Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In case you missed it... The Shanghai Composite index is about to top 4,000 for the first time in 10 years

Source: David Ingles @DavidInglesTV Bloomberg

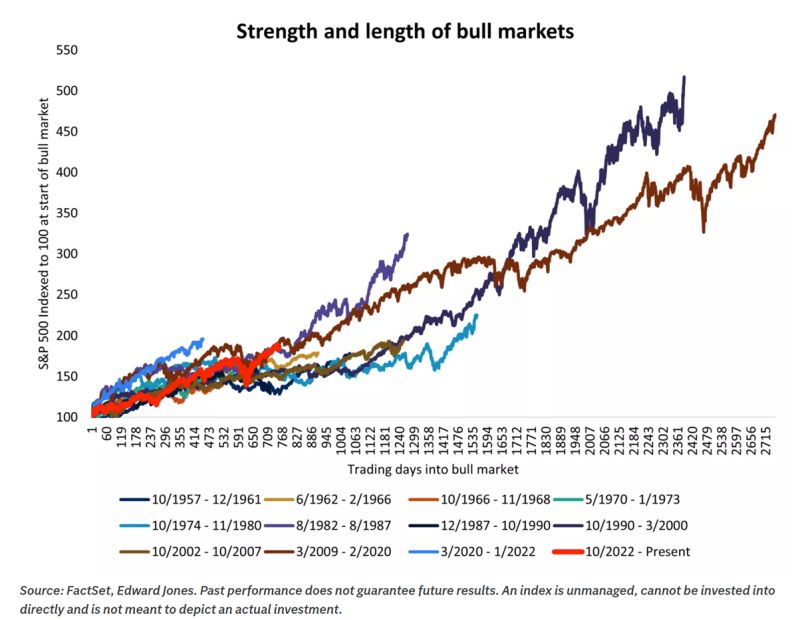

🐂 This Bull Market Isn’t Young… But It’s Far From Done.

It’s not a toddler finding its footing — and it’s not a retiree either. We’re mid-cycle, and that’s where things often get interesting. Yes, history gives us context. But it’s fundamentals — not birthdays — that decide how long a bull market lives. As the saying goes: “Bull markets don’t die of old age. They die from recessions or Fed tightening.” And right now, we see neither on the horizon for 2026. 📈 The takeaway: This run still has legs — just maybe a steadier, more mature stride. Do you think this bull still has room to run? 🐃👇 Source: Edward Jones

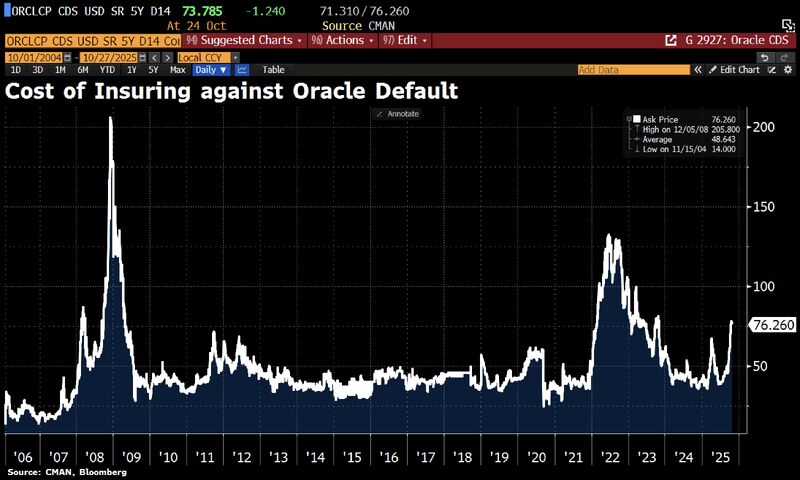

The cost of insuring against an Oracle default has surged following the company’s massive Q3 AI investment announcements – reaching levels not seen outside periods of major macro stress.

According to Goldman, Oracle’s CDS spreads have become a key sentiment indicator for the market’s appetite to finance large-scale AI spending. Source: HolgerZ, Bloomberg

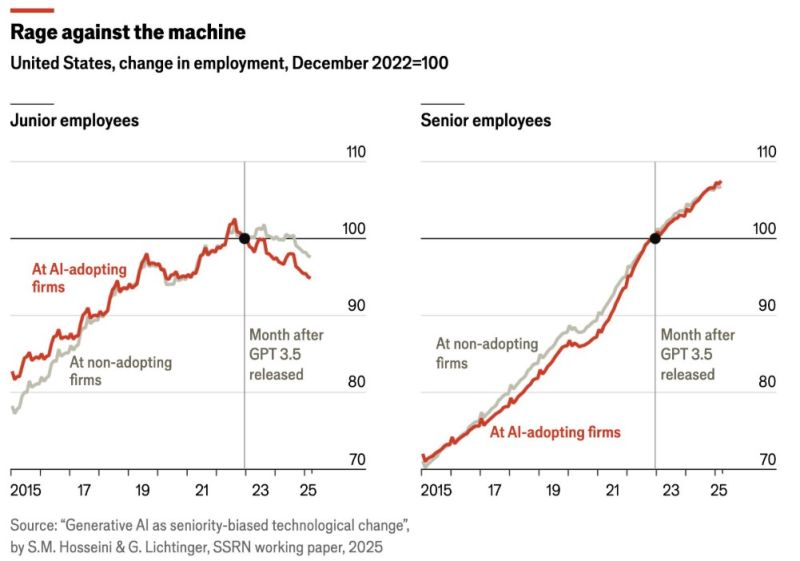

Tough time for the young generation...

Companies that have adopted AI aren't hiring fewer senior employees, but they have cut back on hiring juniors ones. Source: Crémieux @cremieuxrecueil on X

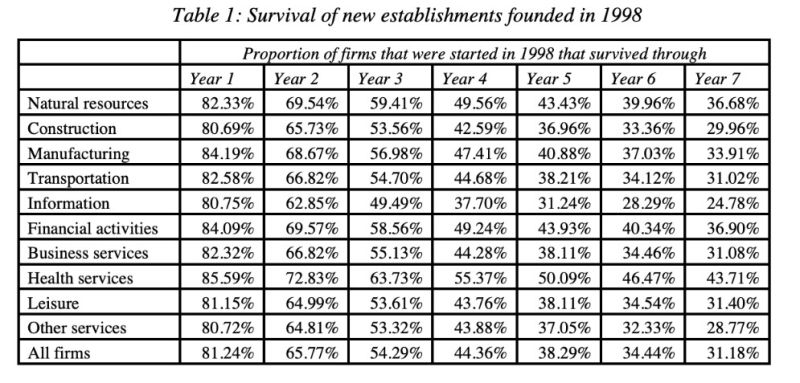

Only 31% of companies started in 1998 were still alive in 2005.

Capitalism is brutal. Source: Brian Feroldi

China’s economy is hitting an imbalance wall. It keeps building, but people aren’t buying.

🧱 Investment eats up 42% of GDP — nearly double the global average. 🛒 Household spending? Just 37% — vs. 60% in most economies. The result: too many factories, not enough consumers. Property prices are still falling, savings rates are sky-high (20%+), and deflation has taken hold. Consumer prices are down, producer prices have been negative for years, and exports are doing all the heavy lifting — but even that’s cracking under U.S. tariffs. Instead of fixing the imbalance, Beijing is doubling down on the old playbook: more infrastructure, more state-led projects, little direct help for households. Economists say China needs a massive rebalancing — trillions in fiscal transfers to boost consumption and rebuild trust in the safety net. But that would mean loosening state control… and that’s not the direction things are heading. 📉 Without change, growth could slow to ~3% a year. 🧊 Deflation lingers. ⚙️ Factories hum, but consumers stay quiet. China’s still building the world’s factories — but it’s running out of people to sell to. Source: StockMarket.news

US Treasury yields are falling — but this time, it’s not about fear. It’s about confidence. 💡

The Trump–Bessent supply-side mix, tariff revenues, and AI-driven growth are reshaping the bond market story. 💵 Tariffs are turning out to be less inflationary than initially feared (at least for now) and deficit-friendly. 💰 Stablecoins now hold $180B+ in Treasuries, quietly anchoring the short end of the curve. 🚀 The U.S. productivity boom powered by AI is leaving others behind — while Europe unravels fiscally, Britain wrestles with debt, and China sinks deeper into deflation. As global credit stress rises, U.S. bonds are the safe haven again. The curve’s bull flattening isn’t a warning — it’s (almost) a vote of confidence. The U.S. is once again the "least worst" house in a bad neighborhood of indebted peers. Source: Bloomberg, James E. Thorne @DrJStrategy

🚨 Germany’s biggest carmaker is in trouble.

Volkswagen is staring at a potential €11 billion cash shortfall next year — a gap big enough to derail its investment plans and EV transition. Half-year profits are down 33%, and cash flow has turned negative (€1.4 billion). What’s driving the crisis? 🇨🇳 Weak sales in China 🇺🇸 Tariffs from the U.S. ⚙️ Fierce competition from fast-moving Chinese EV makers Now, cuts are hitting everywhere — marketing, sales, and even R&D. The company may be forced to sell assets just to fund new models and technologies. Executives are calling it “particularly fatal” — hitting right as Volkswagen tries to shift from combustion engines to electric. The once-unshakable German auto powerhouse is learning the hard way: 🔋 The EV race isn’t just about innovation — it’s about survival. Source: https://lnkd.in/gC5NC2YH, Bild

Investing with intelligence

Our latest research, commentary and market outlooks