Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A new Bank of America survey shows 75% of investors have ZERO exposure to cryptocurrencies.

Now, US lawmakers are requesting the SEC implements President Trump's Executive Order allowing 401(K)s to BUY cryptos. Source: Bank of America, The Kobeissi Letter

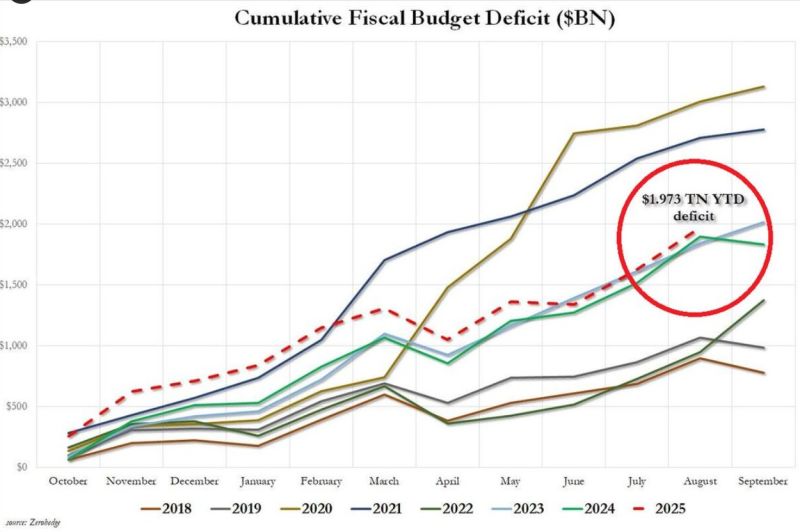

For the first 11 months of FY2025, the U.S. deficit has already hit $1.97 trillion.

That’s the 3rd-largest in history and the year isn’t even over yet. Source: StockMarket.News @_Investinq

The S&P 500 Shiller P/E ratio has surpassed 40x for the first time since the 2000 Dot-Com Bubble BURST.

The US stock market has ALMOST NEVER been so expensive. Source: Global Markets Investor

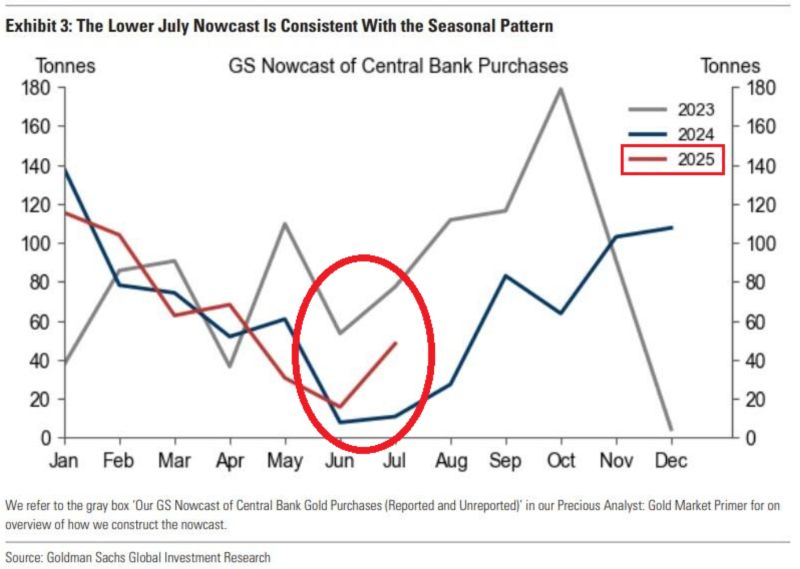

Central Banks are buying MASSIVE amounts of gold:

In July, world central banks acquired 48 tonnes of gold, above 2024 figures, according to Goldman Sachs estimates. Year-to-date, central banks have bought an average of 64 tonnes of gold per month. Gold demand is strong. Source: Global Markets Investor, Goldman Sachs

The US Government is reportedly seeking to buy up to a 10% equity stake in Lithium Americas $LAC

+73% after-hours (CNBC) Source: Reuters

OpenAI and Oracle are betting big on America’s AI future

OpenAI and Oracle are bringing online the flagship site of the $500 billion Stargate program, a sweeping infrastructure push to secure the compute needed to power the future of artificial intelligence. The debut site in Abilene, Texas, about 180 miles west of Dallas, is up and running, filled with Oracle Cloud infrastructure and racks of Nvidia chips. The data center, which is being leased by Oracle, is one of the most notable physical landmarks to emerge from an unprecedented boom in demand for infrastructure to power AI. Over $2 trillion in AI infrastructure has been planned around the world, according to an HSBC estimate this week. Source: CNBC

Gold hits most overbought level on the monthly chart in 45 years.

But beware, an asset can stay overbought during a long period of times in a bull run. And the market isn't speculating; it's rationally repricing the metal for a new era of fiscal dominance, negative real yields, and de-dollarization. Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks