Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

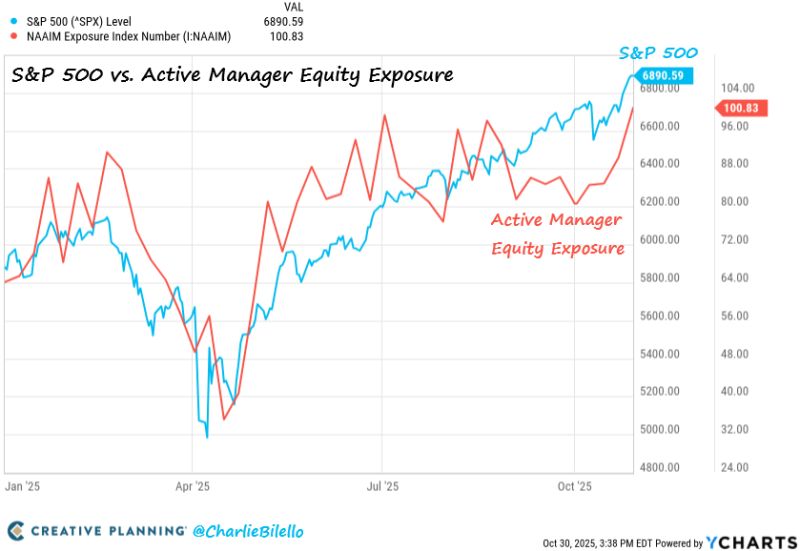

Active Managers are leveraged long equities (>100% exposure) for the first time since July 2024.

Back then, we saw a 10% correction in the S&P 500. $SPX Source: Charlie Bilello

"You have a choice. Either get replaced by AI, or learn how to use it and become 10x more productive"

"Stop thinking of your job as 1 big thing. Instead, think of your job as a bundle of tasks" "In the future, managing robots will be more important than managing humans" "GPT is the new MBA" Source: @Uncle Shaan on X

Michael Burry's hedge fund has 80% of it's $1.38B portfolio on Nvidia & Palantir puts

Can't wait for The Big Short 2 Source: Wall Street Memes on X

Advanced Micro Devices $AMD fell after beating earnings expectations and guiding above expectations.

Tough market! Source. Barchart

🚨 Breaking: New York City just made history.

Zohran Mamdani — a democratic socialist who built his campaign around the rising cost of living — has been elected Mayor of New York City. Across the U.S., Democrats swept major elections in a stunning rebuke to Donald Trump and his Republican Party. From New Jersey to Virginia, the message from voters was clear: economic frustration is real, and leadership that listens matters. This election wasn’t just about politics. It was about people feeling squeezed, families struggling, and voters demanding change. With one year until the next midterms, Democrats suddenly have momentum — and Trump has a warning sign flashing bright red. In the words of political analyst Charlie Cook: “There are just a lot of voters of all different shapes, sizes and colours, who are ticked off by Trump.” 1 million New Yorkers just voted for a radical shift — in the city that symbolizes global capitalism itself. Source: FT

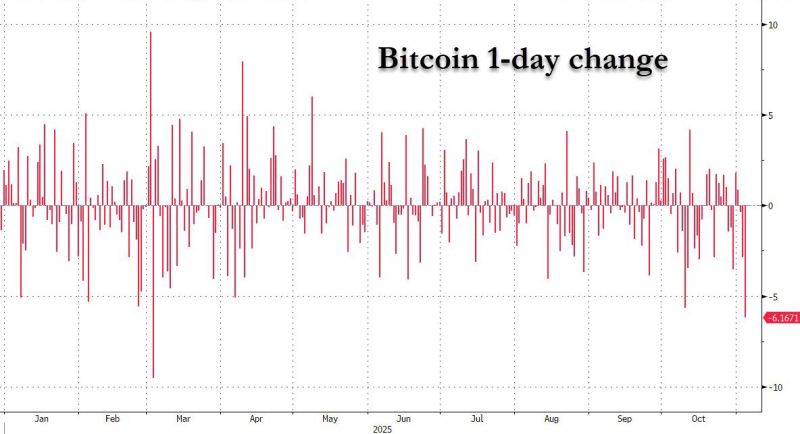

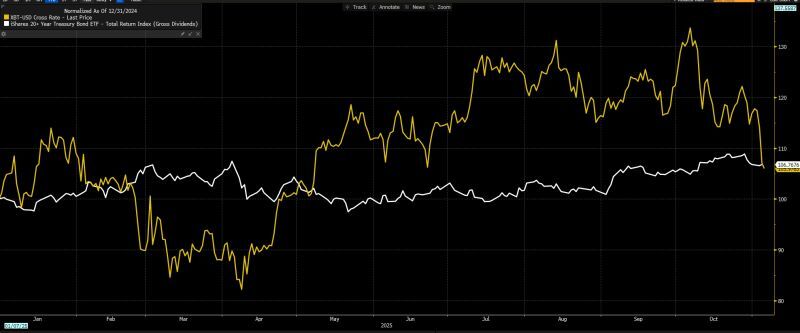

Bitcoin has now performed worse than US Treasuries in 2025

Source: Joe Weisenthal @TheStalwart

Investing with intelligence

Our latest research, commentary and market outlooks