Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

"THE MOST IMPORTANT FOMC OF OUR LIFETIME"

$SPY S&P500 is completely flat

Activist investor Cevian Capital has said it is “not viable” to run a large international bank from Switzerland due to new strict capital proposals

Unless the position changes UBS would have “no other realistic option” but to leave the country. Cevian is Europe’s largest dedicated activist investor and holds about 1.4 per cent of UBS’s shares. It added that the government proposals, which would force the bank to have as much as $26bn in extra capital, could not be meaningfully changed through lobbying efforts. “The board has the responsibility to ensure that UBS protects its competitiveness,” Lars Förberg, Cevian’s co-founder, told the Financial Times. “Under the current proposals, it is not viable to run a big international bank from Switzerland. We therefore see no other realistic option but to leave.” He added: “The message from the Federal Council is clear: UBS is too big for Switzerland . . . I respect the Federal Council’s decision, but I do not understand it. It cannot be undone. Lobbyists cannot change that either. That effort can be spared.” Link to article: https://lnkd.in/ekU4KnUE

Despite some hawkish comments during the Press conference (the "risk management cut"), the Fed now seems more worried about the job market than inflation.

Next job data will be key. Source: zerohedge

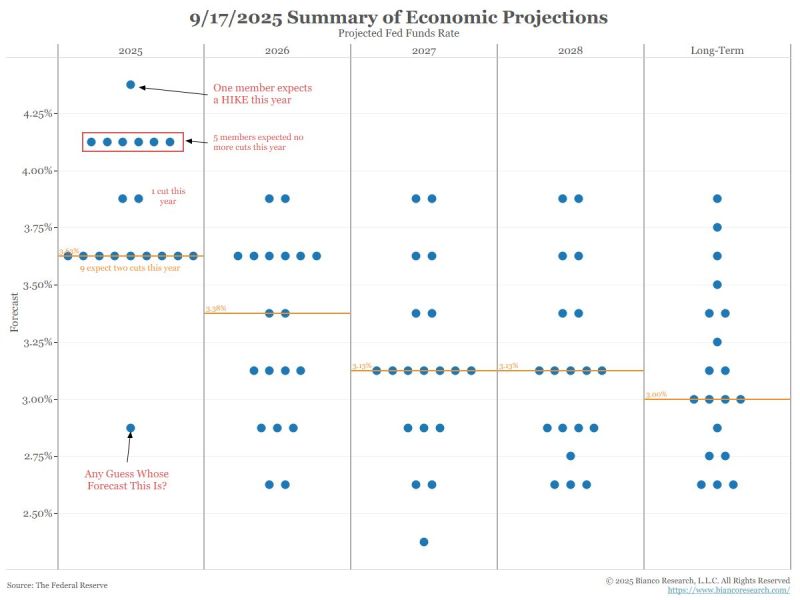

As highlighted by Jim Bianco, isn't the "Fed consensus" just an illusion?

See the labels in the dot plot below: one member of the FOMC thinks the Fed is going to HIKE rates this year. One (Stephen Miran) thinks it is going to cut 1.25% this year (5 cuts over two meetings). And see the spread of dots above (from highest to lowest), the FOMC is showing little to no agreement on what they should do. So on one hand there is an 11-1 vote On the other hand they published a wide dot plot... Add to this is Powell using the term "Risk Management" to describe this cut... It could thus be that "Risk Management" cut is a political decision. As Jim Bianco said "he wants to get Trump off his back". Source: Bianco Research

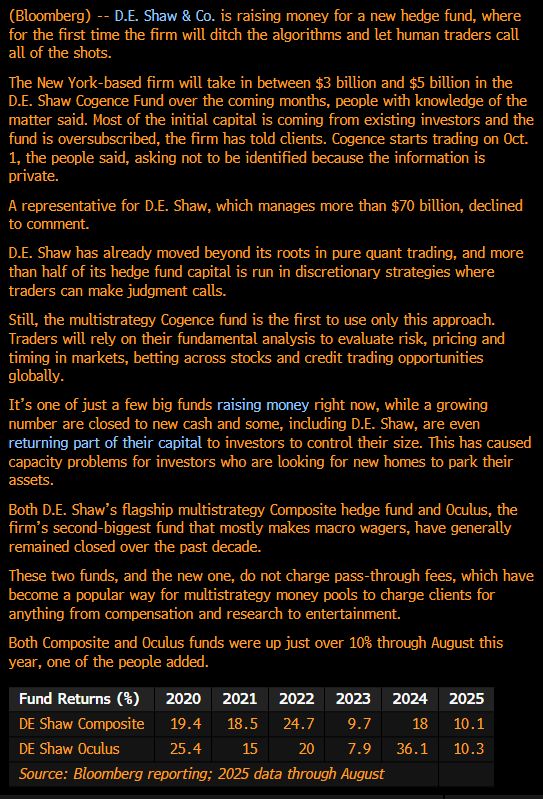

While everyone is moving away from humans towards ai, hedge fund giant de shaw is doing the opposite and launching its first ever fund run by humans, not ai.

DE Shaw is raising as much as $5 Billion in its first Hedge Fund run by humans. The D.E. Shaw Cogence Fund will trade stocks and credit. Source: Bloomberg, Nishant Kumar @nishantkumar07, Gurgavin

In case you missed it... 30-Year US Mortgage Rate plunges to 6.49%, the lowest level in almost 12 months

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks