Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Markets Up, Morale Down: A Summer of Disbelief by JC Parets, CMT

Throughout the summer, investors were wrong about stocks. And it was one of the greatest summers in stock market history. Below is the futures positioning among asset managers and hedge funds: the blue line represents the S&P 500, and the lighter green line shows you how underinvested they've been. They sold into the hole and never got the chance to get back in. This was a textbook V-bottom, and they're still not back in. This is one of those things that can help keep a bid underneath the market. Source: J-C Parets

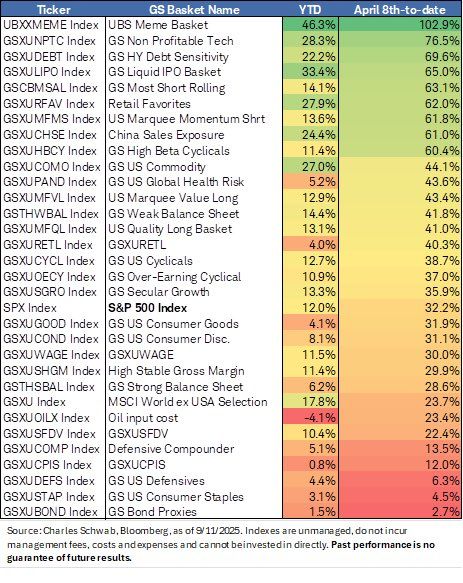

Meme stocks continue to power higher since early-April lows, alongside other retail trader favorites; while classically-defensive baskets bring up the rear

Source: Liz Ann Sonders, Bloomberg

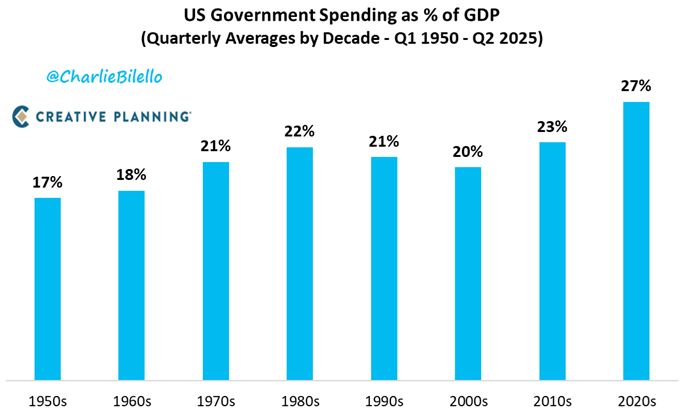

US Federal Government Spending as % of GDP...

1950s: 17%, 1960s: 18%, 1970s: 21%, 1980s: 22%, 1990s: 21%, 2000s: 20%, 2010s: 23%, 2020s: 27%. Source: Charlie Bilello

Financial Times:

"Apollo Global Management has amassed a short position against the debt of a US automotive parts supplier that has come under scrutiny for its accounting policies and financing techniques. Apollo holds a credit default swap against First Brands Group, according to five people familiar with the matter, an Ohio-based seller of windscreen wipers and fuel pumps that last month shelved a $6bn loan deal because of concerns about its financial reporting. The derivative contract means that Apollo will profit if FBG fails to continue paying its debts. The trade has pitted one of the largest private credit specialists on Wall Street, with $840bn in assets, against a company that has borrowed billions of dollars away from the glare of public debt markets. In order to short FBG’s private debt, Apollo obtained a so-called “bespoke” contract written against the company’s loans, according to people familiar with the trade. They added that the firm had held the position for at least as long as a year and had paid a significant amount in fees to maintain the short". Link to article >>> https://lnkd.in/ejCPZSsY

JUST IN:

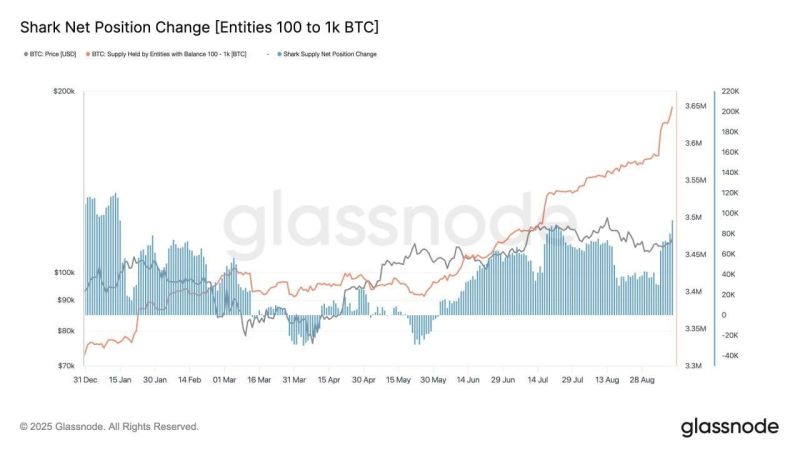

🦈 Bitcoin sharks (100–1k BTC wallets) added 65,000 BTC in the past 7 days. They now hold a record 3.65M BTC. Source: Glassnode, Bitcoin archive

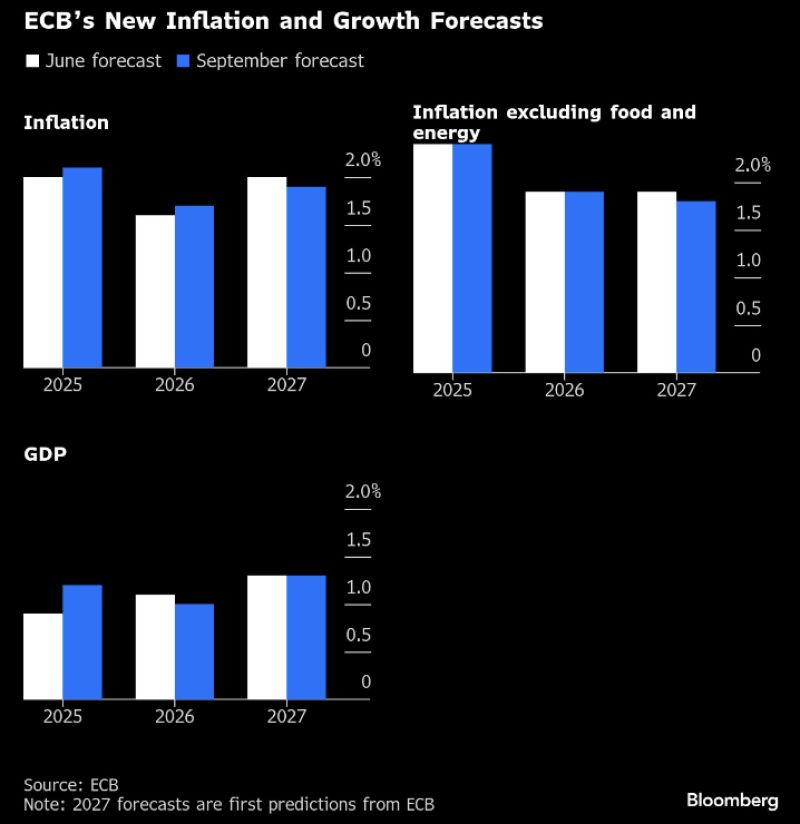

Yesterday, ECB ups inflation outlook for 2025, 2026, cuts it for 2027

2025 Inflation forecast now 2.1% (from 2%), 2026 inflation forecast now 1.7%; (prior forecast 1.6%). ECB sees 2027 at 1.9% (prior estimates 2%). Source: HolgerZ, Bloomberg

UPDATE:

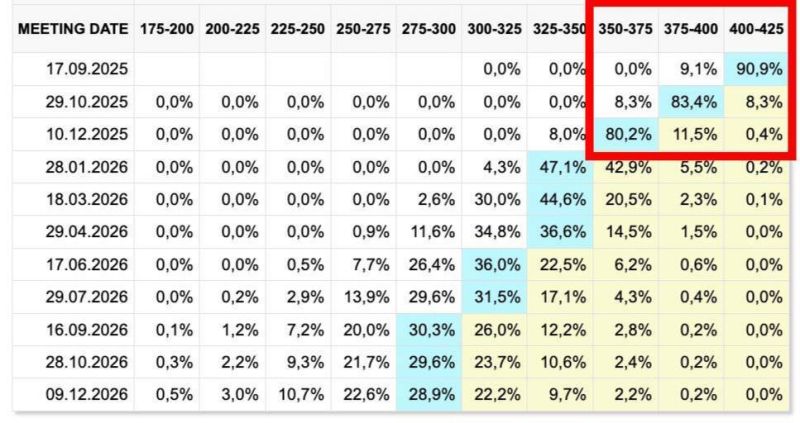

According to the CME FedWatch tool, markets see a ~93% chance of one rate cut in September 2025 (to 4.00–4.25%) and a ~92% chance of two cuts by December (to 3.50–3.75%). Source: cointelegraph

Investing with intelligence

Our latest research, commentary and market outlooks