Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

$7,000,000,000,000 sitting in money markets.

As rates come down that $7T will go somewhere. Where? • Gold • Bitcoin • Real Estate • Stocks Source: Grant Cardone

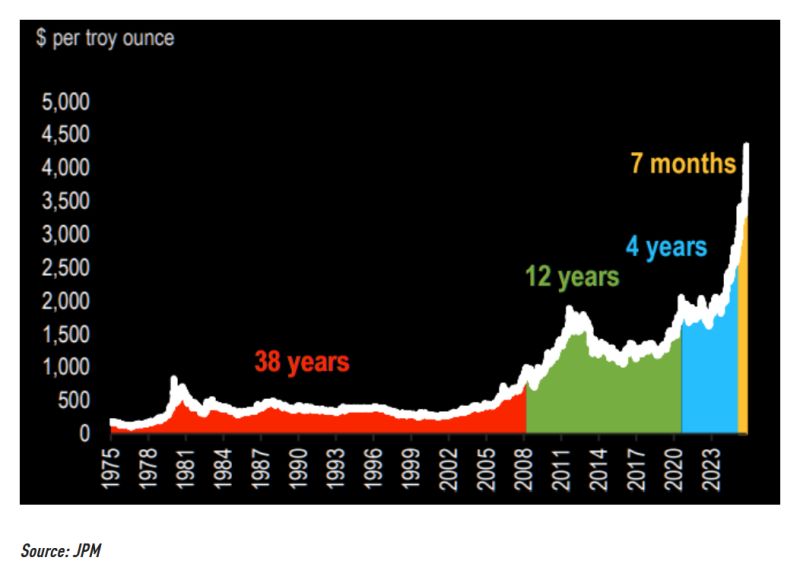

JP Morgan: “After taking 12 years to double from $1,000 to $2,000 (2008–2020), gold doubled again in just 5 years, crossing $4,000 this month.

The move from $3,000 to $4,000 took ~200 days — and from $3,300 to $4,300 only ~60.” Source: The Market Ear, JPM

$500 billion dollars of annual trade is being paused because of a $75,000 commercial?

Source: Spencer Hakimian @SpencerHakimian

Yesterday we saw another $3 billion FED pump into the banking system.

The use of the facility is now a daily occurrence; the regional banking sector obviously has a liquidity issue. That's a total of $21 billion in 4 weeks. Source: The Great Martin on X

🚨 Is Quantitative Tightening (QT) about to end?

GoldmanSachs, JPMorgan, and BofA now see the Fed flipping course as liquidity gets dangerously tight. 💧 Bank reserves have dropped below $3 trillion again, a critical threshold for financial stability. 🏦 The reverse repo balance, which acted as a key liquidity buffer for the past 4 years, is now basically zero. That’s a big deal. With more Treasury bill settlements coming — and no reverse repo cushion left — the Fed may soon have no choice but to end QT and pivot back toward liquidity support. Both Goldman and JPMorgan have moved up their forecasts: they now expect the Fed to halt balance sheet runoff this month, well ahead of earlier expectations. Why? Because dollar funding costs are rising, and the system is flashing early signs of liquidity stress. 🧩 QT may have done its job. Now the Fed’s next move could be about stabilizing, not draining. Source: www.zerohedge.com

Big Move in AI + Mobility!

On Thursday, $NVIDIA dropped a game-changing announcement — it’s partnering with Uber Technologies to push the frontier of autonomous driving. Here’s what’s exciting 👇 🚗 Uber brings massive real-world driving data from millions of trips. 🧠 NVIDIA brings its Cosmos World foundational model — built to power self-driving intelligence. ⚡ Development will run on NVIDIA DGX Cloud, supercharging the entire training pipeline. The market noticed: Uber’s stock jumped after the news, as investors saw this as a strong move to cement Uber’s edge in next-gen transportation tech..

Don't tell your favorite bear, but November is the best month for stocks since 1950

It is the second best month the past 20 years, best month the past decade, and third best in a post-election year. Source: Ryan Detrick, CMT @RyanDetrick

Finally some US data... And it might please the markets... The September CPI was indeed softer than expected.

CPI MoM: 0.3% vs 0.4% exp. CPI Core MoM: 0.2% vs 0.3% exp. CPI YoY: 3.0% vs 3.1% exp. CPI Core YoY: 3.0% vs 3.1% exp. It’s still the hottest YoY print since January, but overall confirms inflation is easing again. Gasoline drove most of the increase, rising 4.1%, while electricity and natural gas fell. Food prices barely moved at +0.2%, with only small upticks in bakery and beverage costs. Shelter continues to cool. Rent inflation dropped to 3.4% YoY, the lowest since 2021 and monthly rent growth was the smallest in more than two years. Shelter overall rose just 0.28% MoM, signaling that housing, one of the biggest drivers of sticky inflation, is finally loosening its grip. Core CPI rose just 0.2% MoM, bringing the annual rate down to 3.0%, its lowest since June. Airline fares and apparel climbed, but used cars, insurance, and communication costs all declined. “Supercore” services ex-shelter fell to 3.3%, the lowest since May, showing that inflation pressure in service-heavy areas like travel, insurance, and recreation is softening across the board. Source: Charlie Bilello, StockMarket.news on X

Investing with intelligence

Our latest research, commentary and market outlooks