Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

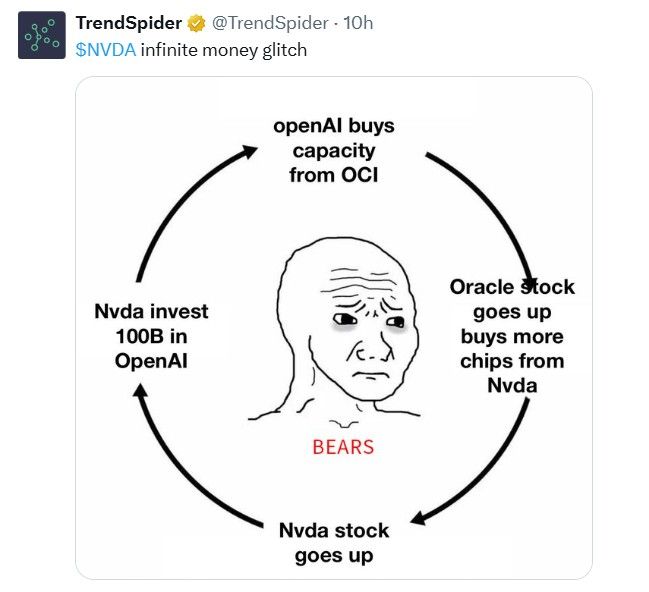

All the Magnificent 7 stocks are now in positive territory for the year!

Source: Bloomberg, HolgerZ

The gold price is rising again.

It fell back briefly after last week's Fed, as markets digested a more complicated meeting than they had hoped for. But now we're back off to the races and gold is resuming its rise. As rightly put by Robin Brooks, "the world is running out of safe havens. Gold is the winner..." Source: Robin Brooks

Is Silver a pure AI play?

Note how Silver has been moving in sync with Global X Artificial Intelligence ETF $AIQ... Source: The Market Ear

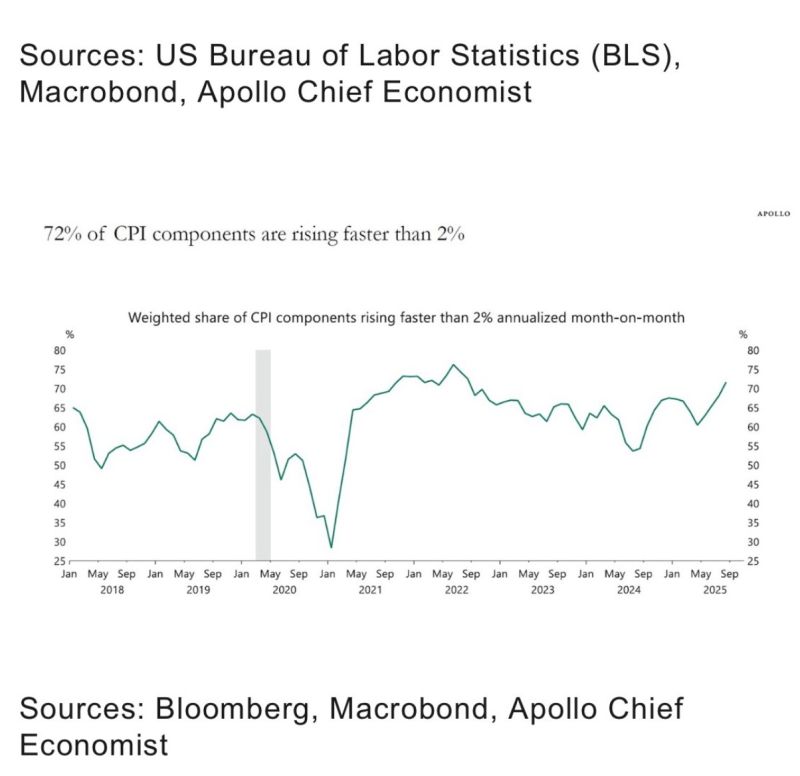

Apollo’s Torsten Slok on US inflation: “72% of the CPI components are growing faster than the Fed’s 2% inflation target”

Source: Mo El Erian

This table from BofA is a fantastic reminder that "all good things eventually come to an end."

Source: Lance Roberts, BofA

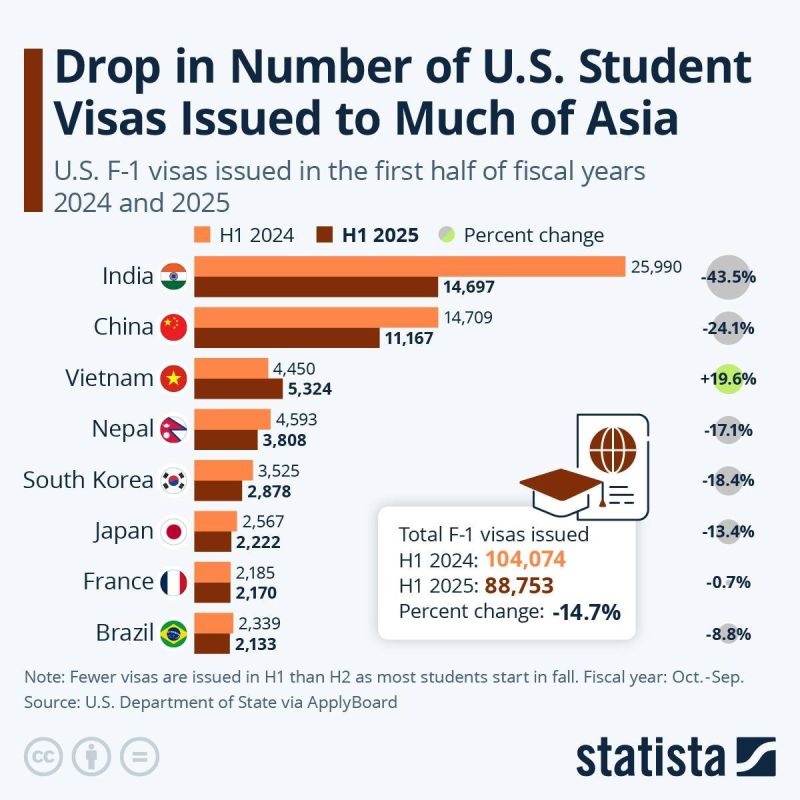

Big drop in U.S. student visas to Asia - India down 43.5%

New data shows a major decline in U.S. F-1 student visas issued in H1 2025, with total visas falling 14.7% year-over-year. India saw the steepest drop: down 43.5%. China fell 24.1%, Nepal 17.1%, and South Korea 18.4%. Vietnam was the only major country to increase, up 19.6%. Source: Statista, U.S. Department of State, ApplyBoard thru Mario Nawfal on X

Investing with intelligence

Our latest research, commentary and market outlooks