Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

New research paper from OpenAI sheds light on user behavior by analyzing sample of 1.1M messages from active ChatGPT users between May 2024 to July 2025

Findings, summarized in visualization by MadeVisualDaily, shows ChatGPT’s core appeal is utility: helping users solve real-world problems, write better, and find information fast. Source: @VisualCap, Liz Ann Sonders @LizAnnSonders

Remember when the government prints another trillion, this is how much money they’re printing.

Source: Bitcoin magazine

Paul Atkins, chairman of the U.S. Securities and Exchange Commission, said his agency will propose a rule change

It follows President Donald Trump’s call to end earnings reports on a quarterly basis and switch to semiannual. “I welcome that posting by the president, and I have talked to him about it,” Atkins said on CNBC’s “Squawk Box” Friday. “In principle, I think to propose change in what our rules are now, I think would be a good way forward, and then we’ll consider that and move forward after that.” Earlier this week, President Donald Trump proposed the idea that companies should no longer provide earnings reports on a quarterly basis and switching to semiannual instead. The SEC said the agency is actively looking into that plan. “At President Trump’s request, Chairman [Paul] Atkins and the SEC is prioritizing this proposal to further eliminate unnecessary regulatory burdens on companies,” an agency spokesperson said earlier. Current regulations require companies to report earnings on a quarterly basis, though providing forecasts is voluntary. The rules can be changed by just a majority vote on the SEC, where Republicans currently hold a 3-1 voting majority, with one open seat. Source: CNBC

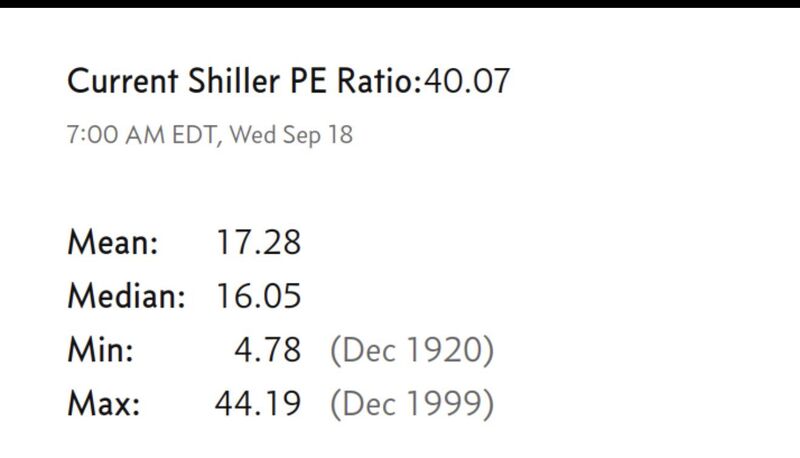

The Schiller P/E has hit 40 for the second time in history since the dotcom bubble.

Source: The Great Martis @great_martis

In case you missed it...

The Russell 2000 has joined the Dow, S&P 500, and Nasdaq 100 in hitting a record high – its first since 2021. That ends the longest drought without a new high in Russell 2000 ETF history. Source: J-C Parets

Yesterday's Russell 2000 heatmap by Finviz

That's a lot of green...

BREAKING: The Bank of Japan announced that it will leave its benchmark interest rate on hold

The decision was widely expected amid political uncertainty stemming from the resignation of PM Shigeru Ishiba. BUT HERE'S THE BIG NEWS: The Bank of Japan has decided to begin SELLING its ETF holdings. The BOJ is the largest shareholder of ~70% of large listed stocks in Japan; if it really does this, it will put downside pressure on Japanese stocks. The planned pace of sales is based on an annual book value of ¥330 billion. As of June 2025, the BOJ’s ETF balance stood at a book value of ¥37.1861 trillion. The stock market is already asking the BOJ: “are you sure bro?” - see chart below. Best of luck to the BOJ plan to sell stocks when the BOJ IS THE MARKET.

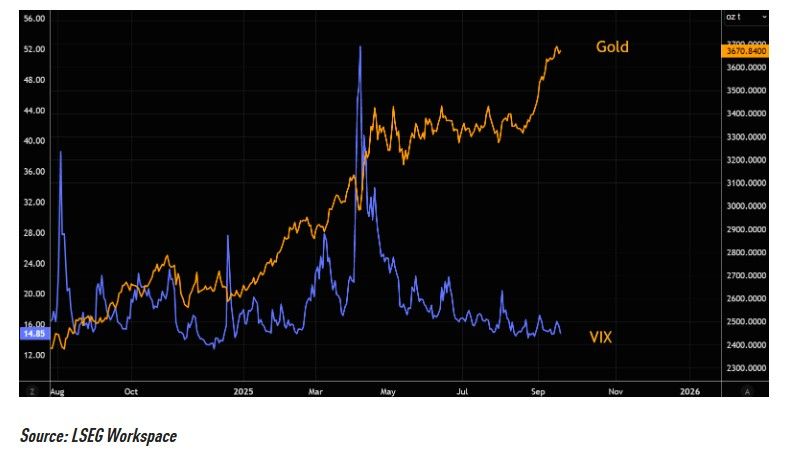

The hedge factor

Gold is the "everything hedge", but if you are looking for global equity hedges, then VIX looks relatively more interesting compared to chasing gold here. Source: TME, LSEG

Investing with intelligence

Our latest research, commentary and market outlooks