tomas @TomasOnMarkets

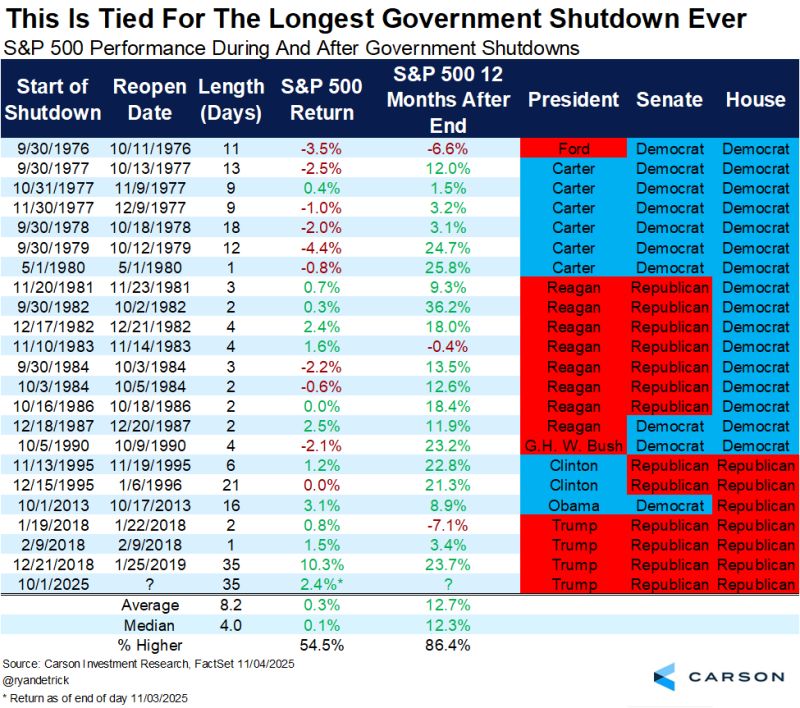

Yesterday was day 35 of the government shutdown, tying it for the longest ever.

Source: Ryan Detrick

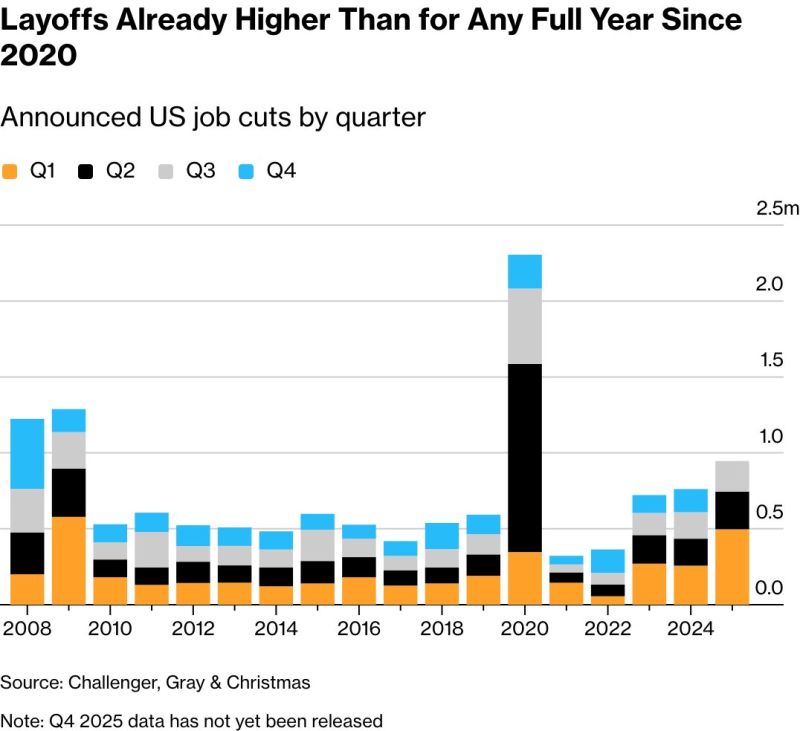

🦔 Layoffs are back — and they’re bigger than you think.

Through September, U.S. companies cut nearly 950,000 jobs — the highest year-to-date total since 2020 and worse than any full year since the Great Recession (excluding COVID). October alone brought headlines: 💻 Amazon – 14,000 corporate roles gone (AI cited as a factor) 🏪 Target – 1,800 jobs cut ☕ Starbucks – 900 employees laid off 🎬 Paramount – 1,000 roles eliminated Even Southwest Airlines announced its first major layoffs ever. Government jobs made up ~300,000 of those cuts, but tech and retail are taking the brunt. “We’re not just in a low hire, low fire environment anymore. We’re firing.” – Dan North, Allianz Trade The new pattern? AI is accelerating restructuring. 60%+ of executives on LinkedIn say AI will replace entry-level tasks. Companies are trimming labor to protect profits amid tariffs and cost pressures. Job security is no longer guaranteed — even in stable sectors. Source: zerohedge, Bloomberg

🔥 “We’ve entered the AI virtuous cycle.” — Jensen Huang, CEO of NVIDIA (CNBC)

At the APEC CEO Summit in South Korea, Jensen Huang painted a powerful picture of what’s happening in AI right now — and why growth might only accelerate from here. He explained it simply: “The AIs get better. More people use it. More people use it — it makes more profit. More profit creates more factories. More factories create better AIs. And the cycle repeats.” That’s the AI virtuous cycle — a self-reinforcing loop driving innovation, usage, and investment at record speed. 💡 The result? Smarter models → More adoption → Bigger profits → Massive infrastructure buildouts → Even smarter models. It’s not just hype, it’s momentum. Big Tech is pouring billions into AI infrastructure, fueling this cycle and redefining how fast industries evolve. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks