Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

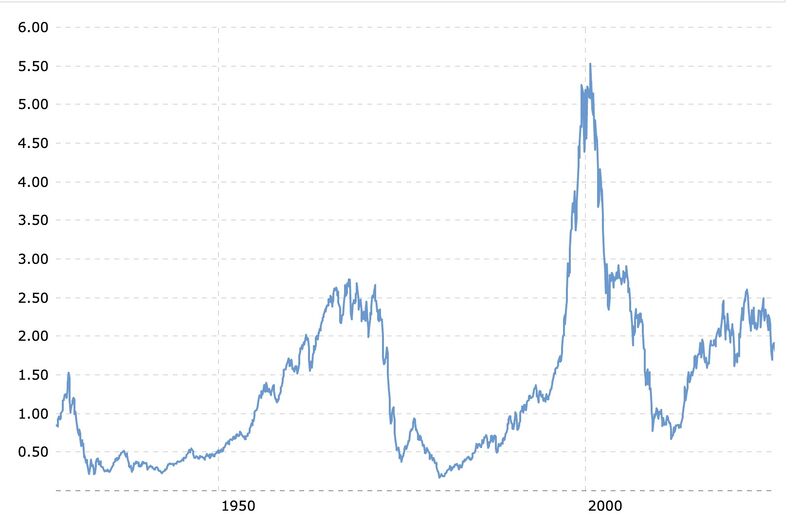

S&P 500 priced in gold...this is what the stock market looks like in real money (looks like a big head and shoulders pattern...)

As highlighted by Quoth the Raven on X, "If we go back to 0.5x, that puts gold at $12,000, or the S&P at 1850 or they meet in middle at $9000/4500 which would be gold 2.5x and S&P -30%ish"

Big Tech groups are losing a political battle in Brussels to gain access to the EU’s financial data market

This was despite Donald Trump’s threats to punish countries that “discriminate” against US companies with higher tariffs. With the support of Germany, the EU is moving to exclude Meta, Apple, Google and Amazon from a new system for sharing financial data that is designed to enable development of digital finance products for consumers. Such a decision would hand a significant boost to banks in their efforts to fight off a competitive threat from Big Tech groups, which they fear will use their data to disintermediate them from their customers while extracting much of the value of knowing people’s spending and saving behaviour. After more than two years, negotiations on the Financial Data Access (FiDA) regulation are entering the final stages in coming weeks, with Big Tech groups facing almost certain defeat, according to diplomats. Source: FT https://lnkd.in/eMfM2QFb

We just had flash crash in crypto and in 10 minutes we got +$1B in liquidations.

$ETH dropped -%10 for a moment and now it’s climbing back. $BTC hit $11.4k (now recovering as well) The interesting part is this happened just a few moments after news came out about a “major crypto announcement” coming this week. Source: Chill Rader on X, @ArkadiBaudelair

Stocks just saw the largest weekly inflow all year from retail investors

Source: Barchart

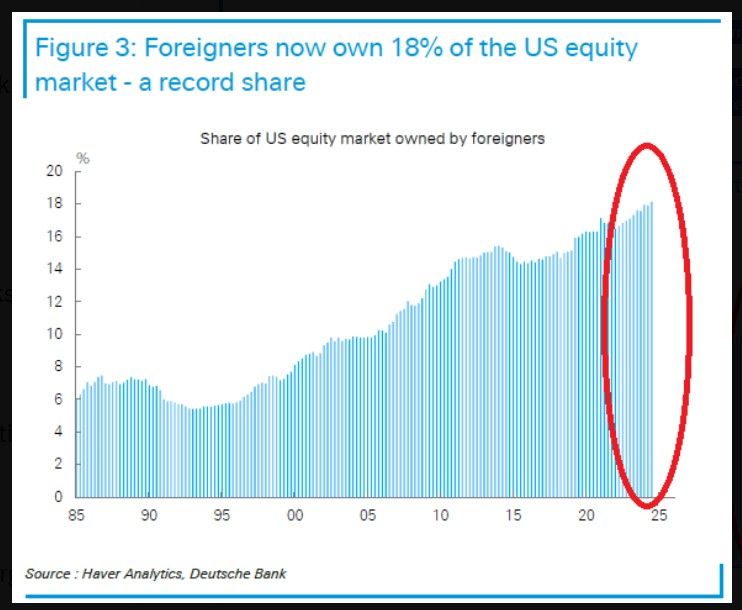

Foreigners own more US stocks than EVER

Overseas investors now own a RECORD 18% of the US equity market. Foreign investors collectively own ~$20 trillion of US stocks and ~$14 trillion in US debt, including Treasuries, mortgage and corporate bonds, according to Bloomberg. Source: Global Markets Investor, DB, Haver analytics

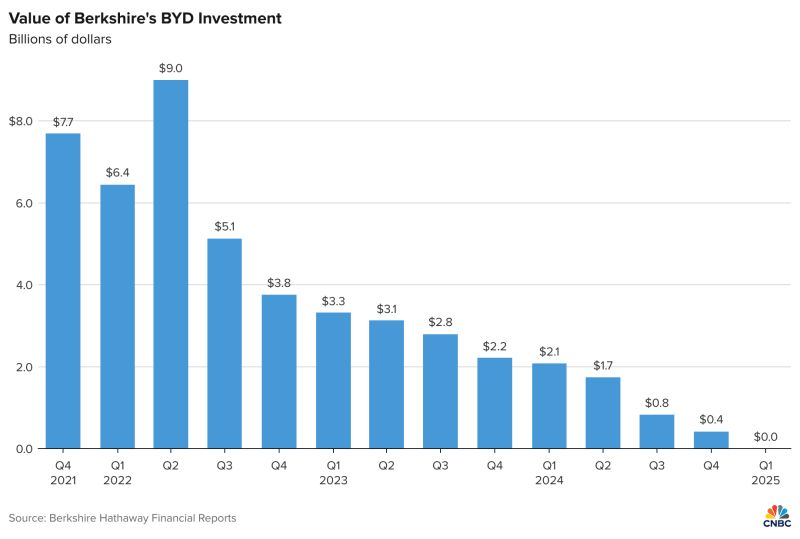

Warren Buffett and Berkshire Hathaway $BRK.B no longer own any shares of BYD - CNBC

Source: Evan

The Fed has cut rates by 25bps 47 times since 2000

Here’s how $SPY usually reacted the next week, month, quarter, and year. Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks