Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Donald Trump has called for US companies to stop reporting quarterly results

He added that a shift to publishing figures twice a year will save them cash and allow executives to focus on their businesses. The US president issued his call in a post on his Truth Social network on Monday, contrasting standard practice in the US with what he depicted as China’s more long-term approach. Most publicly listed US companies are required to file quarterly and annual financial filings with the Securities and Exchange Commission, known respectively as 10-Q and 10-K disclosures. “Subject to SEC Approval, Companies and Corporations should no longer be forced to ‘Report’ on a quarterly basis . . . but rather to Report on a ‘Six (6) Month Basis’,” Trump said. “This will save money, and allow managers to focus on properly running their companies.” Source: FT

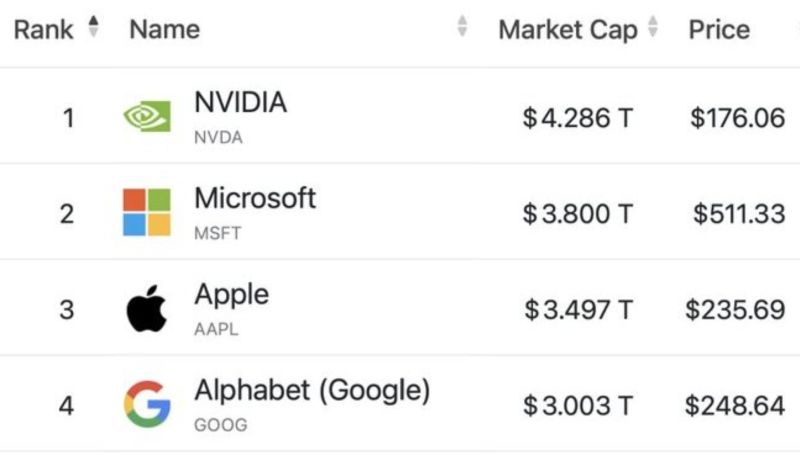

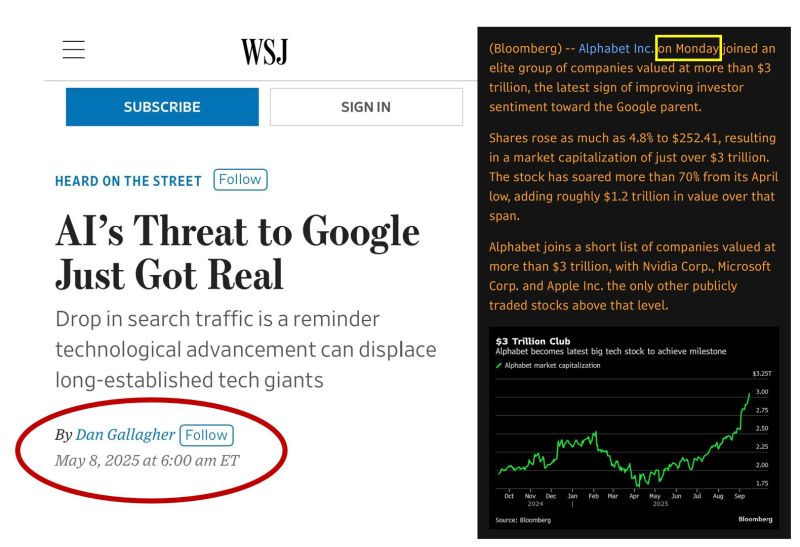

$GOOGL JUST JOINED THE $3T CLUB ALONGSIDE $MSFT, $AAPL & $NVDA

Source: Shay Boloor

Nicely put by Matthew Yglesias on X as another example that just owning index funds is often the wiser investment decision.

Source: Matthew Yglesias on X

Interesting theory...

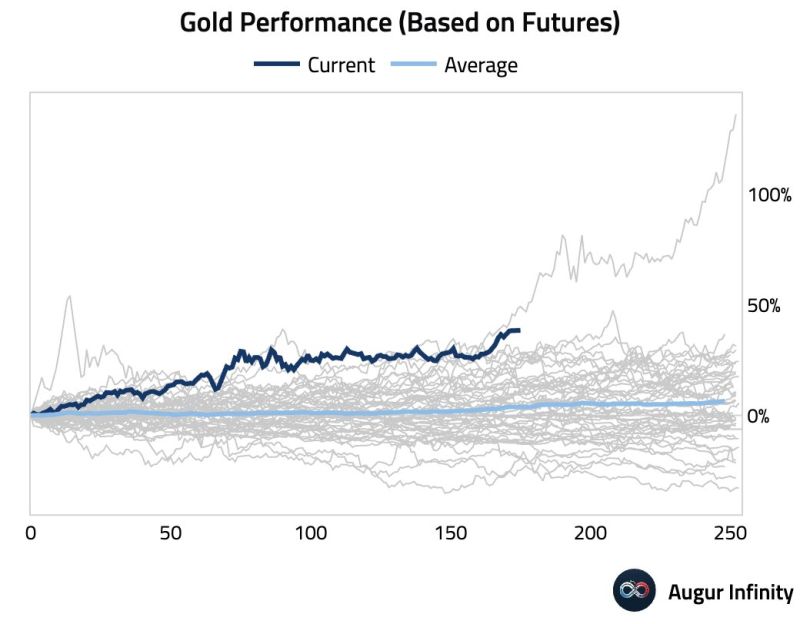

The Shanghai Gold Exchange (SGE) has activated two overseas vaults—one in Saudi Arabia, the other in Hong Kong—marking a direct expansion of RMB-denominated gold trading beyond mainland borders. This move represents a strategic move to enhance China’s gold trading infrastructure and strengthen the SGE’s role in global gold price discovery. These aren’t symbolic moves. They’re operational. They’re live. Source: Alasdair Macleod @MacleodFinance

Investing with intelligence

Our latest research, commentary and market outlooks