Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Atlanta Fed is now projecting that Q3 GDP will be +3.4%… a massive expansion

The US economy is running HOT. But the fed is going to cut rates... Source: Federal Reserve Bank of Atlanta

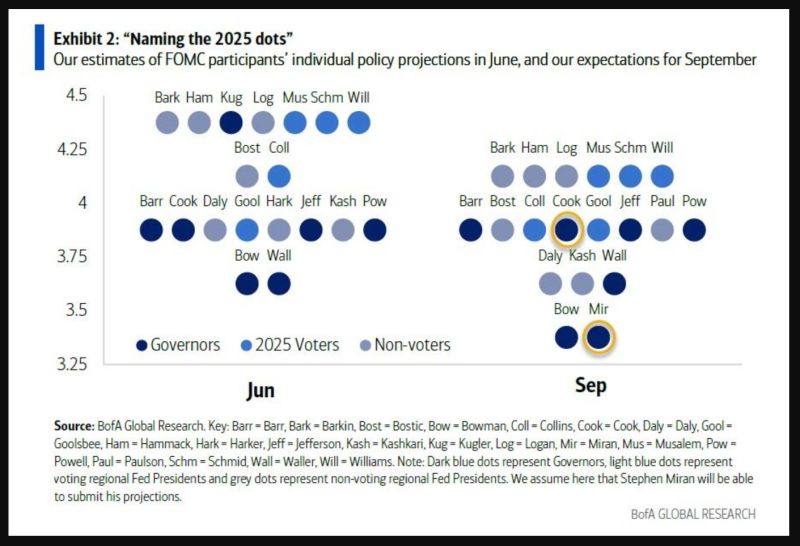

Since a 25bps rate cut is fully priced in, the main focus for markets will be whether the median 2025 dot shows 50bp or 75bp of cuts

With little change in the macro forecasts - for now - Bank of America thinks the 2025 median will continue to show 50bp of cuts, even as the distribution of dots moves down. Alternatively, Goldman now expects 75bps of rate cuts this year and another 50 next year. Clearly, it's all a close call for now. The dot plot should then show one more 25bp cut in 2027, although with Powell on his way out in May 2026 all bets are off regarding the longer horizon. The longer-run median is likely to stay at 3.0%. With that in mind, here is what Bank of America thinks the names behind tomorrow's dots will look like. Of particular interest will be the Lisa Cook and Stephen Miran dots. Source: BofA

AI is eating the world

The 109 AI stocks in the Goldman Sachs TMT AI Basket are now worth $29.2tn, almost as much as the annual economic output of the US. Source: HolgerZ, Bloomberg

BREAKING: Robinhood announces that they have filed with the SEC to launch Robinhood Ventures Fund I (RVI), a concentrated portfolio of innovative private companies leading their industries.

It looks like Robinhood is going to IPO a fund that allows retail to invest in the best private companies... “For decades, wealthy people and institutions have invested in private companies while retail investors have been unfairly locked out. With Robinhood Ventures, everyday people will be able to invest in opportunities once reserved for the elite,” said Robinhood Chairman and CEO Vlad Tenev. Source: amit @amitisinvesting

Is AI seriously overbought?

$AIQ is the Global X Artificial Intelligence & Technology ETF. It is at the most overbought levels since July 2024...just before markets crashed. Source: TME, LSEG

Senate votes 48-47 to confirm Stephen Miran to Fed board

Source: Kevin Gordon @KevRGordon, Blomberg

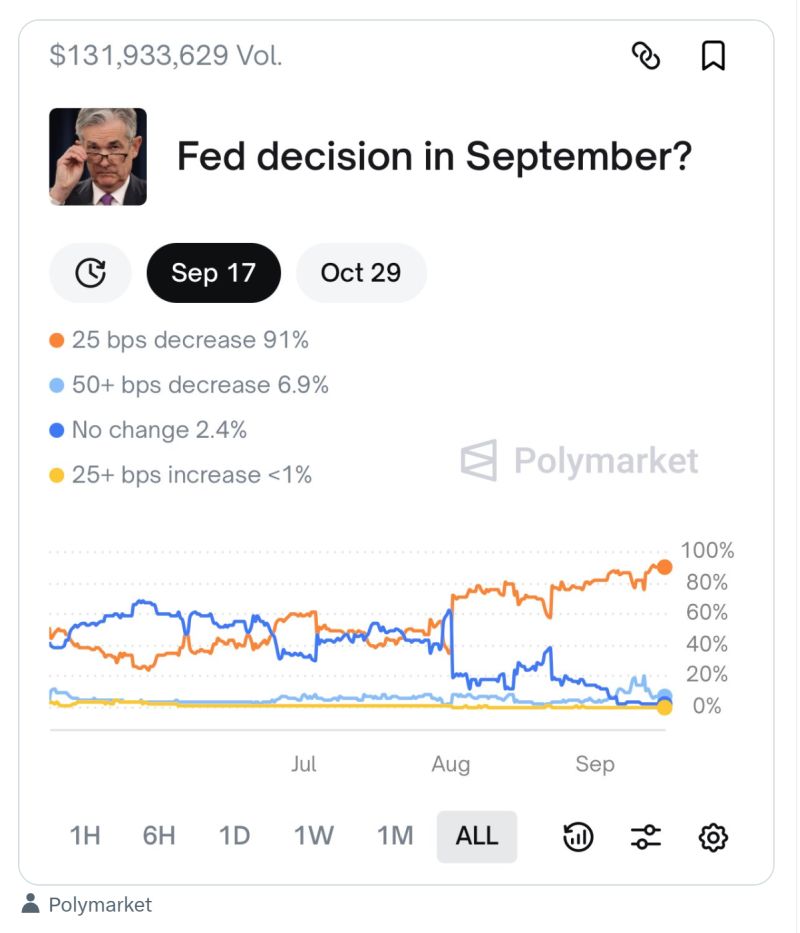

September FOMC: odds on the Fed’s rate decision

Source: Polymarket

Seagate is now the top performing stock in the S&P 500 for 2025

The GenAI bull market is expanding. Source: Mac10

Investing with intelligence

Our latest research, commentary and market outlooks