Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

J-C Parets on Lithium:

"Lithium is the bridge commodity - connecting cyclical reflation with structural demand. EVs, battery storage, datacenters, renewable energy - these aren't optional trends. They're structural. Lithium demand doesn't go away because the economy slows for a quarter. When capital rotates back into lithium, it tells us that the forward-looking, technology-driven demand story is aligning with the cyclical reflation story that gold and copper already flagged". Source: J-C Parets

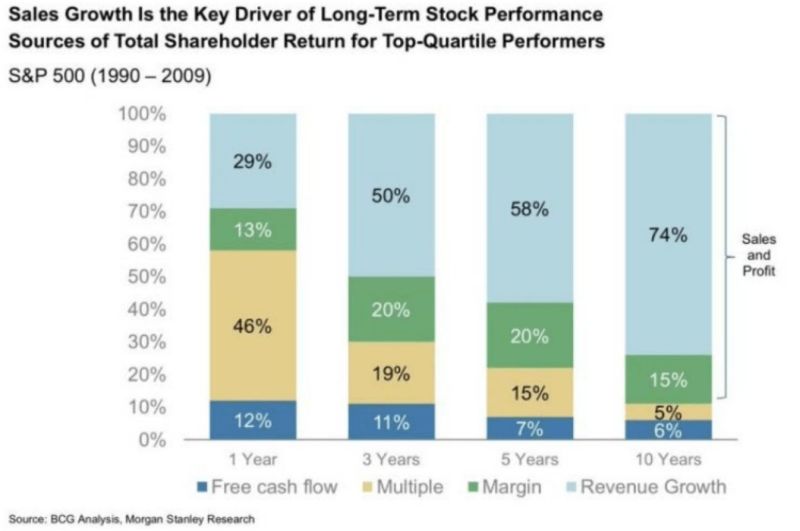

Growth is the best long-term predictor of a stock market winner

Source: Invest In Assets 📈

Apple on the verge of forming a Golden Cross for the first time since June 2024

The last one sent $AAPL soaring 21% over the next 6 months. Source: Barchart

In case you missed it...

According to NY Post, banking giant UBS is ramping up its threats to leave Switzerland and set up shop in the US — a radical response to Swiss regulators who have proposed onerous new capital requirements on the financial behemoth. Source : New York Post

"MAYBE WE’LL PAY OFF OUR $35 TRILLION HANDING THEM A CRYPTO CHECK, A LITTLE BITCOIN"

Source: Documenting Saylor @saylordocs

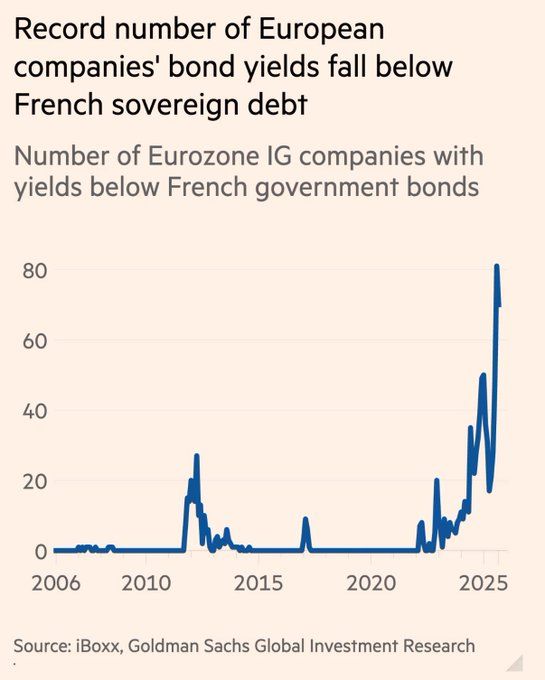

The ECB has tentatively allowed a little bit of price discovery in the bond market

The French government wakes up to discover their cost of funding is higher than L'Oréal's. Source: Hanno Lustig, FT

China economic slowdown deepens in August

➡️ Retail sales rose 3.4% in August from a year earlier, missing analysts' estimates for a 3.9% growth and slowing from July's 3.7% growth. ➡️ China’s industrial output growth slipped 5.2%, the worst performance since August last year. ➡️ Fixed-asset investment, reported on a year-to-date basis, expanded just 0.5%, a sharp slowdown from the 1.6% expansion in the January to July period. ➡️ China's survey-based urban unemployment rate in August came in at 5.3%. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks